Exciting New Bank Account Options Tailored Specifically for Students

In today’s world, managing finances can be quite a challenge, especially for those embarking on an academic journey. Fortunately, there are a variety of tailored financial solutions designed specifically for those navigating this pivotal stage of life. These pathways not only assist in budgeting and saving but also offer perks that make managing money a whole lot easier.

As young adults balance classes, social lives, and potential part-time jobs, having the right tools to handle finances becomes essential. There’s a growing trend to provide customized solutions that cater to the unique needs of this demographic. With features like minimal fees and convenient online access, it’s easier than ever to stay on top of expenses while studying.

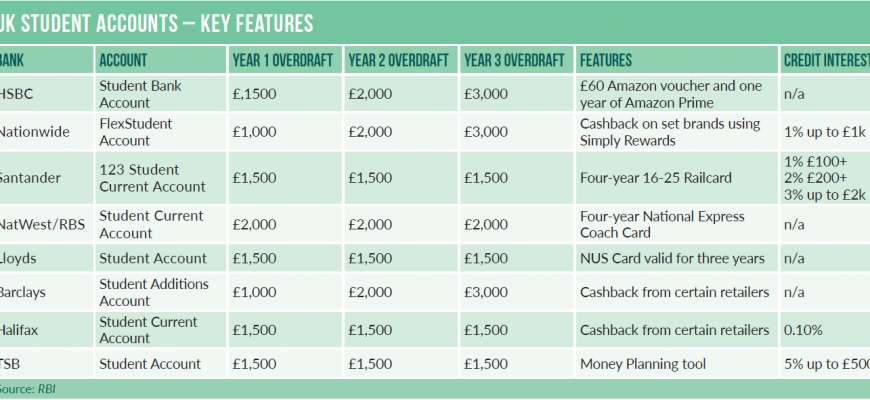

What’s truly remarkable is the extra benefits that often come with these financial products. Some may include cashback rewards, special discounts, or even incentives for responsible spending. These enticing elements help foster positive financial habits that can lead to a solid foundation for future financial success.

As you explore your options, keep in mind the importance of choosing wisely. The right path can enhance your experience, making it not only manageable but also enjoyable. So let’s take a closer look at what’s available out there to support your financial journey!

Best Student Banking Options in 2023

Finding the right financial solution can be a game changer for young adults navigating their academic journey. With a variety of choices tailored to meet unique needs, it’s essential to explore different alternatives that offer great features, low fees, and beneficial perks. Let’s dive into what makes these options stand out in 2023.

One popular choice comes with no monthly maintenance fees, allowing students to keep their hard-earned money where it belongs – in their pockets. Additionally, many providers offer enticing incentives like cash bonuses or cashback rewards on certain purchases, making it easier for individuals to manage their expenses while enjoying some added benefits.

Accessibility is another crucial aspect to consider, with numerous platforms featuring user-friendly apps and online portals. This means managing finances can be done on the go, perfect for busy scholars juggling classes, part-time jobs, and social lives. Instant notifications for transactions also ensure there are no surprises when checking balances.

Lastly, some services even feature support tailored specifically to the younger demographic. Whether it’s financial literacy resources or specialized savings tools, these options aim to empower users in making informed decisions about their money. In 2023, it’s all about convenience, rewards, and support for those embarking on their educational endeavors.

Features to Look for in Student Accounts

When considering the right financial solution tailored to young learners, there are several key characteristics that can make a significant difference. It’s important to focus on aspects that not only simplify managing funds but also enhance the overall experience.

No Monthly Fees: One of the primary benefits should be the absence of monthly service charges. This feature allows individuals to save more of their hard-earned money without worrying about unnecessary deductions.

Flexible Access: Look for options that provide easy access to money. This can include features like mobile banking and ATMs with convenient locations. The ability to manage finances on-the-go is crucial for a busy lifestyle.

Low Minimum Balance: Another important aspect is the low or nonexistent minimum balance requirement. This is ideal for those who may not always have a large sum available, ensuring that you won’t incur fees for falling below a certain threshold.

Educational Resources: Some institutions offer valuable resources that promote financial literacy. Access to workshops or online tutorials helps in building budgeting skills and understanding financial responsibilities.

Rewards and Incentives: Consider options that provide cash-back rewards or other incentives for maintaining a certain activity level. These perks can make managing finances more gratifying and encourage responsible saving habits.

By keeping an eye on these vital features, individuals can find a financial partner that truly supports their journey during these formative years.

How to Choose the Right Financial Institution

Finding the perfect financial partner can feel like navigating a maze, especially when you have unique needs and preferences. The key is to identify what matters most to you, whether it’s accessibility, fees, or even digital services. With so many choices out there, taking a systematic approach will help you make an informed decision.

First, consider what services are essential for your daily transactions. Do you need easy access to cash, or is online banking more your style? Different establishments provide various features tailored to diverse lifestyles, so know what you value most.

Next, pay attention to the fee structures. Some institutions might lure you in with enticing rates but hit you with hidden charges down the road. Look for transparency in fees to avoid surprises that could strain your budget.

Lastly, don’t underestimate the importance of customer support. Having responsive and knowledgeable staff can make a significant difference when you have questions or need assistance. Research reviews and ask around to gauge the reputation of potential choices.

By keeping these factors in mind, you’ll be better equipped to select a financial establishment that aligns with your goals and lifestyle, making your financial journey smoother and more manageable.