Comprehensive Overview of Q&M Financial Performance and Insights

As we delve into the latest overview of our company’s performance over the recent three-month period, it’s essential to grasp the key elements that shaped our trajectory. These insights not only highlight our achievements but also illuminate the challenges we’ve encountered along the way. Our aim is to provide a clear understanding of the financial landscape, setting the stage for informed decision-making moving forward.

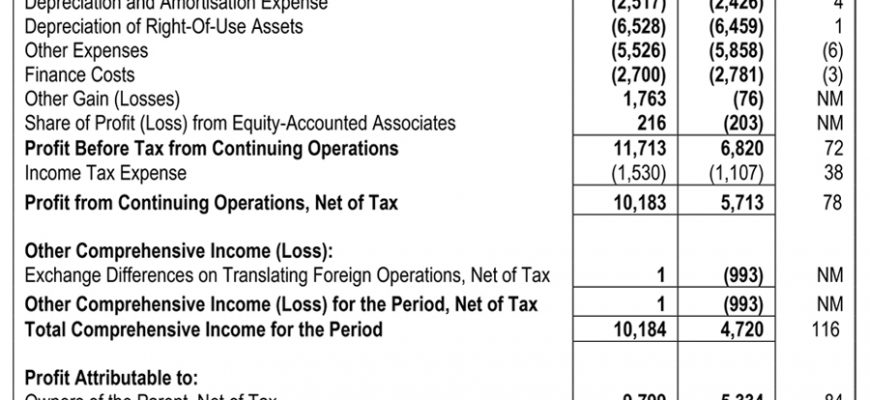

In this section, we will unpack the various metrics and figures that have defined our progress. This will include an examination of revenue trends, expense management, and overall growth tendencies. By analyzing these components, we can grasp how well we’ve aligned with our strategic objectives and what adjustments might be necessary as we navigate the future.

Stay tuned as we break down this complex information into digestible pieces, ensuring that every stakeholder has the clarity needed to make sound judgments. Whether you’re a long-time partner or new to our journey, our thorough overview aims to connect you with the essential data that drives our success. After all, understanding where we’ve been is crucial in charting the course ahead.

Overview of Q&M Financial Performance

In this section, we’ll take a closer look at the recent performance metrics of the company, focusing on key indicators that illustrate its economic standing. Understanding these figures helps paint a clearer picture of how well the organization is navigating the market and achieving its objectives.

This period has shown a resilient uptrend, indicating a solid grasp of industry dynamics. Revenue streams have demonstrated notable growth, driven by strategic initiatives and enhanced customer engagement. The operational efficiency also contributed positively, showcasing the company’s ability to manage costs while maximizing output.

Moreover, it’s essential to highlight the balance sheet’s strength, reflecting smart asset management that supports ongoing investments and future projects. Metrics such as profit margins reveal not just the company’s ability to generate income but also its operational prowess. Overall, the organization appears well-positioned for continued success in a competitive landscape.

Key Drivers Influencing Recent Earnings

Examining the factors that have shaped the recent performance of a company reveals the intricate web of influences at play. Various elements come together to create a clear picture of what boosts profitability or pulls it down. Understanding these drivers is crucial for stakeholders aiming to grasp the company’s trajectory.

First and foremost, market demand has surged in specific sectors, leading to increased sales and expanded customer bases. Consumer behavior often changes, and identifying these trends early can position a business favorably. Alongside this, operational efficiencies have improved, allowing for cost-cutting measures without sacrificing quality.

Moreover, innovations in product offerings can capture attention and spark interest among consumers. When a company successfully launches something new or enhances an existing product, the potential for increased revenue grows significantly. External economic factors, such as shifts in regulations or changes in the competitive landscape, also play a vital role in shaping performance outcomes.

Lastly, strategic partnerships or acquisitions can provide a substantial boost, opening doors to new markets or enhancing product lines. Tracking these elements helps stakeholders understand not just where the company stands now, but where it could head in the future. The interplay of these influences is what truly defines a company’s financial journey.

Future Projections and Strategic Initiatives

The path ahead is filled with exciting possibilities and ambitious plans aimed at fostering growth and innovation. As we look toward the horizon, it’s clear that we must tailor our strategies to not only adapt to evolving market conditions but also to seize emerging opportunities. With a proactive approach, we can ensure our robust position in the industry while meeting the demands of our stakeholders.

First and foremost, our analysis indicates a need for investment in technological advancements to enhance operational efficiency. By embracing cutting-edge solutions, we aim to streamline processes and reduce overhead costs. This will not only increase productivity but also provide us with a competitive edge in our sector.

Additionally, expanding our market reach is a critical component of our strategic framework. Targeting new demographics and entering untapped regions presents an invaluable chance for revenue growth. Through careful research and targeted marketing campaigns, we will establish our presence in these areas, building brand awareness and customer loyalty.

Furthermore, fostering partnerships and collaborations with key players in the industry is essential. These alliances can lead to shared resources and knowledge, ultimately resulting in innovative products and services that appeal to a broader client base. We are committed to identifying and nurturing these relationships to enhance our overall offering.

As we move forward, our focus will remain on sustainable practices that not only drive profitability but also contribute to the well-being of our communities and the environment. Implementing greener initiatives will resonate with consumers and strengthen our brand’s reputation.

In summary, by embracing technology, expanding our footprint, forging strategic alliances, and prioritizing sustainability, we are well-positioned to navigate the future with confidence and purpose.