Understanding the Reasons Behind My Low Credit Score and How to Improve It

In a world where financial health plays a crucial role in our lives, understanding what influences our standing can feel overwhelming. Many people find themselves scrutinizing their financial habits, often wondering why they struggle to secure favorable terms for loans or credit services. It’s no secret that your fiscal reputation carries significant weight in determining your access to various financial resources.

As you navigate this complex landscape, it becomes clear that certain elements greatly impact your overall assessment. From payment history to the amount of available borrowing options, every detail counts in crafting the perception that lenders have of you. The goal here is to demystify these assessments and empower you to take positive steps toward improvement.

Perhaps you’ve recently discovered that your fiscal evaluation isn’t quite where you want it to be. Whether you’re looking to make a major purchase, secure a rental agreement, or simply take control of your finances, understanding the implications of your current situation is essential. But don’t worry–there are methods to enhance your standing and open up a world of opportunities.

Understanding the Impact of Low Credit Scores

When your financial reputation takes a hit, it can feel like a dark cloud looming over your future. This condition can create obstacles that make it harder to secure loans, rent an apartment, or even get certain jobs. A poor standing in the financial world can come with a range of consequences that influence both your immediate choices and long-term plans.

One major consequence is the potential for higher interest rates. Lenders view individuals with less-than-stellar financial profiles as higher risks, leading to increased costs over time. This can apply pressure not only to your wallet but also to your overall financial health. You may find yourself stuck in a cycle of debt, trying to keep up with payments that continually strain your budget.

Moreover, having a struggling financial history can impede your ability to find housing. Many landlords check applicants’ financial standings as part of their screening process. A negative rating can result in disqualification, leaving you with fewer options than those with a positive track record.

Additionally, your opportunities in the job market might be narrowed. Some employers review financial histories, especially in roles that involve managing finances or confidential information. A blemished record may hinder your chances, even for positions you’re well qualified for.

Understanding the ramifications of a troubled financial standing is crucial. It highlights the need for taking steps toward improvement. Whether it involves paying down existing debts, establishing a budget, or seeking professional guidance, there are ways to rebuild and regain control of your financial future. Taking proactive steps can pave the way for brighter opportunities and enhanced credibility over time.

Steps to Improve Your Rating

Raising your financial reputation doesn’t have to be daunting. With a bit of dedication and some smart strategies, you can make meaningful changes that will enhance your standing in the eyes of lenders and financial institutions. Here are some practical steps to guide you along the way.

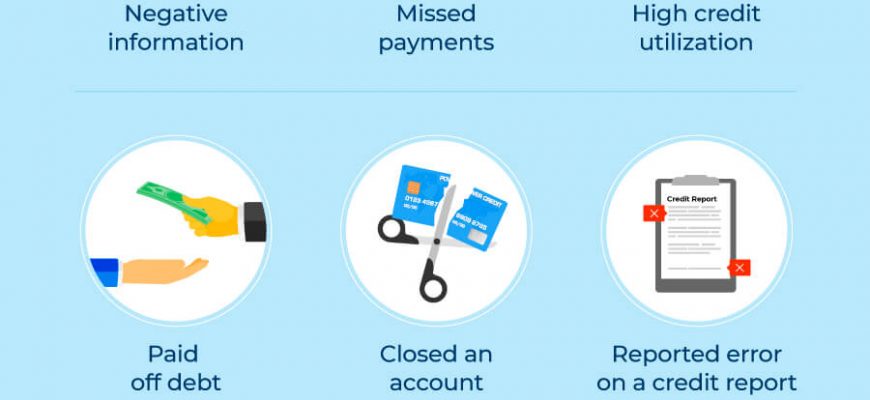

First and foremost, it’s essential to review your financial history. Obtain a detailed report from relevant agencies and check for inaccuracies. Mistakes can impact your standing significantly, and disputing errors can lead to quick improvements.

Next, focus on timely payments. Making your payments on time, whether for loans or bills, is crucial in establishing a positive financial image. Set reminders or automate payments to ensure you never miss a deadline.

Reducing outstanding debts is another vital step. Work on paying down your existing balances, starting with those carrying the highest interest rates. This not only lowers your overall debt but also boosts your image with lenders.

Another tip is to utilize credit wisely. When using revolving accounts, aim to keep your usage below 30% of the available limit. This demonstrates responsible management, which can enhance your attractiveness to providers.

Lastly, consider diversifying your financial portfolio. Having a mix of installment loans and revolving credit can show lenders that you can handle various types of debt responsibly. Just be cautious not to take on more than you can manage.

Common Myths About Financial Ratings Debunked

When it comes to understanding financial evaluations, there are plenty of misconceptions floating around. These myths can lead individuals to make poor decisions or feel unnecessarily anxious about their financial standing. Let’s take a moment to clear the air and shed light on some prevalent misunderstandings that many people share.

One common belief is that checking your own rating will negatively impact it. In reality, when you look at your own financial standing, it’s considered a “soft inquiry” and does not affect your overall assessment. It’s crucial to stay informed about your finances without fear of repercussions.

Another myth suggests that carrying a balance on your cards is better for maintaining a favorable evaluation. In truth, it’s more beneficial to pay off your balances in full each month. Lenders prefer to see that you can manage your finances responsibly rather than maintaining debt unnecessarily.

Many individuals think that only young adults or those with minimal financial experience have poor evaluations. However, factors like late payments, high debt levels, and inactivity can affect anyone, regardless of age or experience. It’s important to regularly monitor your situation and not underestimate your financial health.

Lastly, some people assume that their financial assessments can’t be improved if they’ve encountered issues in the past. While past performance does play a role, time and responsible management can lead to recovery. There are numerous ways to enhance your standing over time with diligence and smart strategies.