Exploring the Limitations of Financial Aid and Its Impact on My Education

Starting a new chapter in life, especially in education, often comes with a mixture of excitement and uncertainty. As students take their first steps into this journey, they might encounter unexpected hurdles that add complexity to their plans. While many resources can help along the way, it’s crucial to acknowledge that sometimes, the available assistance doesn’t quite meet all the needs that arise.

Understanding the full scope of expenses is vital for anyone embarking on this adventure. From tuition fees to daily living costs, many factors can weigh heavily on a budget. Sometimes, the assistance from various sources may fall short, leaving individuals to navigate additional challenges on their own. These circumstances can foster a sense of determination as they seek alternative solutions and creative ways to make ends meet.

In this article, we’ll explore the realities that often accompany the pursuit of education and personal growth, shedding light on the importance of planning and resourcefulness. It’s essential to tackle these obstacles head-on and find ways to bridge the gaps effectively. After all, every journey has its difficulties, but they can also lead to valuable life lessons and newfound resilience.

Understanding Financial Aid Limitations

Many students find themselves in a situation where their assistance packages don’t fully meet their needs. It can be a bit disheartening when you realize that the support you assumed would be sufficient falls short. This section delves into the common reasons behind these gaps, helping you navigate the complexities of funding your education.

First off, it’s essential to recognize that the amount of support available varies significantly among individuals. Factors like personal circumstances, the type of institution, and even the chosen field of study all play a considerable role in determining how much is provided. Often, individuals may expect a generous sum, only to learn that the total available is limited.

There’s also the aspect of eligibility criteria. Various programs have specific requirements that must be met to qualify. It’s not unusual for students to overlook certain details that might prevent them from unlocking additional resources. Understanding these stipulations can mean the difference between receiving more assistance or facing a shortfall.

Moreover, costs can escalate rapidly. Tuition fees, living expenses, and other necessary costs can add up quickly, sometimes exceeding what you initially anticipated. Being prepared for these unexpected expenses is crucial, as relying solely on support may leave you unprepared for the reality of expenses.

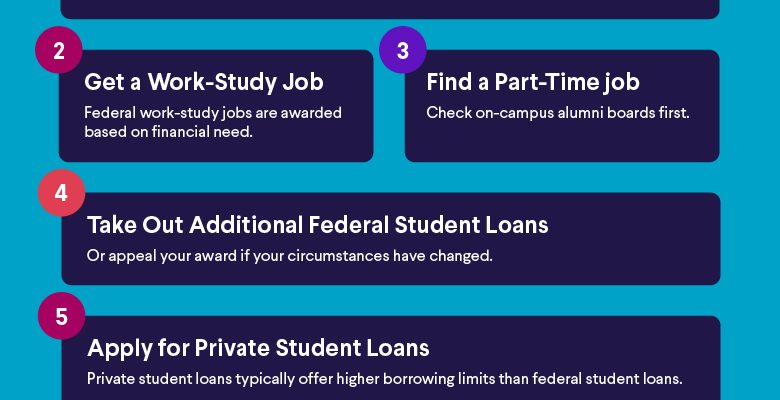

Ultimately, it’s important to take a proactive approach. Researching all available options, including scholarships and part-time work opportunities, can provide some relief. By understanding the constraints you may face, you can better strategize your financial planning and make informed decisions about your education journey.

Exploring Alternative Funding Options

Finding support for your educational journey can sometimes feel overwhelming, especially when traditional sources don’t meet all your needs. However, a wide range of opportunities exists beyond the usual avenues that can help bridge the financial gaps. Let’s dive into some creative approaches to securing the funds you require.

One innovative method is to research scholarships offered by various organizations, businesses, and community groups. These awards often have specific criteria, so take the time to align your skills and passions with the right opportunity. You might be surprised at how many options are available.

Additionally, consider part-time employment or internships related to your field of study. Not only do they provide income, but they also offer valuable experience that can enhance your resume. Flexibility is key; look for positions that allow you to balance work and academics effectively.

Crowdfunding has gained popularity as well. Many platforms allow you to share your story and seek donations from friends, family, and even strangers who resonate with your cause. It’s an engaging way to involve others in your journey while potentially raising necessary funds.

Lastly, explore low-interest loan options specifically designed for educational purposes. While this route involves borrowing, the reasonable repayment plans can ease the burden after graduation. Always ensure that the terms are manageable and align with your financial situation moving forward.

With a bit of creativity and effort, navigating the funding landscape can lead you to the resources you need. Keep exploring and don’t hesitate to reach out to your community for support–there are often more avenues available than you might think.

Managing Expenses on a Tight Budget

When you’re keeping an eye on your spending, it can feel a bit overwhelming at times. But with a little creativity and planning, you can navigate through your costs and make your resources stretch further than you might think. It’s about making smart choices and prioritizing what truly matters in your life.

First off, start with a clear picture of your situation. Track where your money goes each month. You might be surprised by some of the patterns you discover! Once you’re aware of your habits, you can begin to identify areas where you can cut back or adjust. It’s all about finding balance and being mindful of your choices.

Another effective strategy is to set specific goals. Whether it’s saving for that dream trip or just putting away a little extra each month, having a target can keep you focused. You might even find it fun to challenge yourself to stick to your plan, turning it into a rewarding experience.

Lastly, don’t hesitate to seek out resources and tools that can help you along the way. From budgeting apps to community resources, there are many options that can support you in managing your outlays. Remember, you’re not alone in this journey, and with determination, you can successfully navigate your financial landscape.