Comparing the Student Aid Index with the Expected Family Contribution in Higher Education Funding Analysis

When it comes to funding higher education, navigating the various financial metrics can be a bit overwhelming. Two terms that often come up in this conversation are crucial for anyone looking to understand how financial resources are determined and allocated. These metrics help to paint a clearer picture of what individuals might need to cover their educational expenses and how different aspects of their financial situation are assessed.

At first glance, these parameters might seem similar, but they serve distinct purposes in the funding landscape. Recognizing the differences can empower individuals and families to make informed decisions regarding their financial planning for education. Understanding how these figures are calculated allows for a more strategic approach in applying for resources and budgeting for academic journeys.

In this article, we will break down these two important financial concepts, highlighting their implications and helping you grasp how they can affect educational affordability. Whether you are exploring options for yourself or guiding someone else, having a solid grasp on these financial indicators can be immensely beneficial.

Understanding the Support Framework

When it comes to financing education, there’s a crucial system in place that helps determine how much assistance a student might require. This framework is designed to evaluate various factors related to a student’s financial background. By understanding this system, families can better navigate the complexities of educational funding and identify what resources might be available to them.

The metrics involved aim to paint a clear picture of a household’s economic situation. Through this evaluation, institutions can gauge the level of support necessary for a student to pursue their academic goals. It considers income, assets, and overall financial standing, allowing for a comprehensive assessment.

It’s essential to recognize that this framework is not just about numbers–it’s also about opportunities and access. By breaking down potential barriers, it paves the way for brighter futures. Knowledge of how this system works can empower families to make informed decisions regarding their educational journey, ultimately shaping the opportunities available for aspiring scholars.

How Finances Influence Support Eligibility

Understanding how monetary resources affect funding availability can be crucial for many individuals. The financial background of a household plays a significant role in determining the types and amounts of support a person may receive. Let’s dive into the factors that come into play.

- Income Level: Higher earnings often lead to fewer available resources for funding. Conversely, lower income may qualify for more assistance.

- Assets: Savings, properties, and investments can impact the overall financial picture. Those with substantial assets may face reduced opportunities for support.

- Household Size: The number of dependents in a household can change the equation. More dependents typically require more resources, which can affect eligibility.

- Special Circumstances: Unforeseen situations, such as medical expenses or job loss, can complicate finances but may also provide avenues for increased support.

When navigating this landscape, individuals should gather all relevant financial information and explore options thoroughly. Understanding the impact of these factors can lead to more informed decisions and a clearer path toward receiving the necessary support.

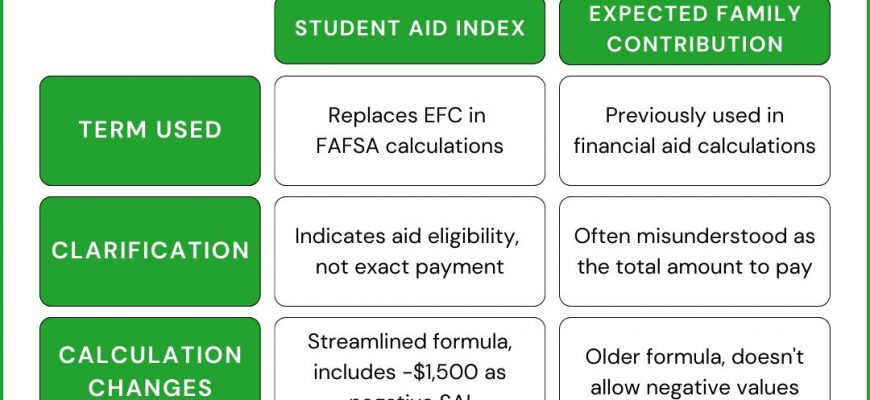

The Shift from EFC to SAI

Recently, there has been a notable transition in how financial circumstances are assessed for those seeking assistance for their educational journeys. This change aims to create a more transparent and equitable method of determining who qualifies for funding. The focus is now on providing a clearer picture of each student’s situation, ensuring that resources are distributed more effectively.

This evolution is about recalibrating the formulas and metrics used in evaluating financial need. By adopting new parameters, the system intends to better reflect the complexities of modern family finances. This move is particularly beneficial for those who may not fit the traditional molds of financial assessment, allowing a greater number of individuals to access necessary resources.

Moreover, this shift signifies a broader acknowledgment that the previous methods may not have adequately represented the realities many face today. Families everywhere are navigating diverse economic landscapes, and it’s crucial that the criteria applied for support adapt accordingly. Ultimately, the goal is to foster inclusivity and help ensure that no aspiring learner is left behind due to financial barriers.