Comparing Tap Benefits and Financial Aid Options for Students

As the cost of education continues to rise, many students find themselves looking for ways to alleviate financial burdens. Navigating the various resources available can feel overwhelming, especially when trying to determine which paths offer the best support based on individual circumstances. Today, we’ll explore two primary avenues that can assist students in managing their expenses and achieving their academic goals.

It’s essential to understand the core differences between these support structures, as each serves a unique purpose. One option typically focuses on providing resources that must be paid back later, while the other aims to offer assistance without the expectation of repayment. By unpacking these choices, we hope to shed light on how students can leverage these resources to their advantage.

This discussion goes beyond the basics; it delves into the intricacies of how these forms of support are structured and the benefits they bring to learners. So, let’s take a closer look at what each option entails and how they can influence your educational journey.

Understanding TAP and Its Benefits

Navigating the world of higher education funding can be quite the challenge, but it’s crucial to grasp the essentials that can help lighten the financial load. One such resource provides substantial support to students pursuing their academic dreams. It’s designed to ease the burden of tuition costs, making education more accessible for many. So, let’s break down what this resource is all about and how it can positively impact your educational journey.

Firstly, this program aims to bridge the gap for those who might struggle to afford college expenses. By offering monetary assistance, it allows students to concentrate on their studies rather than constantly worrying about finances. This can significantly enhance the overall college experience, as learners can focus on acquiring knowledge and skills instead of resorting to part-time jobs to make ends meet.

Another noteworthy benefit is the potential for students to graduate with less debt. With rising tuition rates, minimizing the need for loans is more important than ever. This resource helps ensure that students can complete their education without the heavy financial burden that often accompanies student loans, allowing them greater financial freedom in the future.

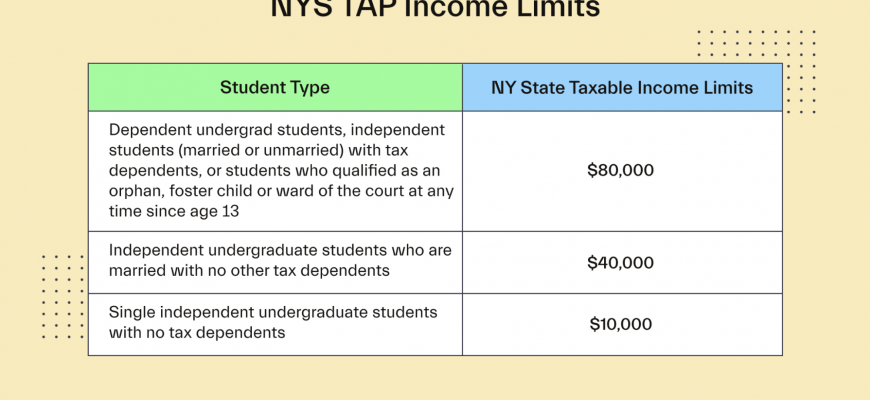

Additionally, eligibility criteria are designed to reach a broad spectrum of individuals. This inclusivity means that many aspiring scholars, regardless of their background, have the opportunity to receive this support. As students explore their options, they may find that this assistance aligns well with their specific circumstances, ultimately enabling them to take crucial steps towards their educational goals.

In conclusion, understanding the nuances of this assistance program can make a significant difference in how students approach their education. From reducing financial stress to providing opportunities for a diverse range of applicants, this resource is a vital component in the landscape of modern education. With the right information and support, students can embark on their academic journeys with confidence and optimism.

Options for Students Funding Their Education

When it comes to supporting your education, there are plenty of pathways to explore. Many students find themselves in need of financial support to help cover costs like tuition, books, and living expenses. It’s essential to understand the various resources available to make your academic journey more manageable and less stressful.

Scholarships are a popular choice among learners seeking financial assistance. These awards don’t require repayment and often target specific groups, interests, or achievements. From academic excellence to community service, there are numerous opportunities waiting to be discovered. Be sure to research local organizations and schools to find potential funding options.

Grants function similarly to scholarships, providing funds that don’t need to be repaid. They are typically based on financial need and can come from federal, state, or even institution-specific sources. Understanding the eligibility criteria and the application process can help maximize your chances of receiving this type of support.

Work-study programs offer students the chance to earn money while balancing their study commitments. These positions can range from on-campus jobs to roles with community organizations. Participating in such programs not only helps alleviate financial burdens but also provides valuable experience that can benefit future career opportunities.

Lastly, many students may consider loans as a way to fund their education. While this option requires repayment, it can be a necessary step for those who need immediate support. It’s crucial to shop around for the best interest rates and repayment plans to minimize long-term financial strain.

Ultimately, understanding these different funding avenues empowers students to make informed decisions that can greatly impact their academic and financial future. Don’t hesitate to explore each option to find the best fit for your needs.

Comparing TAP with Other Funding Sources

When it comes to supporting your educational journey, there are various options available to ease the financial burden. It’s essential to explore these different avenues and understand how they stack up against each other. By comparing grants, scholarships, and alternative sources, you can make informed decisions that best suit your needs.

First, let’s talk about scholarships. These are often awarded based on merit, achievements, or specific criteria, such as your field of study or background. Unlike some forms, they do not require repayment, making them highly sought after. Evaluating eligibility requirements and deadlines is crucial since they can vary significantly.

Next up are loans. While they provide immediate resources, they come with the responsibility of repayment, often with interest. It’s vital to consider long-term financial impacts when taking this route. Many students find themselves weighing the pros and cons to find a balance that keeps education accessible without leading to overwhelming debt.

Then we have work-study programs, which offer students the chance to earn money while attending classes. This hands-on experience not only helps fund education but also adds valuable work experience to your resume. It’s a great way to develop skills and build a professional network while managing study commitments.

Lastly, there are state and federal grants, commonly awarded based on needs. These funds typically do not require repayment and can significantly reduce tuition costs. Yet, they often come with eligibility requirements and may require a complicated application process.

In conclusion, understanding these various funding options allows you to create a well-rounded financial strategy for your education. Exploring all avenues will help you identify the most beneficial support available to you on your academic path.