Exploring the Challenges of Inadequate Financial Aid for My Academic Journey

Many individuals find themselves facing a common dilemma: relying on available resources to manage the rising costs of education. The challenge of making ends meet often leads to concerns about whether the assistance provided truly covers the necessary expenses. This scenario can create a sense of anxiety, particularly for students striving to achieve their academic goals.

In numerous cases, what seems like a helping hand can quickly reveal limitations, prompting a need for alternative strategies. As students navigate this complex landscape, the pressure to find supplementary solutions can be overwhelming. They may wonder how to balance their aspirations with the reality of budget constraints, which can impact not only their studies but also their overall well-being.

Understanding the scope of available help and the gaps that exist is crucial for those embarking on this journey. A proactive approach is essential for identifying solutions that can bridge the divide between expectations and reality. It’s important to explore different avenues, seek out community resources, and connect with others who share similar experiences, in order to foster a sense of empowerment and resilience in the face of financial challenges.

Understanding Support Limitations

When it comes to pursuing education, many individuals rely on various types of support to help cover costs. However, it’s crucial to recognize that these resources often come with certain boundaries and may fall short of covering all expenses. Grasping these limitations can help you make better financial decisions and plan more effectively.

One key aspect to consider is the way these resources are calculated. Many institutions have specific criteria that determine the amount available, which can fluctuate based on various factors. Here are some points to keep in mind:

- Eligibility criteria: Your financial situation, academic achievements, and even the type of program you’re enrolled in can influence the amount you receive.

- Resource caps: There may be upper limits set on how much can be granted depending on the funding source, which means some expenses might go uncovered.

- Renewal process: Many types of support require annual applications, which means that amounts can change based on yearly assessments.

- Restrictions on usage: Some funds may only be used for tuition or specific fees, leaving other necessary costs, such as living expenses, uncovered.

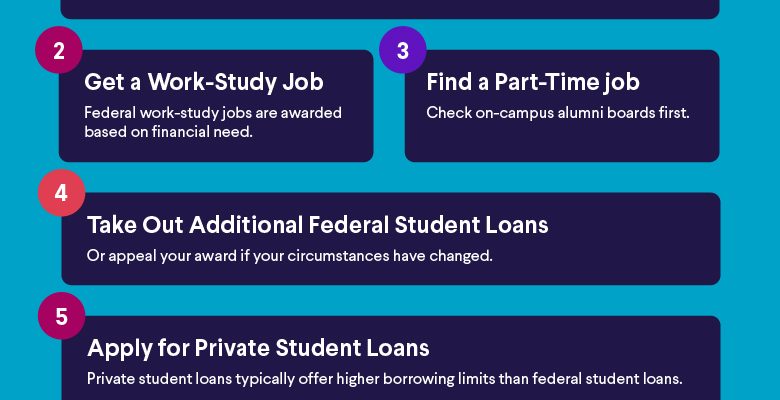

Understanding these factors is essential for effective planning. By acknowledging the boundaries surrounding available assistance, you can explore supplementary options to bridge any gaps. This may include part-time work, scholarships, or alternate financing arrangements tailored to your unique situation.

Exploring Additional Funding Opportunities

Finding ways to support your educational journey can sometimes feel overwhelming. However, there are plenty of options out there that can help bridge the gap when resources seem limited. By looking beyond traditional sources, you can discover various avenues to secure the assistance you need.

Start by researching scholarships that cater to your specific field of study or personal circumstances. Many organizations offer grants based on academic merit, community involvement, or even unique talents. These awards can significantly lighten your financial burden.

Don’t overlook part-time job opportunities or internships related to your area of interest. Earning money while gaining valuable experience can be incredibly rewarding and can help cover costs associated with your education.

Additionally, consider reaching out to local community groups or foundations. Many have funds set up to assist students in pursuing their goals. Networking within your community might reveal unexpected support options that could make a difference.

Lastly, take the time to talk to your educational institution’s resources. They often have information on available programs or emergency funds that can provide temporary relief in times of need. By being proactive and exploring these various resources, you can create a more flexible plan for your educational expenses.

Managing Expenses with Limited Resources

When you’re working with a tight budget, it’s essential to get creative with your spending. Knowing how to navigate through financial responsibilities can make a significant difference in your day-to-day life. It becomes all about prioritizing needs over wants and making strategic decisions that help you stretch your funds further.

Start by tracking your spending. Keeping an eye on where your money goes can reveal patterns and areas where you might cut back. Use apps or a simple spreadsheet to categorize your expenses. This awareness can empower you to identify unnecessary costs and make adjustments accordingly. Remember, small changes can lead to considerable savings over time.

Consider setting up a budget that clearly outlines your priorities. Allocate specific amounts for essentials like food, transportation, and housing, while also setting aside a little for entertainment or unexpected expenses. This way, you can enjoy some flexibility without derailing your overall goals.

Another effective strategy is to explore alternatives for regular expenses. For example, look into community resources, local discounts, or fewer expensive hobbies that still bring joy. Sharing costs with roommates or friends can also ease the burden. Whether it’s groceries or subscriptions, collaborating reduces individual expenses and fosters a sense of community.

Lastly, don’t hesitate to seek out new ways to increase your income. Part-time jobs, freelance gigs, or even monetizing a hobby can provide that extra support you may need. Every little bit helps, and diversifying your income sources can create more stability in your situation.