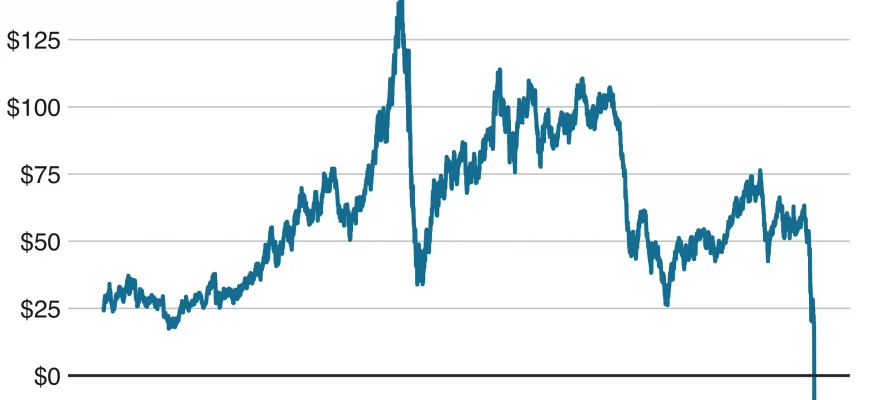

The Unexpected Phenomenon of Oil Prices Falling Below Zero

The landscape of commodities often surprises us, revealing unexpected turns and fluctuations that challenge conventional wisdom. Recently, the energy sector has witnessed an astonishing event that shook the very foundations of market dynamics. Imagine a scenario where the value of a fundamental resource drops to astonishing lows, leaving many scratching their heads in disbelief.

This unprecedented situation has prompted both investors and consumers to reconsider their understanding of supply and demand. While it might seem counterintuitive for a vital energy source to trade for less than nothing, there are underlying factors that contribute to this rare occurrence. In this exploration, we will delve into the mechanics behind this phenomenon, unraveling the complexities and implications that ripple across the global economy.

As we navigate through this topic, it is crucial to recognize the interconnectedness of various elements at play. From geopolitical tensions to shifts in consumption patterns, the reasons behind such a drastic downturn are multifaceted. Join us as we investigate this remarkable chapter in the history of energy markets, seeking to grasp the lessons learned and potential future impacts.

Understanding the Concept of Negative Oil Prices

Imagine a scenario where the demand for a particular commodity dwindles to such an extent that sellers are willing to pay buyers just to take it off their hands. This situation might sound bizarre, yet it can occur under specific economic conditions. The concept challenges traditional understanding and encourages us to rethink the dynamics of supply and demand.

When the available quantity exceeds what consumers are willing to purchase, sellers face significant dilemmas. They could either let their inventory accumulate, potentially incurring hefty storage costs, or they can incentivize buyers with financial compensation. This unusual phenomenon highlights how volatile markets can shift rapidly due to unforeseen circumstances, external factors, or drastic changes in consumer behavior.

Such circumstances often arise in the context of crises, where usual consumption patterns break down. When people are not using a product as expected, market forces can lead to extraordinary situations that no one could have predicted. It reflects the fragility of economic systems and reinforces the principle that values are not static but rather fluctuate based on immediate realities and perceptions.

Ultimately, encountering a scenario where sellers offer financial incentives to move their goods serves as a stark reminder of the unpredictable nature of markets. It compels businesses and economists alike to adapt their strategies and approach to forecasting, reminding everyone that in economics, anything is possible.

Impact on Global Energy Markets

The recent downturn in the energy sector has sent shockwaves around the globe, affecting not just producers but also consumers and investors alike. This unforeseen situation has led to a reevaluation of how energy is produced, transported, and consumed, altering the conventional dynamics of the market.

With such drastic shifts, many countries dependent on energy production have had to reassess their economic strategies. Countries that thrived on high extraction rates are now facing budgetary constraints and economic challenges, leading to potential geopolitical ramifications. This situation encourages diversification across various energy sources, fostering innovation and investment in renewable technologies.

On the consumer side, lower energy costs have sparked an increase in demand, as businesses and individuals alike find it more affordable to operate. However, this demand surge may be temporarily overshadowed by concerns regarding supply stability and the long-term viability of traditional energy sources. The market’s recovery may hinge on the balance between these opposing forces.

The financial sector is also feeling the heat, as energy companies grapple with cash flow issues and credit concerns. This has prompted investors to reconsider their portfolios and seek out opportunities in alternative energy solutions. Overall, the ramifications of this situation are reshaping the very foundation of the global energy landscape.

Historical Context and Future Implications

Understanding the shifts in the energy market requires a glance back at previous occurrences that set the stage for unprecedented developments. Over the years, the dynamics of supply and demand have played a crucial role in shaping the economic landscape. Episodes of extreme fluctuations have raised eyebrows and prompted discussions about the sustainability of traditional energy sources.

Events like the sudden surge in extraction capabilities, geopolitical tensions, and unexpected global events can lead to swift changes, impacting economies and the environment alike. These remarkable instances challenge our notions of market behavior and force us to rethink the resilience of our energy systems. Looking forward, the lessons learned from past anomalies can guide policymakers and industry leaders in crafting strategies that not only anticipate but also mitigate future crises.

As we delve into the implications of these historical events, a critical inquiry arises: How might shifts in energy consumption and production affect societies moving ahead? The growing emphasis on renewable sources signals a potential transition, prompting a reevaluation of energy dependence and its long-term consequences on both global markets and environmental sustainability.