Comparing Oa and Sa Interest Rates to Understand Their Impact on Financial Decisions

When it comes to making smart financial decisions, distinguishing between two key concepts can significantly influence your choices. In this exploration, we will dive into the fundamental differences and implications of two important financial mechanisms. One might find themselves pondering how choices made today can have lasting impacts on tomorrow’s financial landscape.

Oa and Sa each hold distinct characteristics that cater to various needs and contexts. By understanding their underlying principles, you can better navigate options that align with your financial goals. It’s not just about numbers; it’s about how these figures play out in real-life scenarios and what they mean for your financial health over time.

In this conversation, we’ll break down the core aspects of these two mechanisms, shedding light on their benefits, drawbacks, and potential outcomes. This understanding is essential for anyone looking to optimize their financial strategies to achieve desired results.

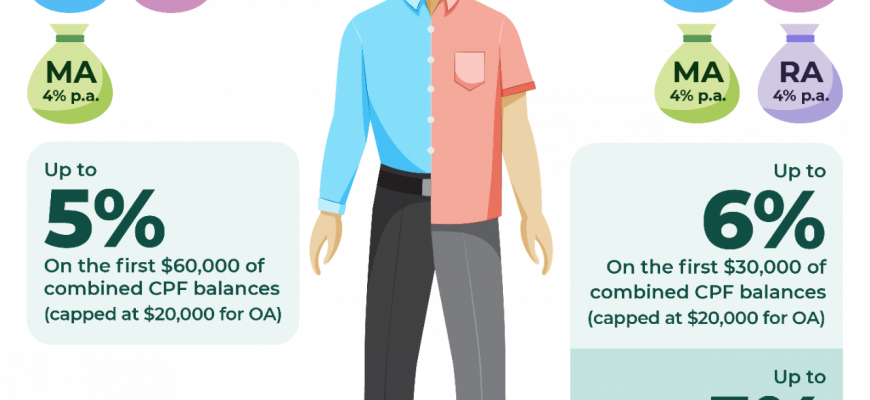

Understanding Oa and Sa Interest Rates

When it comes to personal finance, distinguishing between the various options available can make a significant difference in managing your funds effectively. In the realm of financial products, two prominent choices often come into play: Oa and Sa. These terms denote different approaches to how your capital can grow or be utilized over time, each offering unique benefits and features that cater to diverse financial needs.

Oa typically refers to a more traditional method of accumulating returns, often associated with fixed payouts. On the flip side, Sa represents a more dynamic approach, allowing for greater flexibility and potentially higher returns depending on market fluctuations. Understanding the nuances of these two choices is essential in tailoring your financial strategy to suit your specific goals, whether you seek stability or are willing to embrace some risk for possibly greater rewards.

The key lies in recognizing how each option aligns with your objectives. Those who prioritize security may find the Oa model appealing due to its predictable outcomes. Conversely, individuals desiring adaptability in their financial planning might gravitate towards the Sa model, which offers the potential for enhanced growth based on performance metrics. By delving deeper into the distinct characteristics of Oa and Sa, you can navigate the financial landscape more confidently and make informed decisions that align with your aspirations.

Impact of Financial Charges on Investments

Understanding how financial charges can affect your investments is crucial for making informed decisions. These charges can significantly influence the performance of various assets, creating a ripple effect throughout your portfolio. When these costs fluctuate, they can either empower or constrain your financial growth, depending on the chosen asset class and your overall strategy.

Lower costs usually foster an environment conducive to growth, encouraging more individuals to venture into investments. For instance, when borrowing costs are down, investors might be more inclined to take on larger projects or invest in new ventures, which can lead to greater returns. Conversely, if borrowing becomes expensive, it can lead to a more cautious approach, making individuals think twice before committing their funds.

Moreover, the overall economic climate often shifts alongside these financial dynamics. When the price for borrowing is low, it generally supports expansion, leading to a vibrant market where opportunities abound. On the other hand, a rise in expenses can curtail spending and investment, resulting in slower economic activity and potential downturns.

Additionally, various asset types react differently to these variations. For example, real estate may become less attractive if borrowing becomes costly, while equities might see fluctuations in valuations based on projected earnings. Understanding these nuances is essential for any investor looking to navigate the complexities of the financial landscape effectively.

Comparative Analysis of Oa and Sa Rates

When it comes to investment and savings options, understanding the nuances between two types of financial returns can be quite enlightening. Oa and Sa represent different approaches to growing your funds, each with its distinct characteristics that can significantly impact your overall gains. In this segment, we’ll explore the distinctions and similarities that define their appeal to various investors.

One notable difference lies in how each option calculates the accumulation of value over time. Oa typically offers a straightforward, predictable method of growth, making it an attractive choice for those who prefer stability and consistency. On the other hand, Sa introduces a more dynamic approach that can yield potentially higher rewards but also comes with an element of risk that might not suit every investor’s profile.

Moreover, the flexibility of both options can vary significantly. While Oa may appeal to those who want to lock in their funds for a set period with guaranteed returns, Sa often allows for more adaptable terms, giving investors the ability to adjust their strategies based on market conditions. This adaptability can be crucial for individuals looking to capitalize on favorable trends.

In terms of audience, Oa may cater better to conservative investors or those who are new to financial planning, while Sa often attracts seasoned individuals who understand the complexities of the market and are willing to navigate through its fluctuations. It’s essential to assess which type aligns with your financial goals and risk tolerance.

In conclusion, both Oa and Sa offer unique advantages, and the choice between them ultimately depends on individual preferences and financial objectives. Conducting thorough research and considering personal circumstances will guide you towards the best option for your financial journey.