Discover the Best Ten Credit Card Offers Available Right Now

In the vast world of personal finance, navigating through various options can be both exciting and overwhelming. Each individual has unique needs and preferences, making it essential to find the right choices that not only suit your lifestyle but also enhance your financial wellness. Whether you’re looking to earn rewards, save on interest, or enjoy exclusive perks, there’s something out there waiting for you.

As you embark on this journey, it’s crucial to stay informed about the most appealing alternatives available on the market today. With numerous providers vying for your attention, distinguishing the standout selections can lead to substantial benefits in your financial planning. Let’s dive into an exploration of the most enticing selections currently offered, perfect for anyone seeking to optimize their spending power and gain additional advantages.

From cashback incentives to travel bonuses, the variety of available options ensures that you can tailor your approach to fit your personal goals. Prepare to uncover remarkable deals that not only simplify transactions but also reward you for your everyday purchases. With a little guidance, you’ll be well on your way to making informed choices that can significantly enhance your financial experience!

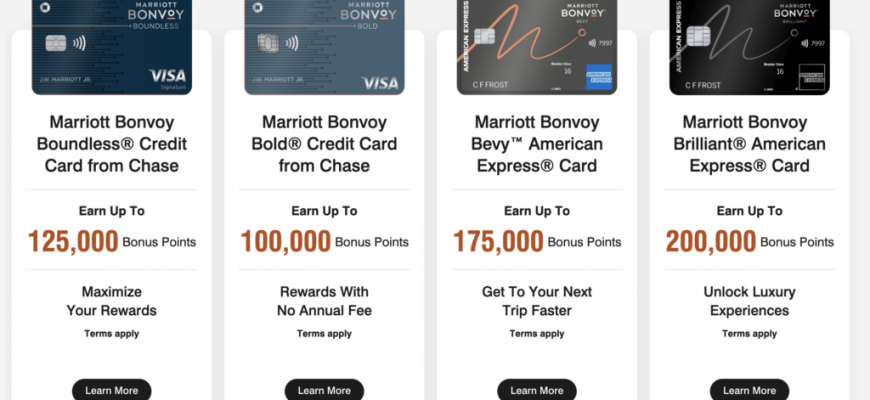

Best Rewards Options of 2023

This year brings a fresh wave of enticing opportunities for those looking to maximize their benefits. With an array of choices, savvy individuals can earn points, miles, or cash back on every dollar spent. It’s all about making your transactions work in your favor while enjoying perks along the way.

One standout option is designed for travel enthusiasts who crave adventure. Not only do users rack up points quickly, but they also gain access to exclusive experiences and discounts on future trips. Imagine redeeming those points for free flights or luxurious hotel stays!

For everyday spending enthusiasts, there’s an excellent choice that rewards regular purchases with generous cash back. Foodies, shoppers, and entertainment lovers can benefit immensely from this, turning routine expenses into impressive rewards. It’s like getting paid for doing what you already do!

Then there’s the option tailored for small business owners. This choice not only provides outstanding rewards but also offers tools to manage expenses effectively. Every purchase can lead to better financial health for your venture.

Lastly, let’s not forget about those who prioritize simplicity. Some programs offer straightforward rewards without complicated tiers or spending categories. This makes it easy for anyone to understand how to earn and redeem their rewards without unnecessary stress.

Choosing the best rewards program depends on your lifestyle and spending habits. Whether you’re a traveler, a foodie, or a business owner, 2023 has something compelling for everyone looking to gain more from their spending!

Cashback Deals That Save You Money

When it comes to managing your finances, making the most of your spending is key. There are various ways to earn rewards, and one popular method is by taking advantage of cashback programs. These initiatives allow you to receive a percentage back on your everyday purchases, effectively reducing your overall expenses while enjoying your shopping experience.

Imagine earning money just for buying items you already need. Whether you’re filling up your gas tank, grocery shopping, or dining out, cashback schemes can bring a nice little bonus to your wallet. By choosing options that offer rewards aligned with your spending habits, you can maximize benefits without changing your lifestyle.

Furthermore, many of these programs come with added perks. From limited-time promotions to partnerships with major retailers, there’s often the chance to earn even more back during special events. Staying aware of these opportunities can lead to substantial savings in the long run.

In summary, leveraging cashback initiatives can transform routine purchases into money-saving ventures. With a little planning and a keen eye for deals, you can turn your everyday spending into a proactive strategy for financial well-being.

Low Interest Rate Options for Borrowers

When it comes to managing expenses, finding financial tools with minimal charges can be a game changer. For those who might need to carry a balance from time to time, selecting options with lower rates can significantly reduce the cost of borrowing over time.

Lower interest rates provide an excellent opportunity for individuals to save money, especially if they anticipate needing to borrow. These financial solutions are designed for those who prefer to keep their payments manageable while enjoying flexibility. With the right selection, borrowers can navigate their financial commitments with greater ease and confidence.

Additionally, many of these options come with other beneficial features, such as rewards programs or no annual fees. This combination can lead to a more satisfying overall experience, making it easier to handle expenses without the stress of high-interest charges. Remember, it’s essential to review terms and conditions carefully to find the best fit for your needs.