Enhancing Financial Support through MPN Understanding and Utilization

When pursuing higher education, many individuals encounter the complexities associated with funding their studies. It’s essential to understand the different forms of assistance available, as these resources can significantly ease the financial burden of tuition and related expenses. By exploring the various options, students can find the right fit for their unique situations and goals.

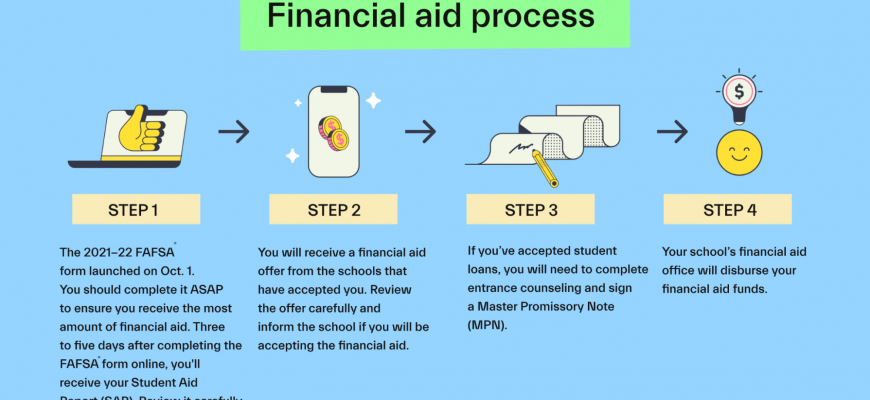

One crucial aspect that often comes into play is the process that enables individuals to formally request and secure these resources. This can involve completing necessary documentation and understanding the terms associated with the support, which can vary widely from one program to another. It’s important to approach this step with clarity to ensure a smoother experience overall.

Additionally, being proactive and informed can make a substantial difference. There are plenty of tools and resources available that guide students through this journey, making it less daunting. Understanding the nuances and requirements can unlock opportunities that might otherwise seem out of reach.

Understanding MPN for Student Loans

When it comes to securing funding for your education, there’s a key document that you’ll need to familiarize yourself with. This form serves as a crucial agreement between you and the lender, outlining the terms and conditions under which you can borrow money for your studies. It’s a fundamental step in the process, ensuring that both parties are clear on their responsibilities.

Essentially, this document details everything from the amount you can borrow to the repayment schedule once you finish your studies. It’s important to grasp the implications of signing this agreement, as it lays the groundwork for your future obligations. Taking the time to read and understand its contents can save you from unexpected surprises later on.

Furthermore, knowing what this contract entails helps you make informed decisions about your educational financing. Whether it’s understanding interest rates or knowing when repayments kick in, being informed empowers you to manage your finances wisely. As you navigate through your academic journey, remember that this agreement is there to provide you with the resources you need to succeed.

The Role of MPN in Financial Aid

When it comes to securing assistance for education, one important step often goes unnoticed by many. It’s a formal agreement that plays a pivotal role in ensuring that students can access the resources they need for their academic journey. This document outlines responsibilities and conditions that help streamline the process, allowing for smoother transactions between borrowers and lenders.

Essentially, this agreement serves as a promise to repay the borrowed amount under specified terms. It establishes the groundwork for how funds will flow from the lender to the student and what obligations the student has in return. Without this crucial step, students might face significant hurdles when trying to obtain the necessary support for their studies.

Understanding the nuances of this agreement can empower students to make informed choices about their educational funding. This knowledge not only demystifies the borrowing process but also highlights the importance of managing one’s financial future responsibly. By engaging with this essential document, students can embark on their academic paths with greater confidence and clarity.

Benefits of Completing Your MPN

Filling out the necessary documentation can open up a world of opportunities. It’s more than just a formality; it’s a crucial step towards securing support that can ease your journey through education. By taking this step, you’re setting yourself up to receive resources that can significantly enhance your academic experience.

One of the major advantages is the peace of mind it provides. Knowing you have a financial plan in place can alleviate stress, allowing you to focus more on your studies rather than worrying about tuition fees or living expenses. Additionally, completing this process can lead to access to various types of support options that you might not be aware of, broadening your horizons in terms of affordability.

Moreover, it often acts as a gateway to additional resources and advice you may need during your academic journey. Once you’ve made this commitment, institutions frequently offer guidance that can help you navigate your finances more effectively. This proactive approach not only benefits you academically but also prepares you for managing your finances in the future.

Lastly, it demonstrates your commitment to your education, which can positively impact your relationship with institutions. By showing that you’re serious about funding your studies, you may find that schools or organizations are more willing to provide assistance or guidance. All in all, taking this step brings a wealth of advantages that can enhance both the current academic experience and future opportunities.