Essential Credit Hour Requirements for Eligibility in Financial Aid Programs

When it comes to pursuing higher education, many students find themselves navigating the often complex landscape of various supports available. It’s crucial to grasp the fundamental requirements that determine eligibility for such programs. By familiarizing oneself with these criteria, students can better prepare for their educational journey while ensuring they receive the assistance they deserve.

Embarking on academic endeavors often comes with its own set of challenges, particularly in terms of managing expenses. Many individuals seek ways to alleviate financial burdens, and understanding the prerequisites for receiving support can significantly impact their experience. It’s not just about meeting specific benchmarks; it’s about strategically planning one’s academic path to take full advantage of the available resources.

This exploration into the essential criteria will shed light on what aspiring students need to consider. From credit hours to course loads, navigating these factors can feel overwhelming at times. However, being informed is half the battle, and with the right information, students can chart a course that aligns with their educational goals while maximizing their chances of receiving necessary assistance.

Understanding Eligibility Criteria

Navigating the landscape of support options can feel overwhelming, but knowing what qualifies you for assistance can ease the process. Many individuals seek ways to fund their education or training, and several factors come into play when determining who gets help and who doesn’t. Whether you’re a full-time student, a part-time learner, or returning to school after some time, understanding these essentials is crucial.

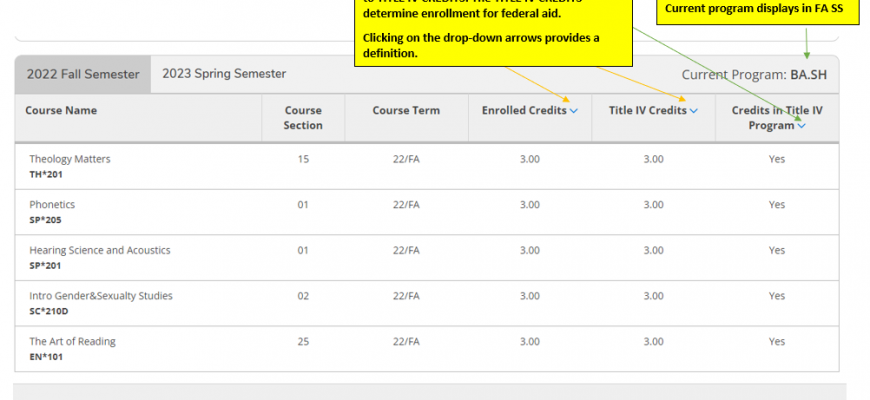

First off, your enrollment status is pivotal. Generally, institutions assess how many courses or credits you’re taking, as this can influence the type of support you may receive. It’s also important to consider your academic performance; maintaining satisfactory progress might play a big part in keeping those opportunities available. Additionally, your financial situation is reviewed to tailor the assistance to individual needs, ensuring that resources go to those who might struggle the most.

Finally, stay aware of deadlines and application processes. Institutions often have specific timeframes and documents needed to evaluate your situation properly. By being proactive and understanding these components, you’ll improve your chances of receiving the support necessary to achieve your educational goals.

How Basic Credit Hours Affect Support Options

The number of credits a student enrolls in can significantly influence the types of assistance they qualify for. When individuals are aware of this connection, it can better inform their academic decisions and help them navigate the complexities of funding their education.

Students who take on fewer courses may find that certain support programs become unavailable to them. This can lead to unexpected challenges in covering expenses, making it critical to understand how academic load interacts with available resources.

On the flip side, attending classes full-time can unlock a wider range of opportunities for scholarships, grants, and other forms of support. Various funding programs often have specific requirements that encourage commitment to a more rigorous academic path.

For many, understanding the relationship between course load and assistance can guide them in planning their studies effectively. Balancing academic ambitions with financial realities is essential for ensuring a successful educational experience.

Strategies for Meeting Academic Credit Requirements

Navigating the intricate world of educational support can seem daunting, especially when it comes to ensuring you meet necessary credit expectations. However, there are several effective tactics you can employ to stay on track while maximizing your resources. Finding a balance between your coursework and financial resources can set you up for success.

One of the most beneficial approaches is to plan your course schedule carefully. Take stock of the classes you need to complete and map out a path that allows you to efficiently fulfill your obligations. This might mean taking advantage of summer sessions or intercessions to lighten your load during more hectic semesters.

Consider also the potential of online courses or community college classes that complement your primary institution. These can be more flexible and often provide a wider array of options that may fit better with your goals. Be sure to verify that these credits will transfer back to your primary program, ensuring they count toward your overall progress.

Engaging with academic advisors can significantly enhance your strategy. They can offer insights into the best courses to take, help you understand all your possibilities, and ensure you’re leveraging all available resources. Regular meetings with them can keep you informed about deadlines and requirements that you might overlook.

Lastly, don’t hesitate to explore work-study programs or internships that align with your interests. These experiences not only provide financial assistance but also connect you to valuable networks, enriching both your academic journey and career prospects. By incorporating these strategies into your educational plan, you’ll find it much easier to meet those essential credit obligations while reaping the benefits of a well-rounded academic experience.