A Comprehensive Comparison of Student Aid Reports and Financial Aid Packages

When it comes to pursuing higher education, navigating through the various forms of assistance can feel overwhelming. Each student aims to gather enough support to make their academic journey smoother and more affordable. However, before diving into the specifics of how funds are allocated and distributed, it’s essential to grasp the broader landscape of available options and the key documents that outline them.

At the heart of this discussion are two crucial elements that prospective learners often encounter. One serves as a detailed summary of eligibility and potential support, while the other presents a comprehensive outline of what is actually offered in terms of monetary help. Understanding how these two aspects connect and differ can significantly impact educational choices, ultimately leading to more informed decisions.

As we explore this topic, it’s important to recognize the role of well-structured information in making sense of financial opportunities. Many individuals may find themselves confused by the terminology and processes involved. By breaking down these concepts into digestible parts, we aim to clarify the paths that lead to achieving educational aspirations without unnecessary stress.

Understanding the Student Aid Report

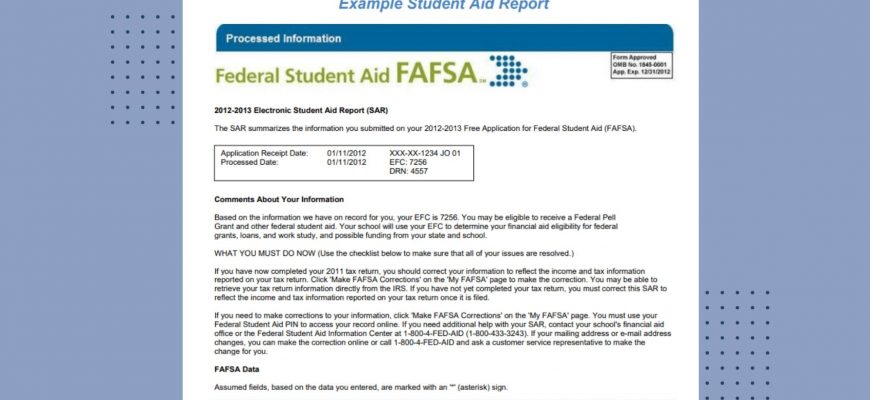

Diving into the details of how funding works for education can seem overwhelming, but it doesn’t have to be. When you apply for financial assistance, you receive a document that outlines your eligibility for different types of support. This crucial document plays a key role in helping you figure out what resources you might qualify for as you pursue your educational journey.

The information presented serves as a summary of your financial situation, gathering crucial data about your income, savings, and family circumstances. It helps the institutions you’re applying to understand your needs better and determine the level of support they can offer you. Reviewing it gives you a clearer picture of the options available and sets the stage for making informed decisions about your funding opportunities.

Ultimately, this document communicates your financial standing to various providers, helping to unlock various possibilities your future educational pursuits. By understanding its contents, you can navigate the complex landscape of tuition support more effectively and take proactive steps to secure the resources you need.

Components of a Financial Support Package

When it comes to planning for education expenses, understanding the various elements included in support offerings is crucial. These components play a significant role in shaping the overall financial landscape for students and their families. By breaking down these elements, one can gain clarity on how they combine to create an effective support structure.

First and foremost, grants and scholarships often take center stage. These funds are typically awarded based on merit or need and do not require repayment, making them highly desirable. They can significantly reduce the cost burden, allowing learners to focus on their studies rather than worrying about mounting debt.

Loans are another fundamental part of the equation. Unlike grants, these funds must be repaid, often with interest. Understanding the various repayment options and interest rates associated with them can help in making informed decisions about borrowing strategies.

Work-study opportunities also contribute to easing financial pressures. These programs allow individuals to earn money while engaging in part-time work, often related to their field of study. This not only helps with tuition but also provides invaluable experience that can enhance future career prospects.

Finally, direct contributions from families or personal savings may fill gaps, providing additional resources needed for a successful educational experience. When you take a closer look at these different components, it becomes clear how they work together to provide a more manageable approach to funding education.

How to Evaluate Your Funding Options

When it comes to covering the costs of education, it’s crucial to navigate the various resources available to enhance your financial landscape. Understanding the differences between what’s being offered can help you make informed choices that align with your personal goals and circumstances. Here’s how to thoughtfully assess your possibilities.

Start by listing all potential sources of support. This may include scholarships, grants, loans, and work-study opportunities. Each option has its own implications, and knowing the terms and conditions will help you weigh the pros and cons. For instance, some offerings do not require repayment, while others might accrue interest over time.

Next, analyze the amounts being provided. Consider not only the total sum but also how it aligns with your overall budget. Are you likely to have leftover expenses? Understanding the full picture will enable you to identify any gaps and take action accordingly.

Be mindful of the requirements associated with each option. Some might demand specific criteria for continued support, while others could have restrictive conditions. Clarifying these details will prevent unwelcome surprises down the road.

Lastly, consult with experts or peers who have navigated similar waters. Their first-hand experiences can offer valuable insights and help you gather essential tips for making the best choice for your situation.