The Ten Best Credit Cards You Should Consider Having in Your Wallet

In today’s fast-paced world, having the right financial instruments at your disposal can make a significant difference in how you manage your expenses and rewards. With so many options available, choosing the best fit for your lifestyle can be a bit overwhelming. It’s important to find alternatives that not only suit your purchasing habits but also enhance your financial well-being.

Why settle for anything less than the best when it comes to managing your finances? These modern tools offer various benefits like cash back, travel perks, and low-interest rates, ensuring you get the most out of every transaction. Whether you are a frequent traveler or simply someone who enjoys the occasional luxury, selecting a suitable option can lead to thrilling opportunities.

So, let’s dive into some of the most sought-after financial instruments that can elevate your monetary game. We’ll explore features, benefits, and what sets them apart, so you can make an informed decision tailored to your personal needs and preferences.

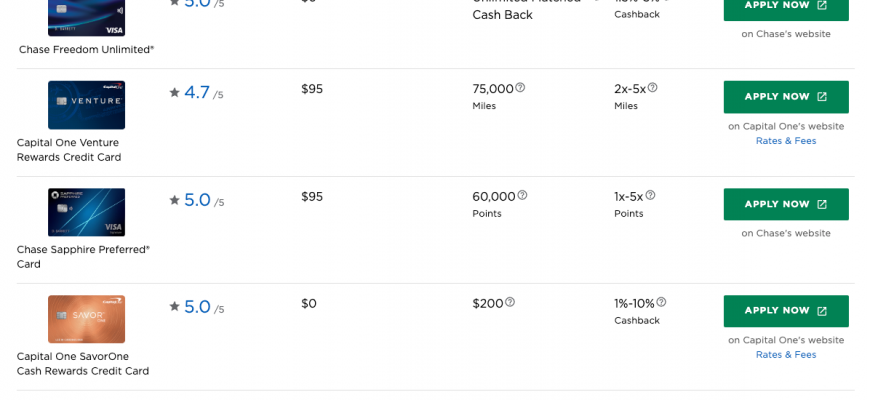

Best Options for Earning Rewards

If you’re someone who loves to get more out of every dollar spent, finding the right rewards program can be a game changer. Imagine earning points, cash back, or miles just for doing your regular shopping. This section dives into some of the most beneficial programs available, designed to maximize your benefits as you go about your daily life.

From generous cash-back offers to flexible travel points, these choices can cater to various lifestyles and spending habits. Many of them come with added perks like no foreign transaction fees, travel insurance, and exclusive discounts. Whether you’re dining out, booking vacations, or just picking up groceries, each purchase can bring you closer to your next reward.

Understanding how these systems work is key to reaping the maximum benefits. Look for partnerships with specific brands or categories where you frequently spend to boost your reward earnings. Some programs even offer sign-up bonuses that can kickstart your savings, making the initial application well worth it.

As you explore different offerings, consider what’s most appealing to you–are you after cash back, travel benefits, or something else entirely? Make sure to read the terms carefully, as you want to avoid surprises down the line. With the right choice, you can turn everyday expenses into extraordinary rewards.

Best Selections for Improving Your Financial Profile

When it comes to establishing a robust financial reputation, making wise selections is crucial. Several options exist to help you enhance your standing, paving the way for future opportunities. Understanding these choices can make a significant difference in your journey toward financial stability.

First up, there are specialized tools designed explicitly for newcomers to the financial world. These instruments often come with lower barriers to entry, allowing individuals to start their path without overwhelming requirements. They provide a chance to demonstrate responsible usage, which is essential for growth.

Another noteworthy point is the practices tied to these options. Consistent, responsible management is the key to reaping the benefits. Making timely payments and keeping utilization rates low can amplify your standing over time. It’s about developing habits that ensure long-term success.

Moreover, some variants offer rewards and perks that can enhance your experience further. These bonuses can include cash back or travel incentives, making the journey more enjoyable while you build a solid foundation. The best part is that you can enjoy these benefits while working towards your financial goals.

In conclusion, choosing wisely among these offerings can have a lasting impact on your financial journey. By understanding your needs and exploring various options, you can effectively lay the groundwork for a brighter financial future.

Ultimate Cards for Travel Benefits

If you’re someone who loves to explore new places and experience different cultures, having the right financial tools can really enhance your adventures. Certain options are crafted specifically to elevate your travel experiences, making every journey smoother and more rewarding. From earning points for flights to getting exclusive lounge access, these choices can turn your trips into something truly special.

When you’re on the go, it’s not just about where you’re going but also how you get there. Imagine accumulating rewards that can be redeemed for amazing getaways, or enjoying perks like free checked bags and priority boarding. It’s the little things that can take a regular trip and turn it into a memorable escapade.

Plus, with additional benefits like travel insurance and emergency assistance, you can travel with peace of mind, knowing you’re well taken care of no matter where you find yourself. Whether it’s savoring new culinary delights or soaking up stunning views, these financial companions can help you make the most of every moment.

So, if you’re gearing up for your next adventure, consider exploring the options that offer exceptional travel-related perks. The right picks can not only elevate your expeditions but also bring a world of benefits that simply make life a little sweeter while you’re on the road.