Criteria and Requirements for Eligibility in Financial Aid Programs

Navigating the maze of support options available to students can sometimes feel overwhelming. Many individuals seeking assistance in pursuing their educational goals often wonder what steps they need to take to qualify for various programs. It’s essential to grasp the criteria that determine who can access these opportunities, allowing for a smoother journey through the academic landscape.

Whether you’re a high school graduate, a working professional looking to upskill, or someone returning to studies after a break, understanding the necessities that influence eligibility is key. Various factors come into play, including personal circumstances, income levels, and academic performance. By familiarizing yourself with these elements, you can better position yourself to make informed decisions about your educational financing options.

It’s not just about meeting a checklist; it’s about discovering pathways that align with your unique situation. With the right knowledge, you can unlock doors to valuable resources that can significantly lessen the burden of educational costs. So, let’s delve deeper into what you need to know to maximize your chances of receiving the assistance you deserve.

Understanding Assistance Criteria

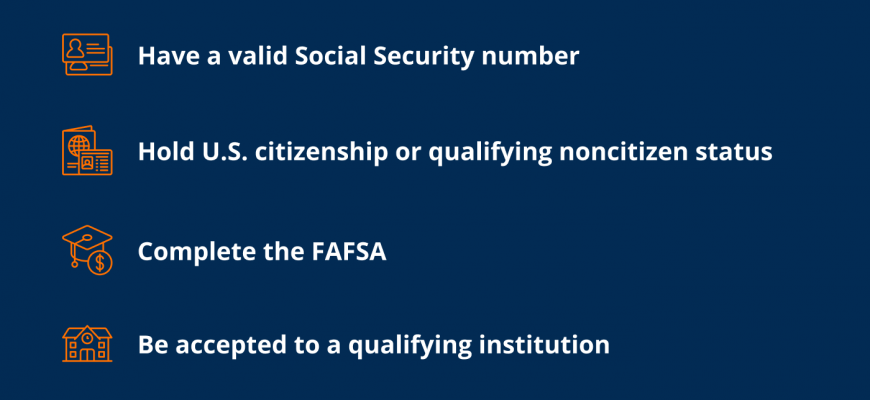

When it comes to pursuing higher education, many students seek support to help cover their expenses. It’s essential to grasp the various elements that determine eligibility for these resources. Navigating through this landscape can seem daunting, but a clear understanding of what is required can make the process much more manageable.

Many organizations and institutions have specific standards in place that influence who can receive help. These criteria often include factors such as academic performance, family income, and enrollment status. Each of these components plays a vital role in the selection process, guiding students toward available options tailored to their situations.

Furthermore, the application process generally involves submitting detailed information to assess your suitability. Completing forms accurately and providing necessary documentation can enhance your chances of receiving the support you need. Remember, being informed and prepared is key to navigating this journey successfully.

Different Types of Financial Assistance

When it comes to pursuing education or managing expenses, there are various support options available to help lighten the load. These resources can come in several forms, each designed to meet the diverse needs of individuals. Understanding the different avenues can empower you to make informed decisions about what might work best for your situation.

Grants represent one of the simplest forms of support, as they typically do not require repayment. These funds are often awarded based on specific criteria, which might include financial need or academic performance. Scholarships, on the other hand, are often merit-based, focusing on achievements in areas like academics, sports, or community service. Both grants and scholarships can significantly reduce educational costs.

Loans are another route, providing funds that must be repaid over time. They can be sourced from a variety of entities, including the government and private institutions. While loans can be a crucial resource for some, it’s essential to understand the terms and conditions, as repayment can become a substantial commitment.

Work-study programs offer a fantastic opportunity to gain practical experience while alleviating some expenses. These arrangements typically involve part-time work that relates to your field of study, allowing you to earn while you learn.

Finally, there are alternative funding options like crowdfunding, where individuals can reach out to their networks to gather contributions for their educational or personal projects. Each of these methods provides unique advantages, and exploring a combination of them can often yield the best outcome for managing educational or living costs.

How to Maintain Eligibility for Support

Staying in the good graces of assistance programs can feel like a balancing act. Each organization has its own set of standards and rules that need to be followed closely. Making sure you meet these criteria requires vigilance, but with a bit of planning, it can be straightforward. Let’s explore some key strategies to help secure your ongoing access to the resources you need.

Stay Informed: Regularly check for any updates or changes in the requirements. Policies can shift, and staying in the loop will help you avoid unpleasant surprises.

Academic Performance: Your grades often play a crucial role. Keep your academic standing in good shape to ensure you continue to qualify for assistance. If you feel overwhelmed, don’t hesitate to seek help from professors or tutors.

Timely Submissions: Make it a habit to submit necessary documents on time. Whether it’s applications or transcripts, adhering to deadlines is essential for maintaining your status.

Financial Status Review: Keep an eye on your financial situation. Sudden changes can affect your eligibility. If your circumstances shift, communicate with the relevant offices as soon as possible.

Engagement in Required Programs: Many support programs have specific participation rules. Make sure you attend workshops, orientations, or any mandated meetings to demonstrate your commitment.

Document Everything: Maintain records of your academic progress, financial changes, and any correspondence related to your support. This information will be invaluable in case of any disputes or questions.

By following these guidelines, you can take proactive steps to ensure you remain eligible for the assistance you rely on. A little effort can go a long way in securing the support needed to achieve your goals.