Exploring the Options – Weighing the Benefits of Student Loans Against Financial Aid Opportunities

In the journey towards higher education, many individuals find themselves navigating the complex landscape of monetary support. With the rising costs of attending college and university, it becomes crucial to explore the various methods that can ease the financial burden. This section will delve into the myriad options available for those seeking assistance in managing their education expenses.

The choices can often feel overwhelming, but knowing where to seek help can make a significant difference. From government-sponsored resources to private programs, various avenues exist to help alleviate costs. Understanding these alternatives can empower individuals, making higher education more accessible and less intimidating.

As the demand for quality education continues to grow, so does the need for effective solutions to funding. Whether you’re considering applying for support or simply want to explore what’s out there, familiarizing yourself with these options is a vital step in ensuring a smooth educational experience.

Understanding the Basics of Student Loans

When it comes to funding higher education, there are various options that can help ease the financial burden. It’s important to grasp the essentials of these options and how they can work for you. Whether you’re contemplating the costs of tuition, books, or living expenses, knowing the landscape of available resources can make a substantial difference in your planning.

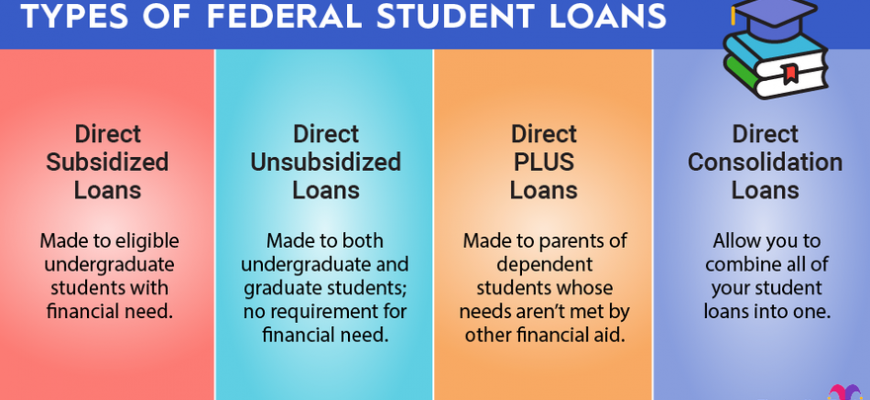

To start off, many individuals turn to borrowing as a solution to cover their educational expenses. This often involves securing funds that need to be repaid over time, sometimes with added interest. The key is to understand the different types of these borrowing opportunities, including the terms of repayment, interest rates, and any potential benefits or drawbacks that come along with them.

Another significant aspect to consider is the eligibility criteria. Each loan type may come with specific requirements that need to be met, which could include financial assessments or enrollment status. Being aware of these guidelines will enable you to make informed decisions about which options align best with your circumstances.

Finally, it’s wise to stay updated on the latest developments in the realm of educational financing. Policies and available resources can change, and being proactive will help you maximize your benefits while minimizing your stress. By familiarizing yourself with the fundamentals, you’re setting the stage for a smoother financial journey throughout your academic endeavors.

Exploring Options for Financial Assistance

When it comes to financing your education, there are numerous avenues to consider that can help ease the burden of costs. Understanding these various pathways can empower individuals to make informed decisions, ensuring a smoother journey through their academic pursuits. From grants and scholarships to specialized payment plans and community resources, the landscape is rich with opportunities.

Grants, often awarded based on need or particular criteria, can significantly reduce the overall expenses. These funds do not require repayment, making them a valuable option for many. Scholarships, on the other hand, are typically merit-based, recognizing achievements in academics, sports, or community service, thus rewarding hard work and dedication.

In addition to these traditional forms of assistance, some institutions offer tailored packages or flexible repayment options that can accommodate varying financial situations. Exploring work-study programs can also provide valuable experience while helping to offset costs through part-time employment opportunities within the campus environment.

Furthermore, local organizations and foundations often provide resources aimed at supporting individuals in pursuit of educational goals. Networking with peers or seeking guidance from advisors can uncover hidden gems in terms of lesser-known programs and funding opportunities. The key is to stay proactive and explore all possibilities that can support your educational journey.

Strategies to Manage Educational Debt

Navigating the world of educational expenses can feel daunting, but with the right approach, it becomes much more manageable. Developing effective strategies to stay on top of your financial responsibilities is crucial for ensuring long-term success and peace of mind. Whether you’ve just embarked on your academic journey or are nearing graduation, understanding how to approach your financial commitments can make a significant difference.

First and foremost, creating a realistic budget is essential. Track your income and expenses meticulously to identify areas where you can cut back. This way, you can allocate more funds toward repaying what you owe. Additionally, consider setting up a dedicated savings account specifically for your education costs, which can act as a safety net for future payments.

Another effective tactic is to explore various repayment options available. Many institutions offer flexible plans that can align with your financial situation. Don’t hesitate to reach out to your provider to discuss options like income-driven repayment programs, which can adjust your monthly contributions based on your earnings.

Moreover, supplementing your income with part-time work or side gigs can provide significant relief. Look for jobs that not only offer financial benefits but also align with your career goals, providing valuable experience while you earn. Networking with professionals in your field can also lead to opportunities that may help you ease some of the financial burden.

Lastly, remain informed about potential forgiveness programs. Some sectors offer the possibility of having a portion of your debt erased after fulfilling certain criteria, typically centered around public service roles. Familiarizing yourself with these options could lead to substantial savings over time.