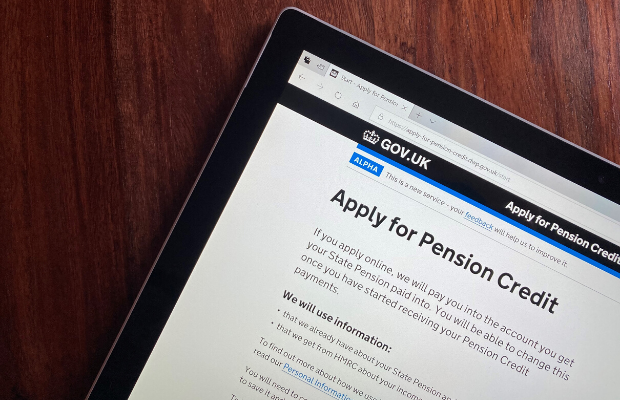

Applying for Pension Credit Online – A Step-by-Step Guide to Simplifying Your Application Process

Navigating the world of financial assistance can sometimes feel overwhelming, especially when it comes to securing the help you need for a comfortable living. Many individuals find themselves in situations where a little extra support can significantly improve their quality of life. Fortunately, there are streamlined processes in place that allow for a smoother way to seek out these resources, particularly for those who have dedicated years to their work.

Embracing technology has revolutionized how we manage such requests, making it easier than ever to connect with the benefits you may qualify for. You no longer need to navigate the complexities of paperwork in person; now, you can explore options and even initiate the necessary steps from the comfort of your own home. This modern approach not only saves time but also provides a sense of empowerment, knowing that help is just a few clicks away.

Getting started might seem daunting, but understanding the process can truly set your mind at ease. By following the right steps and arming yourself with the required information, you can confidently take charge of your financial future. In this guide, we will walk you through everything you need to know to access these essential resources seamlessly.

Understanding Eligibility Criteria

When it comes to securing financial support in your later years, it’s crucial to grasp what makes you eligible for assistance. Knowing the requirements can help you navigate the process with confidence and ensure you receive the benefits you deserve. Let’s break down the key factors that determine if you qualify for financial aid tailored to your situation.

Age plays a significant role in determining your eligibility. Generally, individuals must reach a specific age threshold to qualify for these financial provisions. It’s designed to support those who have retired or are approaching retirement age.

Income level is another essential factor. Financial assistance is aimed at individuals whose earnings fall below a certain limit. This means that your total income from various sources will be evaluated to see if it aligns with the established guidelines for receiving support.

Living situation can also impact your eligibility. Whether you live independently or with a partner can make a difference in assessing your needs. Some schemes may have different stipulations based on household dynamics, so it’s vital to understand how your living arrangements affect your situation.

Assets are taken into account as well. Often, there is a cap on the value of your property and savings that can influence your ability to secure assistance. Knowing what assets count–and how much value is permissible–will help you assess your eligibility accurately.

Finally, it’s essential to remember that eligibility criteria can vary based on local regulations and specific types of support. Always check the guidelines pertaining to your area to ensure you have the most accurate information.

By familiarizing yourself with these factors, you’ll be better equipped to understand whether you qualify for the support you need during your retirement years.

Step-by-Step Guide to Online Application

Applying for financial assistance can feel daunting, but it doesn’t have to be. This guide will walk you through the process in a straightforward manner, ensuring you have all the necessary information and steps at your fingertips. By the end, you’ll be ready to tackle your application with confidence!

Step 1: Gather Your Documents

Before you dive into the process, make sure you have all your paperwork handy. You’ll need details like your identification, proof of income, and any relevant financial records. Having these ready will speed up your experience and reduce the chances of delays.

Step 2: Create an Account

Most platforms require you to set up an account. Head over to the official website and look for the “Sign Up” or “Register” option. Fill in your details and create a secure password. Remember to keep your login information safe!

Step 3: Fill in Your Information

Now comes the fun part! Carefully enter your personal details into the form. Take your time to ensure that everything is accurate. Double-check your answers, as mistakes could lead to complications down the line.

Step 4: Review Your Application

Before submitting, it’s crucial to review all the information you’ve provided. This is your chance to catch any typos or errors. If you can, ask someone you trust to look it over as well – a fresh pair of eyes can be incredibly helpful!

Step 5: Submit and Await Confirmation

Once you’re satisfied, hit that submit button! After submission, you should receive a confirmation notification. Keep an eye on your email for any updates or additional requests for information as the processing begins.

Step 6: Follow Up

If you haven’t heard back within a reasonable timeframe, don’t hesitate to reach out to the support team. They can provide you with updates and clarify any questions you may have regarding your status.

And there you go! With this step-by-step approach, you’re well on your way to securing the assistance you need. Good luck!

Common Mistakes to Avoid During Submission

When you’re navigating the process of seeking additional financial support, it’s easy to trip over a few common pitfalls. Many find themselves making simple errors that can delay or complicate their experience. Here are some key points to keep in mind to ensure a smoother journey.

First and foremost, always double-check the information you provide. Whether it’s your personal details, income data, or any other specifics, inaccuracies can lead to questions or even rejections. Make sure everything is correct and up-to-date before hitting that submit button.

Another frequent mistake is overlooking necessary documentation. Ensure you gather all required papers beforehand. Missing or incomplete documents can stall the process, so it’s wise to prepare them in advance. Take inventory of everything needed and have it all ready to go.

It’s also important to understand the system’s requirements thoroughly. Skimming through guidelines or instructions can result in missteps. Dedicate some time to read everything carefully; knowing what is expected of you helps avoid many common errors.

Finally, don’t hesitate to ask for help if you’re unsure. Many organizations offer assistance, and seeking clarification can save you from unnecessary complications. Remember, it’s better to ask questions than to submit incorrect information.