Exploring the Exciting New Tax Credit Opportunities for 2025

As we approach a new period, many individuals and families are looking for ways to lighten their financial burdens. Government initiatives are designed to support various demographics, helping them maximize their resources and decrease expenditures. With evolving legislation, the landscape can seem complex, but the rewards of staying informed are well worth the effort.

In this discussion, we will explore the various forms of financial incentives that can alleviate some of the financial stress many experience. These benefits can significantly impact how people manage their budgets, providing opportunities for savings and enhancing overall financial well-being. Whether you’re a homeowner, parent, or simply navigating life’s expenses, understanding these offerings can empower you to make better decisions.

Join us as we delve into the specifics of these initiatives, clarifying eligibility criteria and uncovering how to effectively leverage these opportunities to improve your financial situation. Awareness is key to unlocking these advantages, so let’s break down what to expect in the coming year.

Understanding the New Financial Incentives

When navigating through the world of personal finances, it’s essential to stay informed about the latest benefits available to individuals and families. These incentives are designed to ease the financial burden and encourage desirable behaviors, such as investing in education or making environmentally friendly choices. Grasping the core concepts behind these benefits can empower you to make smarter financial decisions in the upcoming years.

One key aspect to consider is who qualifies for these provisions. Many factors can influence eligibility, including income levels, household size, and specific expenses incurred. By understanding the requirements, you can better position yourself to take full advantage of the offerings available and optimize your returns.

It’s also crucial to recognize how these incentives can vary significantly in their structure and impact. Some may provide immediate reductions in your financial obligations, whereas others might offer a more long-term approach. Familiarizing yourself with these differences will help you plan your finances more effectively and make informed choices.

Additionally, the process of applying for and claiming these benefits may involve certain steps and documentation. Being aware of what’s required can save you time and ensure you don’t miss out on valuable opportunities. Keeping organized records and understanding the application framework will streamline your experience.

Ultimately, empowering yourself with knowledge about these financial incentives can lead to better outcomes. As you explore how they can fit into your financial strategy, remember that staying proactive and informed is key to making the most of what’s available.

Key Changes in 2025 Tax Legislation

As we move into the new year, several noteworthy updates are set to reshape the financial landscape. These adjustments are designed to enhance benefits for individuals and families while also addressing economic shifts. It’s crucial to stay informed, as these modifications can have a significant impact on your personal finances.

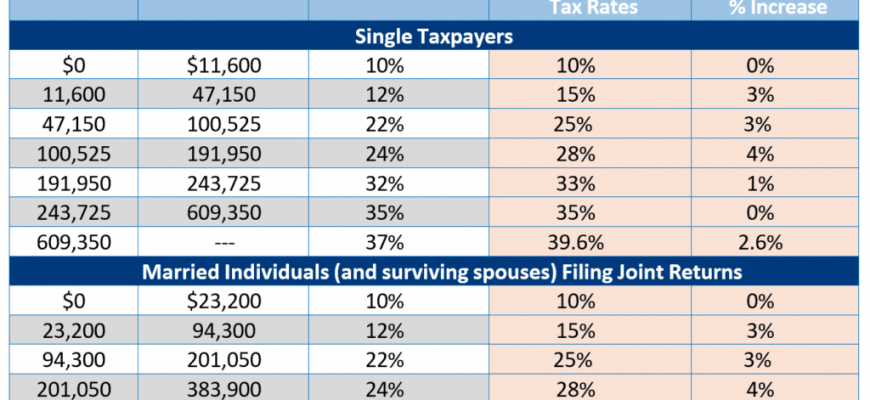

One of the most talked-about alterations involves increased thresholds for various deductions. This means that more people will qualify for advantageous reductions, making it easier for families to manage their budgets. Additionally, new incentives have been introduced aimed at encouraging sustainable practices. These innovations not only provide savings but also promote environmentally friendly initiatives.

Moreover, the revisions encompass changes to eligibility requirements, opening doors for a broader audience. This includes enhancements aimed at supporting small business owners, allowing them to invest more effectively and drive growth. The adjustments reflect a commitment to stimulating economic progress and ensuring a fairer system for all participants.

To sum it up, the upcoming modifications offer a mix of opportunities and challenges. It’s advisable to review your financial situation and consider how these changes might affect your planning. Being proactive can help you make the most out of the new landscape and take full advantage of the benefits on offer.

Who Benefits from Incentives This Year?

This year, many individuals and families can take advantage of various financial benefits designed to lighten the load on their wallets. These advantages are aimed at supporting different segments of the population, particularly those who may need a little extra help in meeting their financial obligations.

Low-to-moderate earners stand to gain significantly, receiving assistance that could result in higher disposable income. Families with children are also in a favorable position, as programs tailored to enhance their economic situation often yield substantial support. Additionally, new parents and caregivers can find particular relief through initiatives designed to ease the financial strain associated with raising children.

Homeowners and renters alike can explore options that assist with housing costs, which can be a major concern for many. Moreover, individuals pursuing education or vocational training might discover opportunities that reward their commitment to personal growth and skill development. Overall, the range of benefits available this year creates pathways for numerous groups to ease financial burdens and invest in their futures.