Discover the Ten Best Credit Cards You Should Consider for Your Financial Needs

In today’s world, navigating the myriad of financial tools available can be quite the adventure. With so many options, it’s crucial to understand which selections offer the best advantages tailored to your lifestyle. A well-chosen financial product can open doors, providing not just convenience but also rewards and savings opportunities.

Whether you’re looking for travel perks, cashback benefits, or simply a reliable means of managing your expenses, having the right option by your side makes all the difference. Let’s explore some of the most enticing offerings out there that can enhance your wallet while ensuring your acquisitions are worthwhile.

Choosing wisely means considering your individual needs and habits. By diving into the best possibilities available, you can find the perfect match that aligns with your financial goals. Here’s a look at ten impressive selections that stand out in the crowded marketplace.

Best Options for Rewards

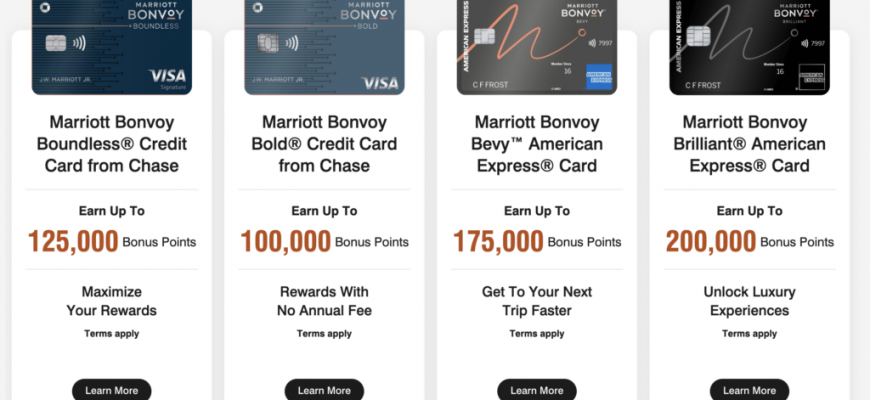

When it comes to earning perks for your everyday purchases, finding the right option can make a huge difference. Imagine accumulating points or cash back just by using your preferred payment method. This section will explore some of the finest choices available for those seeking to maximize their rewards without breaking the bank.

Many individuals are on the lookout for opportunities that allow them to earn subscriptions, travel benefits, or even discounts on items they frequently buy. These selections cater to various spending habits and preferences, ensuring there’s something for everyone. Let’s dive into the exciting world of rewarding opportunities!

Some standout selections offer generous points for dining and groceries, while others shine when it comes to travel-related expenses. Plus, many of these options include sign-up bonuses that can give your rewards journey an immediate boost. The key is to match your spending patterns with the right feature to enjoy the maximum benefits.

In addition to the earning potential, another crucial consideration is how easily you can redeem your rewards. Finding an option that aligns with your lifestyle can enhance the joy of using it. Whether you prefer direct cash back, gift cards, or travel perks, prioritizing these aspects can lead to a fulfilling experience.

As you explore various rewarding options, it’s important to keep an eye on any fees or interest rates. A great rewards program can sometimes come with costs that overshadow the benefits, so being informed is essential. Equip yourself with knowledge and find the perfect choice that provides value for your spending habits!

Affordable Options for Everyday Purchases

When it comes to managing daily expenses, having the right financial tools can make all the difference. Whether you’re shopping for groceries, dining out, or simply enjoying your favorite coffee, there are options that not only provide convenience but also help you save money in the long run.

Look for rewards that align with your spending habits. Some programs offer points or cashback specifically for groceries, dining, or gas. This means that every time you swipe, you’re earning perks that can translate into discounts or free items down the line.

Another important aspect is low fees. Many people overlook annual charges that can eat into your savings. Seek alternatives that boast minimal or even zero fees. This way, you can keep more money in your pocket while enjoying the benefits.

Introductory bonuses can also add significant value. Many financial solutions offer enticing sign-up incentives that can provide a nice boost to your rewards or cashback within the first few months. Just remember to read the fine print to ensure you meet any necessary spending requirements.

Furthermore, flexibility in payment options can enhance your financial experience. Some solutions allow you to choose between various payment plans, making it easier to manage larger purchases without straining your budget.

In summary, having affordable options tailored to your routine purchases not only eases financial pressure but also gives you the chance to reap rewards along the way. With a little research, you can find the perfect match that complements your lifestyle and spending patterns. Happy shopping!

Outstanding Travel Benefits

When it comes to exploring the world, having the right financial tools can make all the difference. Certain options come packed with perks specifically designed to enhance your traveling experience, ensuring that every adventure is not only memorable but also more rewarding. From generous point systems to exclusive access to luxurious lounges, these selections cater to globetrotters in more ways than one.

Imagine earning rewards just for booking your flights or staying at hotels. The potential to rake in points for every dollar spent opens up a world of possibilities, allowing you to redeem them for free trips, upgrades, or other unique experiences. Some options even offer complimentary travel insurance, car rental protection, and no foreign transaction fees, which significantly eases the stress of international travel.

Additionally, exclusive features such as airport lounge access and priority boarding can turn the often-harried experience of air travel into a more pleasant and relaxing one. With these tools in hand, it’s easier to make the most of your journey, turning ordinary trips into extraordinary experiences.

In a nutshell, for those with a passion for exploration, having the right financial option can transform travel from a simple escape into a lavish adventure filled with rewards and comfort.