Comprehensive Guide to Using Tax Forms When Applying for Financial Aid

When it comes to seeking assistance in achieving your educational dreams, understanding the necessary documentation is crucial. This journey often involves some paperwork that helps determine your eligibility for various types of support. While it may seem daunting at first, a little guidance can go a long way in making this process much smoother.

In this section, we’ll explore the essential paperwork required to unlock opportunities that can significantly reduce your financial burden. It’s important to know what details are needed and how to compile them effectively. With the right approach, you can tackle this task with confidence and clarity. So, let’s dive into the specifics that will set you on the path to success!

Getting to grips with the essentials will enable you to demonstrate your situation accurately, allowing decision-makers to assess your needs better. Understanding the ins and outs of this part of the process is key to getting the support you deserve. Remember, being well-prepared is half the battle won!

Understanding Financial Assistance Tax Requirements

Navigating the requirements related to monetary support can often feel overwhelming, especially when it comes to specific financial obligations. It’s crucial to have a solid grasp on how to report these benefits and what implications they may carry for your overall financial picture. Whether you’re a student seeking funds or a guardian assisting with the process, clarity on these issues is essential.

The distinction between various types of aid and how they are viewed can make a significant difference in your financial reporting. Some benefits might be classified differently, affecting your income statement and potential deductions. Therefore, familiarizing yourself with the nuances of how these contributions are documented can save you from future complications.

Moreover, understanding the timing of when to report these gains plays a pivotal role. Some assistance programs have specific periods during which they should be declared, which can vary based on the source and nature of the funding. Being proactive in gathering relevant data and keeping records can help streamline the process come reporting time.

Ultimately, seeking out reliable resources or consulting with a knowledgeable advisor can make all the difference. By staying informed and organized, you can effectively manage your responsibilities and enjoy the support meant to foster your educational or professional journey.

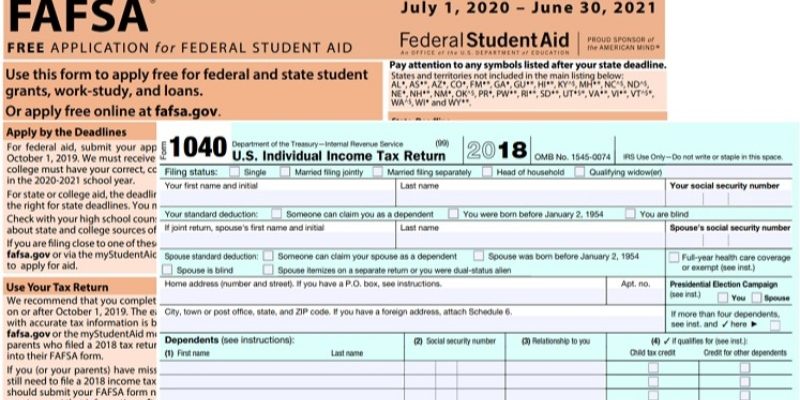

Common Documentation Needed for Assistance

When applying for various types of support, there are certain papers that are essential to provide a clear picture of your financial situation. These documents help organizations assess your eligibility and determine the amount of support you may qualify for.

First off, you’ll typically need a summary of your earnings from the previous year, which is usually a key indicator of your economic standing. Additionally, proof of other income sources, such as investments or support from family members, can also be vital. Besides income-related documents, you might also need statements that illustrate your expenses, particularly if you have dependents or outstanding debts.

Here’s a quick rundown of the most common types:

- Wage summaries – These outline your annual earnings and are often required to reflect your income accurately.

- Investment statements – Helpful for showcasing any additional revenue streams that can affect your eligibility.

- Dependency documentation – If you have children or others relying on your support, it’s important to have relevant paperwork available.

- Expense records – Receipts or bills that detail your monthly costs can give a fuller picture of your financial obligations.

Preparing these documents in advance can streamline the application process and increase your chances of obtaining the help you need. Take your time to gather everything methodically to speed things along.

Impact of Taxes on Financial Support

When it comes to the assistance people receive, the influence of government levies often plays a significant role. Many don’t realize how the obligations we bear can affect the resources available to us and, ultimately, our ability to pursue educational opportunities or other support programs. Understanding these connections is essential for making informed decisions about funding and budgeting.

The amount one contributes can shape their eligibility for various support systems. Higher contributions might indicate a more stable financial situation, leading to less available aid, while lower contributions could suggest a need for more resources. This relationship implies that understanding these contributions is vital for anyone navigating the landscape of available support.

Furthermore, the timing and method of these contributions can also create varying levels of assistance from different programs. Some avenues may take previous obligations into account, while others focus on current situations. This discrepancy means individuals should be aware of how their obligations might reflect on their current standing when seeking resources.

Ultimately, having a clear grasp of how these obligations impact personal financial situations can help individuals better prepare for the future, especially when it comes to aligning their needs with available resources. Taking a proactive approach and seeking guidance can ensure one is making the most of every opportunity.