Exploring the Fluctuations and Impact of Oil Price Volatility on Global Markets

In the ever-evolving landscape of global commerce, few factors wield as much influence as the shifts in energy resources. These changes can stir profound repercussions, impacting everything from consumer behavior to government policies. As the world increasingly relies on various forms of energy for daily functioning, understanding the nuances of these alterations becomes imperative.

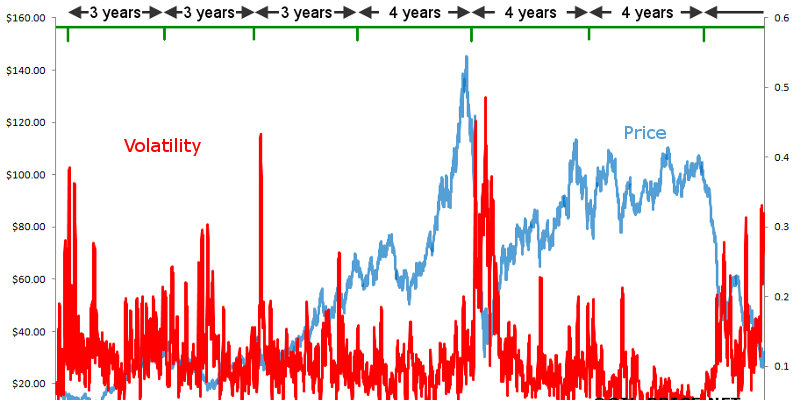

Over time, we have witnessed a dramatic interplay between supply and demand, geopolitical tensions, and technological innovations. Each of these elements contributes to the unpredictability of the market, making it a constant source of intrigue for analysts and industry experts alike. As we delve deeper, we aim to unravel how these fluctuations shape economic realities and affect everyday lives.

Furthermore, the ripple effects of these changes extend far beyond the boardrooms of major corporations. They can influence transportation costs, manufacturing expenses, and even the average household budget. Navigating this complex environment calls for a keen awareness of the ongoing trends and an ability to anticipate forthcoming shifts.

Join us as we explore the intricacies of this fascinating subject, shedding light on the forces at play and providing insights that can help us better understand our world.

Understanding the Causes of Oil Price Fluctuations

When it comes to the world of energy resources, shifts in market dynamics can create significant ripples that affect economies, consumers, and industries alike. Grasping what drives these changes is essential for those looking to navigate the complex landscape of energy markets.

Several key factors contribute to the instability observed in the energy sector:

- Supply and Demand: The basic principles of supply and demand play a crucial role. When the production levels are disrupted or when demand spikes unexpectedly, we can see noticeable changes in market values.

- Geopolitical Events: Unrest in resource-rich regions often leads to fears of supply disruptions, causing fluctuations. Political stability is essential for maintaining consistent production.

- Economic Indicators: Broader economic trends, such as growth rates and employment figures, can signal shifts in consumption patterns, impacting values in this sector.

- Technological Advances: Innovations in extraction and production can alter supply dynamics, influencing market perceptions and reactions.

- Regulatory Changes: New laws and regulations can have immediate effects on production costs, impacting supply chains and market access.

- Natural Disasters: Events like hurricanes or earthquakes can disrupt infrastructure, leading to temporary supply shortages and subsequent fluctuations.

By understanding these diverse factors, individuals and organizations can better anticipate changes and make informed decisions in a constantly shifting marketplace.

The Impact of Geopolitical Events on Energy Markets

When we talk about the dynamics of energy resources, it’s impossible to ignore how global tensions can shake up the market. Conflicts, political shifts, and diplomatic disputes often serve as catalysts that lead to significant changes in demand and supply. These developments affect not only the production levels of countries but also consumer behavior, making the entire landscape quite unpredictable.

For instance, when key regions face unrest or instability, the perceived risk surrounding production can spike. Investors and traders keep a close watch on these events, adjusting their strategies based on the potential impacts on the availability of these crucial resources. This reaction can lead to immediate fluctuations, as everyone scrambles to make sense of how geopolitical tensions might translate into market realities.

Moreover, sanctions, trade agreements, and international relations play pivotal roles in shaping the landscape. When a major player decides to impose restrictions on another, it sends ripples throughout the industry. Nations that depend heavily on imported supplies feel the pinch, potentially leading to a scramble for alternative sources, which further complicates the overall scenario.

It’s also interesting to note how sentiments can sometimes drive the market, independent of actual supply and demand changes. Speculators and analysts often lean on news reports and expert opinions, which can further exacerbate the reactions seen in trading. This human element ties into the broader, more analytical understanding of how global events influence market behavior.

In summary, the interplay between global affairs and energy markets is complex and multifaceted. As international situations evolve, they can lead to a ripple effect that touches numerous stakeholders, from producers to consumers, making awareness of these events crucial for anyone involved in the sector.

Strategies for Investing Amid Price Uncertainty

When navigating the turbulent waters of investment, particularly in sectors affected by unpredictable shifts, having a solid strategy becomes essential. The key is to remain adaptable and informed, allowing you to make prudent choices even when the market experiences wild swings. Understanding the dynamics at play can help you embrace opportunities while managing risks effectively.

Diversification plays a crucial role in mitigating potential losses. By spreading your investments across various sectors, you reduce the impact of adverse movements in any single area. Consider allocating resources not only to traditional assets but also to emerging technologies or renewable alternatives, which may offer more stability or growth potential during uncertain times.

Another practical approach is to adopt a long-term perspective. Short-term fluctuations can be dramatic and often lead to emotional decision-making, which may not be in your best interest. Focusing on your overarching financial goals can help you weather temporary market disruptions and capitalize on long-standing trends.

Staying informed is vital for making sound investment decisions. Keeping an eye on geopolitical developments, economic indicators, and industry reports will provide valuable insights into potential market shifts. Regularly reviewing your investments and adjusting based on new information can help you stay ahead of the curve.

Additionally, employing risk management techniques such as setting stop-loss orders can protect your portfolio from extreme downturns. These tools allow you to define your limits and exit positions before incurring substantial losses, giving you a safety net in turbulent times.

Lastly, consider working with a financial advisor who understands the nuances of market fluctuations. Their expertise can guide you in tailoring your strategy, ensuring your investments align with your risk tolerance and financial aspirations.