A Comprehensive Comparison of the Student Aid Index and Expected Family Contribution Discussed on Reddit

Choosing the right educational path can often feel overwhelming, especially when it comes to understanding the various financial metrics involved. There are several factors that influence how funding is determined, and these elements can significantly impact your potential opportunities. It’s essential to delve into the different evaluations that institutions and organizations use to assess financial needs, as each one contributes to a broader picture.

In the world of higher learning, metrics play a crucial role in determining what resources individuals might qualify for. Discussions on platforms focused on student financing reveal a common confusion surrounding those metrics. By exploring the nuances of these methodologies, learners can gain insight into what to expect and how to prepare for the financial commitments of their educational journey.

Join us as we unravel the complexities of these financial assessments, comparing their implications and relevance to those seeking educational advancement. Grasping these concepts can make a significant difference in securing the support needed to achieve academic dreams and aspirations.

Understanding the Financial Contribution Scale

Grasping the essentials of how financial support is assessed can empower individuals to navigate their educational funding options more effectively. This framework serves as a crucial tool in determining how much a family is expected to contribute towards their educational expenses. The information provided through this system can significantly influence the amount of assistance one can receive, making it vital for prospective scholars to familiarize themselves with its mechanics.

The calculation takes into account various elements such as family income, assets, and the number of dependents. By understanding these components, students can better prepare for their financial obligations and plan their resources accordingly. It’s not just about numbers; it’s about creating a clearer picture of what families can realistically manage when it comes to educational costs.

One of the key aspects to remember is that this figure is not static. Changes in financial situations–like job loss or unexpected expenses–can affect one’s contribution level. This means staying informed and potentially reassessing one’s situation can lead to more favorable outcomes when applying for financial resources.

Ultimately, acquiring knowledge about this financial gauge equips future students with a better understanding of their funding landscape, allowing for more informed decisions as they embark on their academic journeys. Whether discussing plans with family or seeking additional resources, being proactive in this area can yield significant benefits.

Comparing Financial Contribution Metrics

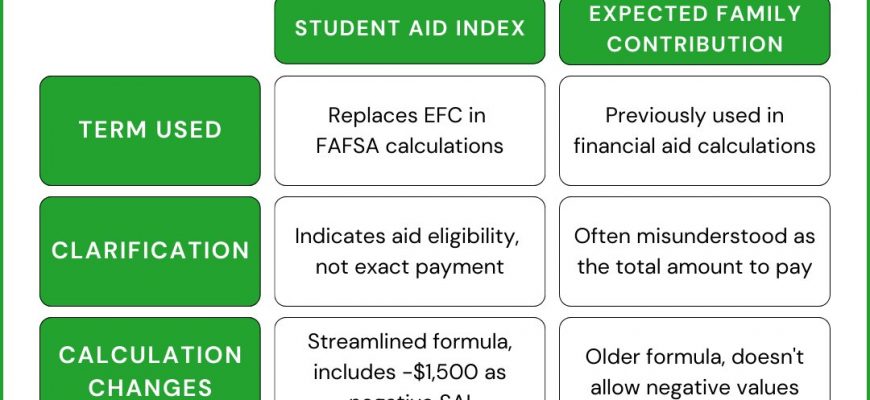

When it comes to navigating the world of higher education financing, understanding different financial contribution measurements is crucial. While one metric attempts to estimate the family’s ability to contribute financially, another focuses on a broader range of factors that influence funding availability. This comparison sheds light on how these tools impact eligibility for monetary support and overall college affordability.

On one hand, the first approach primarily considers household income and assets, which provides a baseline figure often used in assessing financial readiness. This figure can significantly vary based on individual circumstances, such as the number of dependents or other financial obligations that families may have. Consequently, while it offers a snapshot of financial capacity, it doesn’t capture the whole picture when evaluating the need for funding assistance.

On the other hand, the alternative metric encompasses a wider array of variables beyond mere financials. It accounts for academic potential, institutional trends, and available resources, allowing for a more nuanced evaluation. This comprehensive view helps institutions tailor their support offerings, ensuring that more students receive the necessary resources to succeed academically, regardless of their family’s economic status.

In essence, while both systems aim to assess financial capability, they operate through different lenses. Understanding these distinctions can be pivotal for families planning for educational expenses, helping to identify which approach aligns best with their unique situation.

The Impact of Online Discussions on Financial Support

In today’s digital age, online platforms serve as vital resources for individuals seeking guidance on monetary assistance for education. These spaces allow users to share their experiences, tips, and insights, creating a rich tapestry of information that can significantly influence decision-making. Many turn to these communities to navigate the often complex world of funding options and eligibility criteria.

Conversations frequently revolve around personal stories and practical advice, offering a sense of solidarity among those facing similar financial challenges. Participants actively engage in dialogue, exchanging valuable knowledge that can demystify the process. This collaborative environment fosters a greater understanding of the various programs available, helping individuals identify what might work best for their circumstances.

Furthermore, community feedback plays a crucial role in shaping perceptions and expectations. Insights gained from others’ journeys can illuminate potential pitfalls and highlight effective strategies. The candid nature of these exchanges encourages participants to ask tough questions and explore realistic scenarios, ultimately empowering them to make informed decisions.

As more individuals participate in these online conversations, the collective wisdom grows, creating an expansive knowledge base that benefits everyone involved. This communal sharing not only enriches personal understanding but also propels broader discussions about financial accessibility, inspiring advocacy for more inclusive support systems in education.