Comprehensive Review of the Financial Statements of the Monetary Authority of Singapore

When diving into the world of economic governance, one often encounters a plethora of documents that showcase the health, performance, and strategies of oversight organizations. These valuable records provide insights into how such entities manage their resources, execute their mandates, and navigate the complexities of the economic landscape. By examining these documents, we can gain a clearer picture of their efficacy and transparency.

These disclosures serve as vital communication tools between the organizations and the public, illuminating their fiscal practices and overall accountability. Often packed with details, they’re designed to foster trust and ensure that stakeholders are well-informed about the operations and priorities of these regulatory institutions. The way these bodies articulate their performance can be telling of their commitment to sound governance and ethical standards.

Ultimately, a close look at these crucial documents reveals not just numbers, but the underlying narratives that shape economic policy and decisions. Understanding them is key to appreciating how these entities contribute to the broader financial ecosystem and, in turn, affect everyday life.

Overview of the Central Banking Institution

Let’s dive into the role and significance of this pivotal institution that plays a crucial part in shaping the economic landscape. It acts as the backbone of the nation’s monetary framework, ensuring stability and confidence in the markets. Through various mechanisms, it aims to foster a sound financial environment that promotes growth and sustainability.

This organization oversees a range of activities, including formulating and implementing policy measures tailored to suit the evolving needs of the economy. It also regulates financial entities to maintain trust and efficiency within the financial ecosystem. By monitoring inflation and other economic indicators, it ensures that the country remains on a steady growth trajectory.

One of its key functions is the issuance of currency and management of foreign reserves, which help underpin economic stability. Additionally, it actively engages in fostering innovation in the financial technology sector, paving the way for modern solutions that cater to both consumers and businesses alike.

Ultimately, this institution not only aims to safeguard public confidence in the monetary system but also to drive progress towards a resilient and dynamic economic future. Its comprehensive approach reflects a deep understanding of the challenges and opportunities within the ever-changing global landscape.

Understanding Reports and Their Importance

Reports that summarize an organization’s monetary activities are crucial for several reasons. They offer insights into the health and performance of an entity, acting as a roadmap for stakeholders. By analyzing these documents, one can identify trends, assess risks, and make informed decisions that drive growth and sustainability.

The significance of these documents cannot be overstated. They serve as a transparent window into operations, allowing investors, regulators, and the public to gauge financial wellness. Such clarity promotes trust, enabling stakeholders to engage confidently with the organization.

Additionally, these analytical tools play a vital role in regulatory compliance. They ensure adherence to established guidelines and standards, protecting both the entity and its stakeholders. Furthermore, they help organizations set realistic goals and measure progress over time.

In essence, grasping the elements of these reports is fundamental for anyone involved in or affected by the financial landscape. Ultimately, understanding them empowers all parties to make better choices, fostering a thriving economic environment.

Analyzing Recent Trends in MAS Financials

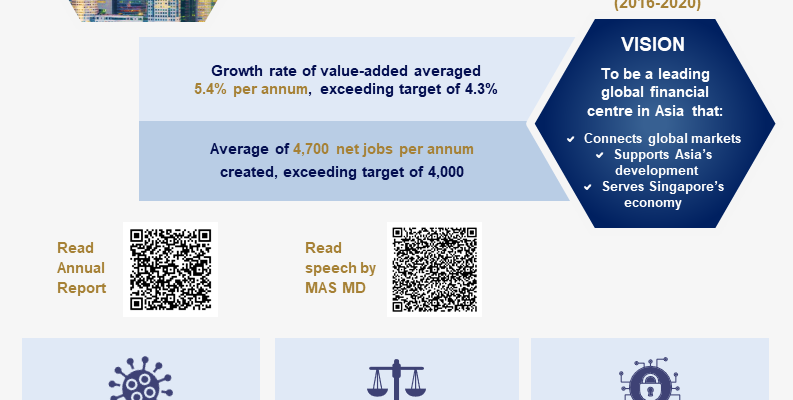

In recent times, a closer look at the economic figures of the central banking institution reveals intriguing patterns that merit discussion. These statistics offer valuable insights into the evolving landscape of monetary strategies and the effectiveness of implemented policies. By examining the numbers, one can gauge the overall health and direction of the institution’s objectives.

One notable trend is the gradual increase in reserves and assets, which reflects a robust approach to risk management and stability in the global economy. This growth not only showcases the strength of the institution but also signifies confidence in the financial systems at play. Moreover, the sustained balance between expenditures and revenues hints at a strategic focus on maintaining operational efficiency while addressing emerging challenges.

Another area of interest is the shift in investment strategies observed recently. The pivot towards more diversified portfolios indicates a proactive stance to adapt to ever-changing market dynamics. Investments in technology and innovation are becoming more prominent, suggesting a forward-thinking approach that aligns with modern financial needs.

Finally, the responses to external economic pressures, such as inflation and shifts in interest rates, underline a level of agility and responsiveness. The effective management of these challenges is crucial for sustaining stability and fostering growth, ultimately benefiting the entire economy.