Discover the Best Ten Credit Card Offers Available Today

In today’s fast-paced world, having the right financial tools can make all the difference. As we navigate through life’s various expenses, many individuals seek options that not only provide convenience but also come with enticing advantages. Whether it’s earning rewards, enjoying cash back, or benefiting from low interest rates, the options available can significantly impact your financial journey.

With so many choices on the market, it can be overwhelming to find the perfect fit for your needs. This is where exploring the latest offerings becomes essential. By narrowing down the most attractive selections available, you can make informed decisions that align with your spending habits and goals.

So, if you’re ready to discover some incredible opportunities that can enhance your purchasing power, let’s dive into a curated list that highlights the most appealing prospects right now. These selections cater to a variety of preferences, ensuring that there’s something for everyone!

Best Options for Earning Cash Rewards

If you enjoy earning a little something back on your everyday purchases, selecting a suitable option can significantly enhance your spending power. These financial tools are designed to provide rewards based on your spending patterns, allowing you to accumulate cash that can be used for future expenses or saved for a rainy day. With numerous choices available, it’s essential to explore which ones align best with your lifestyle and shopping habits.

Many offers in this category provide generous cash rewards on particular spending categories such as groceries, dining, or travel. By focusing on your most frequent expenses, you can take advantage of these incentives and maximize your cash back. Additionally, some options come with sign-up bonuses that can further boost your initial earnings, making the selection process even more enticing.

When considering your options, think about the annual fees, rewards structure, and any special promotions that might be available. Some programs even offer higher percentages back during promotional periods, so keeping an eye out for these can pay off nicely. The key is finding a match that not only provides excellent returns but also fits seamlessly into your financial routine.

Switching to a program that pays you back for your usual spending can make a notable difference in your budget. With a little research, you can uncover fantastic opportunities that align with how you shop and what you value. Start exploring the options available, and you might just find the perfect match for your cash-reward needs!

Low-Interest Options for Purchases

If you’re looking to make significant purchases without the burden of steep interest rates, you’ve come to the right place. There are some fantastic options available that allow you to spread out your payments while keeping financial stress in check. These types of financial products are designed to help you manage larger expenses without feeling overwhelmed.

By choosing a solution with a low-interest rate, you can enjoy the flexibility of paying over time while minimizing extra costs. This approach is particularly useful for big-ticket items like appliances, electronics, or even home renovations. Instead of opting for higher rates that can add up quickly, exploring these options lets you take control of your budget efficiently.

Many institutions offer special promotions that can significantly reduce the interest you’ll pay in the first few months. Some even provide introductory periods with 0% interest, making it easier for you to pay off your balance without worrying about accruing excessive charges. Always read the fine print, though. It ensures you know what to expect once the promotional period ends.

When considering these alternatives, look for features like no annual fees and generous reward programs. This way, you can benefit even more from your spending while enjoying lower costs overall. It’s all about making your financial choices work for you.

In summary, if you’re planning a big purchase, these low-rate options can significantly ease your financial journey. It’s an opportunity to manage expenses smartly, giving you peace of mind as you invest in what matters to you most.

Rewards Programs That Maximize Benefits

When it comes to enhancing your spending experience, many financial offers provide opportunities to earn fantastic perks. The right rewards program can transform everyday purchases into exciting rewards, making your transactions feel more valuable. Understanding the various options and how to leverage them is crucial for getting the most bang for your buck.

Here are several types of rewards programs that can amplify your benefits:

- Cashback Options: These programs return a percentage of your spending, which can accumulate over time. Look for offers that give higher percentages on categories you frequently shop in.

- Points Systems: Earning points for every dollar spent can lead to significant benefits. These points can often be redeemed for travel, merchandise, or even gift cards.

- Travel Miles: If you are a frequent flyer, programs that allow you to earn miles can yield incredible rewards. Accumulate miles on your everyday purchases for discounted flights or upgrades.

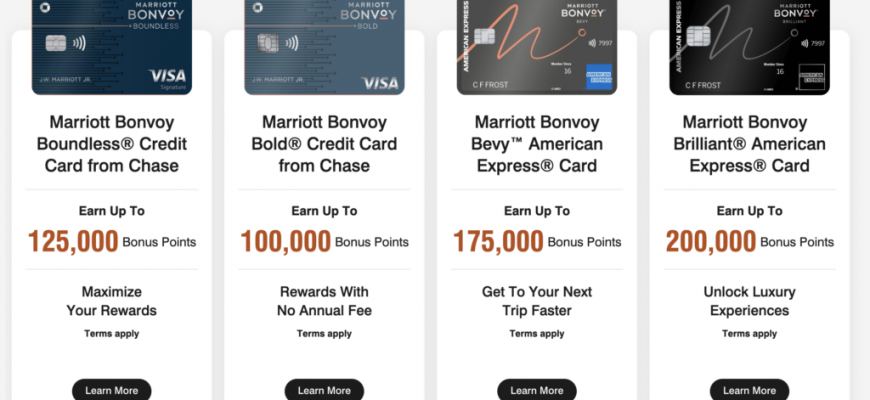

- Bonus Rewards: Some programs offer attractive sign-up bonuses or multipliers for initial spending. These can provide a quick and substantial increase to your rewards balance.

- Tiered Rewards: As you spend more, you can unlock additional benefits. This system encourages loyal spending and can lead to higher rewards as you progress through the tiers.

To make the most of these offerings, consider these tips:

- Analyze your spending habits to determine which types of rewards will benefit you the most.

- Take advantage of promotional periods that often offer heightened rewards in specific categories.

- Keep track of expiration dates for points or miles to ensure you don’t lose out on your hard-earned benefits.

- Combine programs whenever possible to maximize your rewards potential.

With some clever planning, you can turn your everyday expenses into a treasure trove of benefits, enhancing both your lifestyle and your finances.