Understanding the R Credit Rating and Its Implications for Investors and Borrowers

When it comes to evaluating the financial health of organizations or individuals, there’s a fascinating set of metrics that come into play. These measures provide insight into how likely someone is to meet their obligations based on their past behaviors and current situation. In this article, we’ll explore the various aspects of these assessments, shedding light on their importance and the factors that influence them.

Many people wonder, what really goes into determining these evaluations? The truth is, a multitude of elements work together, from payment history to outstanding debts, creating a comprehensive picture of financial reliability. Understanding these components can empower you to manage your finances better and make informed decisions. We’ll break it all down so you can grasp the essentials with ease.

Additionally, we’ll discuss how these assessments affect not only loans but also everyday financial interactions, such as renting an apartment or buying insurance. Recognizing the implications of your score can lead to opportunities that align more closely with your financial goals. So, let’s dive into the world of R scores and discover how they shape the financial landscape.

Understanding R Credit Ratings

When we talk about R scores, it’s all about assessing the financial health of individuals or entities. These evaluations are crucial for lenders, investors, and anyone looking to gauge the reliability of someone’s financial background. Think of it as a report card highlighting how trustworthy someone is when it comes to managing their obligations.

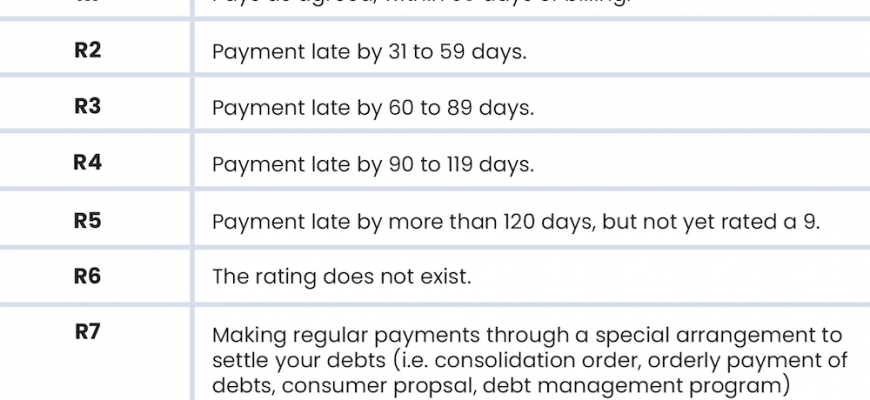

R scores typically range across a spectrum, with different levels indicating varying degrees of risk. A high score suggests that the individual or organization has a solid track record of fulfilling their financial commitments. Conversely, a lower score flags potential red flags that might concern lenders or stakeholders.

These evaluations are influenced by numerous factors including payment history, total debt, and overall financial behavior. Understanding these components can empower you to improve your own score over time. It’s like building a reputation–the more responsible you are, the better your standing. So, whether you’re aiming for a loan or simply want to enhance your profile in the financial world, grasping the ins and outs of R scores can be incredibly beneficial.

Importance of Credit Ratings in Finance

Understanding the evaluation of financial reliability is crucial in the world of economics. These assessments help investors and institutions gauge the likelihood of timely repayments on obligations. The insights gained from these evaluations are essential for making informed decisions in lending, investment, and even policy formulation.

For individuals and businesses alike, these assessments play a significant role in determining access to funding. Higher evaluations typically lead to more favorable terms, such as lower interest rates, paving the way for easier borrowing. On the other hand, lower assessments can restrict financial opportunities and increase costs.

Moreover, these evaluations influence the broader economy. They impact investor confidence and the overall stability of financial markets. When evaluations shift, it can lead to significant movements in stock prices and interest rates, affecting everyone from large institutions to everyday consumers.

Ultimately, staying informed about the status of one’s financial reliability is not just beneficial–it’s essential. By keeping a pulse on these evaluations, individuals and businesses can navigate the financial landscape more effectively and make smarter, more strategic choices.

Factors Influencing R Credit Ratings

When it comes to assessing an entity’s financial reliability, several elements come into play. These aspects help determine how trustworthy a borrower is perceived to be in the eyes of investors and lenders. Understanding these influences is crucial for making informed decisions in the financial landscape.

Economic Conditions: The broader economic environment significantly impacts evaluations. Factors like GDP growth, unemployment rates, and inflation can all play a role in shaping perceptions of an organization’s stability.

Financial Health: An entity’s financial statements tell a compelling story. Metrics such as revenue, expenses, and profit margins provide insights into financial well-being. High levels of debt, in particular, can raise red flags and affect overall assessments.

Management Quality: Leadership matters. The experience and strategic vision of executives can elevate confidence in an organization. A strong and effective management team often instills greater trust among stakeholders.

Industry Trends: The sector in which a company operates also influences evaluations. Industries facing challenges, such as regulatory changes or technological disruptions, may lead to more scrutiny compared to those thriving in favorable conditions.

Market Position: A company’s standing within its industry can signify its strength. Market share, brand reputation, and competitive advantages all factor into how an entity is viewed by external parties.

Historical Performance: Past behavior often predicts future actions. Entities with a consistent track record of meeting obligations can foster confidence, while those with a history of defaults may struggle to gain positive perceptions.

Each of these elements plays a pivotal role in shaping the overall perspective of an entity’s dependability. It’s important for both investors and borrowers to grasp these influences to navigate the financial world effectively.