The Future of Oil Prices – Will They Rise or Fall?

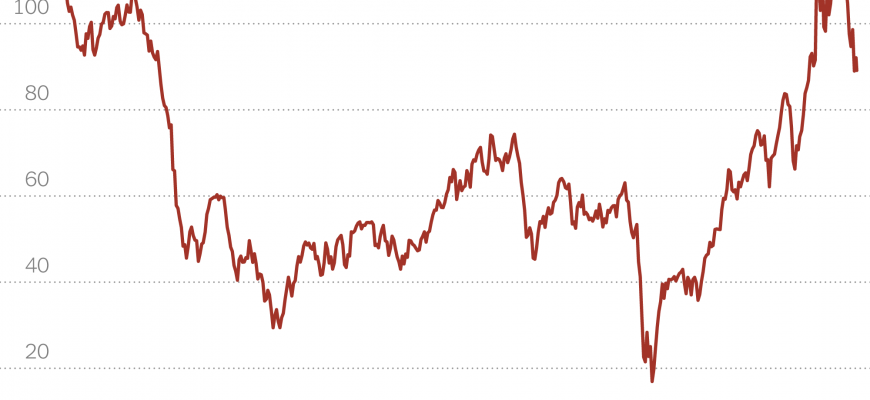

When it comes to the world of energy, fluctuations are part of the game. Many factors come into play, influencing the dynamics and causing shifts that can affect everyone from consumers to industries. This section aims to explore the potential trajectories of this vital commodity in the coming months.

In recent times, market enthusiasts have been closely monitoring various elements that could dictate the future. Geopolitical events, environmental policies, and even technological advancements can create waves that impact how this essential resource is valued. As we dive deeper, we’ll uncover the intricate web connecting these influences and their implications for us all.

The conversation around these fluctuations isn’t just about numbers; it’s about understanding the broader context and preparing for what lies ahead. Whether you’re a casual observer or deeply entrenched in the market, grasping these trends can empower you to make informed decisions in an ever-changing landscape.

Factors Influencing Future Oil Prices

When considering the fluctuations in the petroleum market, it’s essential to examine numerous elements that come into play. Each factor, whether economic, political, or environmental, contributes to the ever-changing landscape of this commodity’s valuation. Understanding these influences helps in making more informed predictions about its trajectory.

One significant aspect to consider is global demand. As countries grow and develop, their need for energy surges. Emerging economies often drive this demand, enhancing their industrial progress and affecting consumption patterns worldwide.

Another critical element is geopolitical stability. Regions rich in natural resources can experience unrest due to political tensions. Such disturbances can disrupt supply chains, leading to sudden shifts in the market. Additionally, decisions made by major producing nations, including production cuts or increases, can significantly sway valuations.

Technological advancements also play a crucial role. Innovations in extraction and production methods can affect the efficiency of resource utilization, thus altering the balance between supply and demand. The growing emphasis on renewable energy sources introduces another layer of complexity, as it could potentially lessen reliance on traditional fuels in the long run.

Market speculation can’t be overlooked either. Investors often react to economic indicators, environmental reports, and various announcements, fostering volatility. Traders’ expectations about future conditions can create ripple effects, influencing the entirety of the market.

In summary, a multitude of factors intertwine to shape the future of this vital resource’s worth. Keeping an eye on these influences helps stakeholders navigate the complexities of the energy landscape more effectively.

Market Trends and Economic Indicators

In the ever-evolving world of commodities, understanding current tendencies and economic signals is essential for making informed decisions. Observing various factors helps us grasp the potential movements in the marketplace, paving the way for strategies that align with foreseeable conditions. The way supply interacts with demand can greatly influence the direction in which markets swing.

One significant aspect to consider is the overall economic landscape. Key indicators such as employment rates, inflation levels, and manufacturing output provide insight into the health of economies. When economies are robust, demand for resources typically rises, potentially leading to upward movements in market values. Conversely, during downturns or uncertainties, consumption may decline, creating downward pressure.

Additionally, geopolitical events often play a crucial role in shaping market dynamics. Conflicts, trade negotiations, and international policies can lead to fluctuations that reverberate across various sectors. Traders and investors closely monitor such developments, as they can swiftly alter the perception of supply stability and future availability.

Furthermore, technological advancements and shifts toward renewable energy sources gradually impact traditional sectors. As alternatives gain traction, the traditional market may experience adjustments, which in turn affect the strategies of all players involved. Staying ahead of these trends is vital for anticipating future developments in the overall economic arena.

Impact of Geopolitical Events on Crude Costs

Geopolitical events have a significant influence on energy markets, often leading to fluctuations that can be felt globally. Tensions in key regions or conflicts between nations frequently result in uncertainties that affect supply and demand dynamics. These disruptions not only capture the attention of analysts and investors but also play a crucial role in shaping the financial landscape for commodities.

As we navigate this complex environment, it becomes essential to understand how these geopolitical factors intertwine with economic fundamentals. Keeping an eye on international developments provides valuable insights for those looking to forecast future movements and make informed decisions in this ever-changing landscape.