Exploring the Spectrum of Credit Score Ranges and Their Implications

When it comes to managing finances, knowing where you stand in terms of your financial reliability can significantly influence your opportunities. Your standing, often evaluated by various scoring systems, serves as a key indicator of how lenders perceive your financial behavior. This understanding can empower you to make informed decisions about borrowing and managing your money.

Many factors contribute to this measurement, reflecting everything from your payment history to your overall debt levels. These metrics play a crucial role in determining the terms of loans or credit lines you may qualify for, impacting your financial future. The better your standing, the more advantageous offers you can receive, opening doors to favorable lending conditions.

As you delve into this subject, you’ll discover different categories that represent varying levels of financial reliability. Grasping these categories will not only help you understand your current position but also motivate you to improve and maintain a robust financial profile. With the right knowledge, you can navigate the financial landscape with confidence and make choices that align with your financial goals.

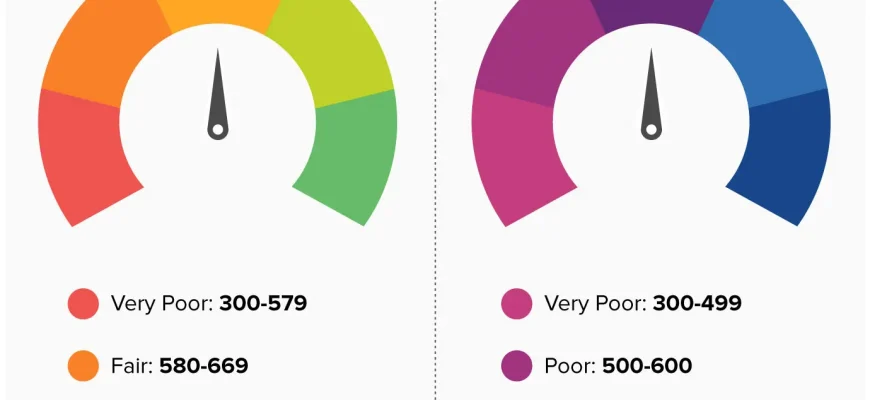

Understanding Credit Score Ranges

When diving into the world of personal finance, one term you will repeatedly come across is the evaluation of your financial health. This is a vital aspect that can influence many areas of your daily life, from loan approvals to interest rates. It’s essential to comprehend how these evaluations are categorized and what each classification signifies.

The classifications typically vary from excellent to poor, each bringing its own implications. A higher classification usually opens doors to better lending options and deals, while a lower classification can lead to hurdles. It’s interesting to note how minor adjustments in your financial behavior can significantly shift your status. Understanding these classifications empowers you to make informed decisions about your financial future.

Your classification isn’t static; it evolves based on your financial activities over time. Keeping an eye on your financial habits, like punctuality in payments and your total debt, can dramatically enhance your standing. Each aspect plays a role, and staying informed can guide you toward financial success.

Impact of Credit Ratings on Loans

Understanding how ratings can influence financial assistance is crucial for anyone looking to borrow money. These evaluations play a significant role in determining the terms and conditions of loans, shaping everything from the amount you can borrow to the interest rates that apply. A solid understanding of where you stand can help you navigate the lending landscape much more effectively.

When applying for a loan, lenders often check your assessment to gauge the level of risk associated with lending you money. A higher assessment generally indicates a lower risk, leading to better terms–think lower interest rates and more favorable repayment options. On the flip side, a lower evaluation might restrict your borrowing options or increase the costs. It’s essential to recognize how these assessments can affect not just approvals but also your overall financial health.

Moreover, when you maintain a robust assessment, it can open doors to various opportunities beyond traditional loans, including credit cards, mortgages, and even rental agreements. Making informed financial decisions will not only improve your rating but can also enhance your overall borrowing experience. Remember, lenders want to feel confident in their choice, and your evaluation is a key factor in that equation.

Improving Your Financial Rating Over Time

Boosting your financial assessment is a journey that takes patience and strategy. It’s not just about making a quick fix; rather, it’s a gradual process that involves developing healthy monetary habits. Understanding the key elements that contribute to your overall evaluation will empower you to make informed decisions that positively influence your status.

One of the first steps on this journey is to consistently monitor your financial profile. Regularly checking for inaccuracies can save you from unexpected setbacks. If you spot any discrepancies, addressing them promptly can help maintain a favorable impression. Additionally, staying on top of your accounts can prevent unpleasant surprises.

Another vital aspect is timely payments. Meeting your obligations on schedule demonstrates reliability and builds trust with lenders. Establishing reminders can ensure you never miss a due date. If you find it challenging to remember, consider setting up automatic payments to stay organized.

It’s also crucial to keep your debt levels manageable. High utilization of your available credit can negatively impact your evaluation. Aim to use only a fraction of your allocated resources and gradually pay down existing debts. This not only elevates your assessment but also releases financial stress.

Diversifying your types of credit can be beneficial too. Having a mix, such as loans and lines of credit, shows you can effectively handle various financial responsibilities. However, be cautious not to open multiple accounts at once, as this could have the opposite effect.

Lastly, patience is key. Significant improvements take time, so focus on applying these practices consistently. Over the months and years, you’ll likely see a positive transformation in your standing. Remember, each small action contributes to a healthier financial future, so stay the course and celebrate your progress along the way!