Essential Criteria for Eligibility in Child Tax Credit Programs

When it comes to financial relief for families, there are various forms of support designed to ease the burden of raising little ones. These benefits can play a pivotal role in ensuring that parents have the resources they need to nurture their dependents. However, not everyone is automatically eligible, and there are specific conditions that must be met to take advantage of these programs.

Those seeking assistance may find it helpful to familiarize themselves with the criteria that determine their eligibility. By knowing what is required, families can make informed decisions and maximize the support available to them. This exploration will cover essential factors that come into play when assessing eligibility for these monetary incentives.

In the following sections, we will delve deeper into the key aspects that influence access to benefits aimed at supporting families with dependents. Understanding these elements can significantly affect how much support families ultimately receive. Let’s take a closer look at what may qualify you for these valuable financial resources.

Understanding Eligibility Criteria for Tax Benefits

To access certain financial rewards, it’s important to recognize what conditions must be met. These stipulations shape who can receive assistance and how much support is available. Each program comes with its own unique set of guidelines aimed at making benefits accessible to those who truly need them.

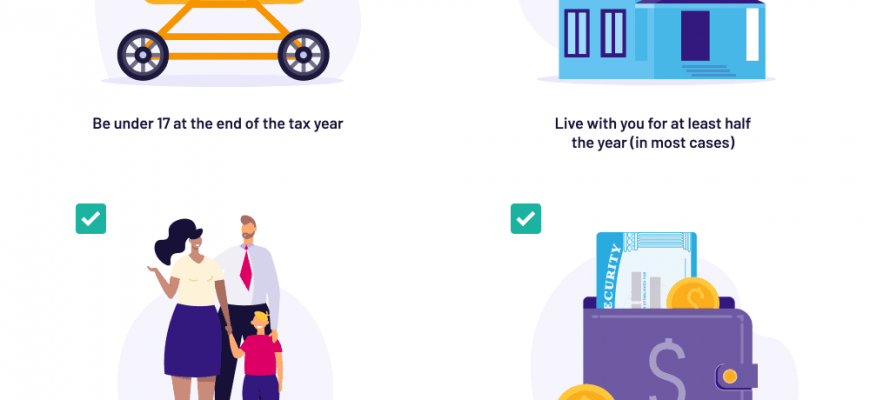

Residency typically plays a significant role in determining access to these incentives. Individuals must often prove they reside in a specific area or country. In addition, the age and dependency status of dependents are essential factors that can influence eligibility. Understanding these aspects helps potential applicants navigate the complexities of the system more effectively.

Moreover, income thresholds are another critical element in evaluating who qualifies for these financial advantages. Generally, there are limits, and applicants must provide evidence of their earnings. Being aware of these financial boundaries ensures that applicants can assess their standing before proceeding with applications.

Documentation also cannot be overlooked. Having the right paperwork is vital when applying. This ensures that all claims are verified and that individuals receive the benefits they deserve. In conclusion, grasping the necessary criteria allows families to make informed decisions and potentially unlock valuable financial support.

How Income Levels Affect Child Credits

The interplay between earnings and available financial benefits can often be puzzling. As families navigate their budgets, understanding how financial standing influences potential support can help in planning and maximizing resources. Essentially, different income brackets can lead to varying levels of assistance, encouraging families to optimize their financial situations.

When it comes to eligibility, it’s essential to recognize that as income rises, the amount of available support typically decreases. This structure is designed to ensure that those who have greater financial means receive less aid compared to families with lower earnings. It’s a balancing act aimed at directing funds toward those who need them most.

For households situated within a lower income range, the potential benefits can be significantly higher. It’s not just about receiving a helping hand; it can mean substantial relief and opportunities for better living conditions. On the other hand, as families earn more and cross certain thresholds, they may find that the help they once enjoyed begins to dwindle, which can feel quite disheartening.

Ultimately, understanding these dynamics aids families in making informed financial decisions. By being aware of how earnings influence available assistance, families can strategize effectively, ensuring they receive the maximum possible support while still aiming for growth and prosperity.

Required Documentation for Claiming Benefits

When it comes to receiving financial support for raising a family, having the right paperwork is essential. It’s not just about filling out forms; you need certain documents to demonstrate eligibility and ensure a smooth process. Gathering this information beforehand can save you time and help avoid any potential issues down the line.

First off, proof of relationship is usually necessary. This could mean providing birth certificates or adoption records to show the legal ties. Additionally, you may need to present identification documents, such as Social Security cards, to verify the identities of the dependent children in question.

Income verification is another crucial element. This typically requires submitting copies of your most recent pay stubs, W-2 forms, or tax returns to showcase your financial standing. Each of these documents plays a role in determining the amount of support you might be entitled to.

Finally, it’s a good idea to have any relevant legal documents in hand, such as custody agreements or divorce decrees, if applicable. These can help clarify your situation and ensure all parties involved are properly recognized. Collecting these items ahead of time not only streamlines the application process but also strengthens your case for receiving assistance.