Exploring the S Pass Opportunities and Regulations for the Financial Sector

Have you ever wondered how some professionals in the finance industry gain access to exclusive opportunities? There’s a unique approach that allows individuals to carve out a niche for themselves in this competitive realm. This method offers a pathway to explore various roles and enhance skills, catering to those looking to make a mark in their careers.

Many aspiring experts find themselves drawn to this avenue due to its tailored structure and supportive framework. It’s designed to not only facilitate entry but also foster growth and development. Whether you are a recent graduate or a seasoned veteran, this opportunity can provide the tools and resources needed to thrive.

In this article, we will dive deep into this initiative, examining its benefits and the steps involved. We aim to uncover how it opens doors and creates a network of professionals dedicated to excellence in this dynamic environment.

Understanding the S Pass Framework

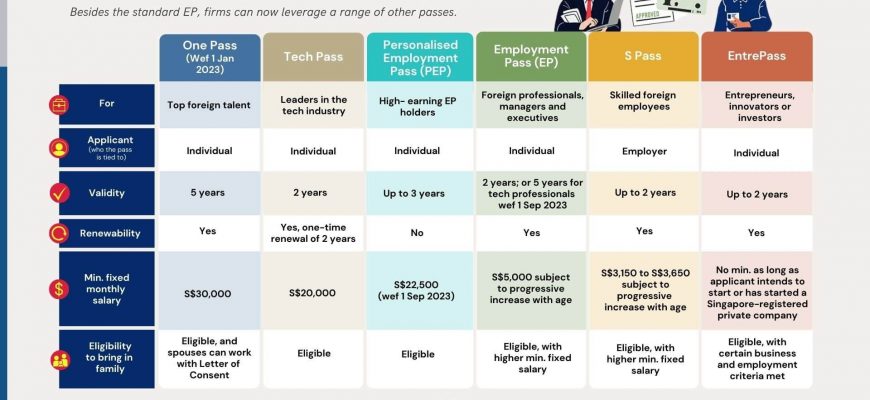

The S Pass framework is designed to establish a structured approach for skilled individuals seeking employment opportunities in specific industries. This system aims to attract talented professionals by providing a clear pathway while balancing the needs of the local workforce. It’s an essential part of the broader immigration strategy, ensuring that organizations can benefit from global expertise.

At its core, this framework is about facilitating the hiring process for businesses that require specialized skills which might not be readily available in the local talent pool. With specific eligibility criteria and application procedures, it streamlines the journey for both employers and prospective employees. The emphasis is on matching skill sets with roles that demand a higher level of expertise, ultimately contributing to the overall growth of industries.

Moreover, the framework sets certain responsibilities for companies as well, ensuring that they remain committed to the development of local talent. This creates a balanced environment where international professionals and local workers can thrive together, fostering innovation and collaboration. Understanding these underlying principles is crucial for anyone looking to navigate this landscape effectively.

Eligibility Criteria for Financial Professionals

When considering opportunities in the realm of finance, it’s important to understand the prerequisites that define who can embark on this journey. Certain standards and qualifications help ensure that individuals entering this domain possess the necessary skills and experience to thrive in a competitive landscape.

First and foremost, possessing a relevant educational background is often expected. Degrees in economics, business administration, or related fields can provide a solid foundation. However, practical experience in the industry is equally crucial, as hands-on knowledge can significantly enhance an individual’s capabilities.

Moreover, certifications and qualifications play a vital role in distinguishing candidates. Credentials like professional designations or licenses demonstrate a commitment to the profession and may be essential for specific roles. Additionally, language proficiency, particularly in English, can be a significant asset, given the global nature of the industry.

Another factor worth noting is the emphasis on personal attributes. Analytical thinking, strong communication skills, and the ability to adapt to a dynamic environment are highly valued traits that can set one apart. Ultimately, a combination of education, experience, recognized qualifications, and personal characteristics contributes to the overall eligibility for individuals aspiring to succeed in this field.

Benefits of S Pass in Banking Sector

When it comes to enhancing recruitment in the banking landscape, the introduction of this particular employment authorization is a game changer. It opens doors for numerous advantages that both companies and employees can seize. Let’s take a closer look at what makes this initiative beneficial for the banking industry.

- Diverse Talent Pool: Organizations can tap into a wider range of skills and experiences, allowing for a more versatile workforce.

- Enhanced Expertise: Access to specialists from different regions brings fresh perspectives and innovative ideas to the table.

- Boosting Productivity: By hiring qualified individuals, banks can improve overall efficiency and service delivery, leading to satisfied customers.

- Attracting Global Competence: The ability to recruit internationally allows firms to remain competitive in a fast-paced market.

- Workforce Stability: With a structured framework in place, companies can ensure a steady flow of skilled professionals for long-term projects.

In summary, integrating this form of employment authorization not only benefits individual institutions but also enriches the overall landscape of the banking community. Embracing diverse talents strengthens the industry, making it resilient and responsive to ever-evolving market demands.