Maximizing Your Retirement Benefits Through Online Pension Credit Systems

In today’s fast-paced world, managing financial resources for the later stages of life has become more accessible and streamlined. Gone are the days of sifting through piles of paperwork and waiting in long lines just to check up on entitlements. With the advent of digital tools, individuals can now take charge of their financial future from the comfort of their homes, ensuring they are well-prepared for the years ahead.

The ability to monitor and optimize your future financial support is more important than ever. Many platforms have emerged that allow users to easily track their accrued advantages, analyze their options, and make informed decisions that align with their personal goals. These innovations provide a level of transparency and control that was once unimaginable.

Understanding how to navigate this modern landscape is crucial. Whether you’re just starting your journey or looking to adjust your plans, familiarizing yourself with the array of resources available is a smart move. By leveraging these tools, individuals can secure a more comfortable and stable existence in their golden years, ensuring peace of mind and the opportunity to enjoy life to the fullest.

Understanding Digital Retirement Benefit Systems

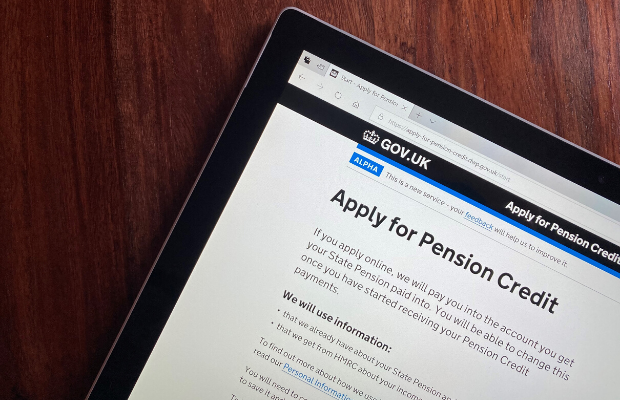

In today’s fast-paced world, managing retirement benefits has become more convenient and accessible thanks to various digital platforms. These systems offer individuals the ability to monitor and enhance their financial security in a way that was previously unimaginable. With just a few clicks, users can explore options, track their entitlements, and even apply for necessary adjustments to ensure a comfortable future.

The essence of these platforms lies in their user-friendly interfaces and real-time updates, allowing individuals to make informed decisions regarding their financial well-being. Whether it’s assessing current eligibility or discovering potential enhancements, these systems streamline the entire process. The convenience of accessing this information anytime and anywhere means that more people can take charge of their financial future without the usual hassle associated with traditional methods.

One of the remarkable features of these digital interfaces is their ability to provide personalized insights. Users can receive tailored recommendations based on their status and circumstances, significantly increasing their chances of maximizing benefits. Furthermore, the integration of secure communication channels ensures that individuals can seek assistance or clarify doubts without any worries about privacy.

As technology continues to evolve, so do these systems. Features such as automated alerts for important deadlines and changes keep individuals informed and engaged, making them feel empowered. Exploring the world of digital retirement solutions can lead to better outcomes and a more secure financial future, proving how beneficial modern technology can be in planning for the years ahead.

Benefits of Digital Retirement Applications

In today’s fast-paced world, managing your retirement planning through digital platforms has never been easier. These modern applications bring a host of advantages, making the whole process smoother and more accessible for everyone. They not only streamline the management of your future financial security but also make it an engaging experience.

One of the standout features of these digital tools is their convenience. You can access your information anytime and anywhere, eliminating the need to visit offices or handle piles of paperwork. This flexibility means you can manage your funds while lounging at home or during your commute, fitting seamlessly into your busy lifestyle.

Additionally, these platforms often come equipped with user-friendly interfaces and educational resources. This helps you make informed decisions regarding your financial strategy. The ability to visualize your growth over time can be an empowering experience, inspiring confidence as you navigate your options.

Moreover, digital solutions typically offer real-time updates and notifications. This keeps you informed about changes in regulations, market trends, or your own financial status. Staying in the loop enables better planning and adjustments, ensuring that you are always on top of your future needs.

Finally, many of these applications incorporate advanced security measures. This gives users peace of mind, knowing that their sensitive information is protected. In a world where security is paramount, trusting a digital tool with your financial future can be a game changer.

Steps to Access Your Retirement Rights

Getting your retirement benefits can feel overwhelming, but breaking it down into simple steps makes the process more manageable. It’s important to understand how to navigate your entitlements and ensure you receive what you deserve during your golden years.

First, gather all necessary documents that outline your work history and contributions. This may include tax statements, employment records, and any relevant correspondence from past employers. Having everything in one place will save you time and headaches later on.

Next, check with the appropriate agency responsible for distribution. Each region may have different guidelines, so it’s crucial to visit the official website or contact their office directly to find accurate information about your rights.

After that, complete any required forms or applications. Many agencies provide user-friendly resources to help you through this step. Take your time to fill out the necessary paperwork accurately to avoid delays.

Once submitted, keep track of your application status. Most agencies offer a way to monitor your progress, whether through an online portal or by phone. Staying informed can help you address any potential issues quickly.

Finally, be patient but proactive. After your application is processed, ensure that you understand the options available to you. This might involve setting up a meeting with a financial advisor to discuss your choices moving forward.