How to Effectively Request Your Credit Report and What You Need to Know

Have you ever wondered about your financial history and how it impacts your life? There’s a fascinating world behind the numbers and scores that determine your financial health. Knowing where you stand can empower you to make savvy decisions, whether it’s seeking a loan, renting an apartment, or even applying for a job.

Exploring your financial profile can be a valuable step in taking charge of your economic future. It’s not just about numbers; it’s about understanding the story they tell. Many people don’t realize how important it is to keep an eye on this aspect of their lives, which can lead to several benefits down the road.

In this section, we’ll dive into how to access an overview of your financial background, the significance of staying informed, and the potential outcomes of knowing your score. Getting familiar with this information might just become a crucial part of your financial journey!

Understanding the Importance of Credit Reports

When it comes to finances, having a clear picture of your financial history is crucial. These evaluations serve as a snapshot of your monetary behavior over time, reflecting how responsibly you manage your obligations. Knowing how these records work can empower you to make informed decisions about your financial future.

Why are these documents essential? They play a significant role in various aspects of life. Whether you are applying for a loan or trying to rent an apartment, potential lenders or landlords often scrutinize this information to assess your reliability. A solid background instills confidence, making it easier for you to secure the terms you desire.

Additionally, maintaining an accurate portrayal of your financial journey can help you identify areas for improvement. If there are mistakes or inconsistencies, addressing them allows you to refine your financial standing. Regularly checking your information helps to ensure that you are aware of your personal financial landscape, paving the way for better management of your resources.

The bottom line? Understanding the significance of these evaluations is a step towards financial independence. It’s not just about borrowing; it’s about building a solid foundation for your future endeavors. So, taking time to familiarize yourself with these essential details can lead to a wealthier, more secure life.

Steps to Obtain Your Financial Record

Getting hold of your financial history is an important step in managing your personal finances. It helps you understand your creditworthiness and gives insights into how lenders view you. Here’s how you can smoothly navigate the process to access this valuable information.

1. Know Your Rights: First off, familiarize yourself with your rights regarding this sensitive information. In many regions, you are entitled to a free check-up of your financial background at least once per year. Knowing this can save you some cash and help keep you informed.

2. Choose the Right Sources: There are multiple platforms available to obtain your financial data, including official websites and agencies. Make sure to opt for reputable sources to ensure the accuracy and validity of the information you receive.

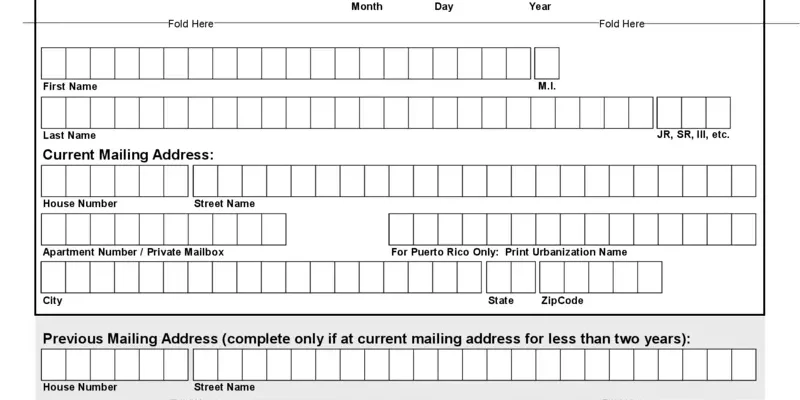

3. Prepare Your Information: Before you dive in, gather necessary details such as your full name, address, date of birth, and Social Security number. This information will be crucial for verification purposes, so keep it handy.

4. Complete the Application: Follow the prompts on the chosen platform to fill out the application. Be prepared to enter personal details and answer some security questions. Take your time to ensure everything is accurate; mistakes here could delay the process.

5. Review the Results: Once your application is processed, take a close look at the information provided. Check for any inaccuracies or discrepancies. If you do spot any issues, there are steps you can take to dispute them, which is crucial for maintaining your financial health.

6. Stay Informed: Finally, remember that keeping an eye on your financial history is not a one-time task. Regularly checking your record can help you catch errors and stay aware of how your finances evolve over time.

How to Interpret Your Financial Assessment Outcomes

Understanding the details of your financial assessment can feel overwhelming at first glance, but it’s essential for managing your financial health. This document provides a detailed snapshot of your financial history and influences your ability to obtain loans, credit, and even job opportunities. By breaking down each section, you can gain valuable insights into your financial habits and where you might need to improve.

Start by examining the personal information section. Ensure that your name, address, and Social Security number are accurate. Mistakes here can lead to significant issues down the line. Next, look at your account summary. This part highlights your open and closed accounts, payment history, and overall credit utilization. A high utilization rate might indicate you’re leaning too heavily on credit, which could negatively impact your standing.

Don’t overlook the inquiries section. This details how many times your financial history has been checked. Too many hard inquiries in a short span can signal to lenders that you may be a risk. Pay close attention to any negative items such as late payments or defaults. These entries can lower your overall score and may stay on the record for several years.

Finally, review any public records, like bankruptcies or liens. These can have a long-lasting effect on your financial reputation and should be addressed promptly if you find inaccuracies. By understanding each component of your financial assessment, you can take informed steps towards improving your standing and safeguarding your long-term financial health.