Exploring the Trends and Influences Behind Current Oil Market Prices

In today’s world, the fluctuations in the value of essential energy resources have become a focal point for many. These variations are not only influenced by demand and supply but also by geopolitical events, technological advancements, and environmental considerations. Understanding this complex web of factors can help us grasp how these commodities impact our daily lives and the global economy.

As we delve deeper into the mechanisms behind these changes, it’s crucial to consider the interplay of various elements. From production levels to regulatory changes, every aspect plays a significant role in shaping the financial landscape of these vital resources. Discussions around sustainability and alternative energy sources further complicate this already intricate puzzle.

Join us on this exploration as we break down the essential factors driving the cost of these key resources, shedding light on the implications for consumers, businesses, and policymakers alike. With insights into both current trends and historical patterns, we’ll equip you with the knowledge to better navigate this ever-evolving domain.

Factors Influencing Global Oil Prices

When it comes to the cost of crude resources, there’s a whole universe of elements at play that can push values up or down. Understanding these influences is crucial for anyone interested in the trends that shape the economics of fuel. From geopolitics to natural disasters, various aspects can impact how much we pay at the pump or for industrial usage.

One major contributor is the balance between supply and demand. When production exceeds consumption, you often see a dip in values. Conversely, when there’s a surge in consumption or disruptions in production–think political unrest in oil-rich regions–the figures can skyrocket. This delicate equilibrium is a dance that stakeholders must watch closely.

Another significant factor is the state of the global economy. During growth phases, demand for energy typically rises, pushing up valuations. In contrast, economic downturns usually lead to reduced consumption, resulting in a decline in figures. This connection between overall economic health and energy valuation is an essential observation for investors and policymakers alike.

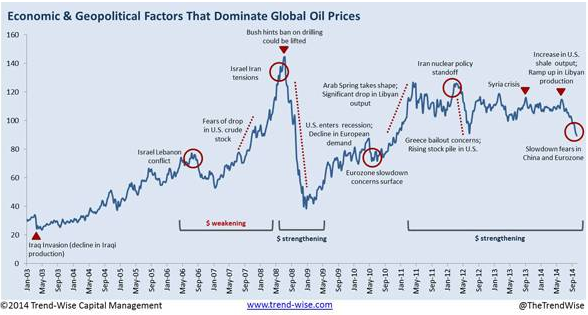

Geopolitical tensions also play a remarkable role. Conflicts, sanctions, or trade regulations can lead to uncertainties in supply lines, often causing fluctuations. The speculation surrounding these events can heavily influence trader sentiments, leading to abrupt changes in the market’s behavior.

Technological advancements in extraction and production methods also affect financial assessments. Innovations that lower production costs can increase output efficiency, leading to a greater supply at stable or even reduced costs. This aspect can significantly shift the dynamics of how resources are valued in the global landscape.

Lastly, environmental policies and regulations are becoming increasingly important. As nations strive to meet climate goals, the transition to alternative energy sources can impact dependency on traditional fuels. This shift could lead to long-term changes in demand, fundamentally altering the financial landscape.

Geopolitical Events and Market Reactions

Unexpected incidents on the global stage can significantly influence the dynamics of valuable resources trading. Whenever tensions rise or diplomatic relations shift, traders closely monitor the headlines, anticipating shifts in supply and demand. These events often lead to fluctuations that can be perceived both positively and negatively, depending on perspective.

For instance, conflicts in key regions known for resource extraction can lead to fears of supply disruptions, prompting prices to soar as buyers scramble to secure quantities. Conversely, peaceful resolutions or increased stability may ease concerns, resulting in a decline as suppliers boost output to capitalize on new opportunities. This dance between uncertainty and stability is a constant in the world of commerce.

Additionally, decisions made by influential nations regarding exports can send ripples through the entire industry. Sanctions, trade agreements, and legislative changes can create a ripple effect, causing immediate reactions in various sectors. Through all of this, savvy investors keep a keen eye on global developments, knowing that one news bulletin can change the landscape in an instant.

Ultimately, the interplay between geopolitical occurrences and trading activities underscores the intricate relationships that define the economic environment. Stakeholders must navigate these complexities carefully to stay ahead in an ever-evolving marketplace.

Impact of Renewable Energy on Oil Costs

In recent years, the emergence of sustainable sources of power has begun to shift the dynamics of the traditional energy landscape. As society increasingly turns toward cleaner alternatives, the influence on fossil fuel expenditures becomes more pronounced. This transition not only affects the demand for hydrocarbons but also alters the behavior of those involved in the extraction and distribution of these resources.

One significant outcome of the rising popularity of renewable energy is the increased competition it introduces. As technologies like solar, wind, and hydropower improve and become more accessible, households and industries may choose to invest in these alternatives rather than rely solely on conventional sources. This choice can lead to a decrease in consumption patterns of traditional energy resources, causing fluctuations in their associated costs.

Moreover, the integration of renewable energy into national grids can enhance energy security and stability. Countries investing heavily in sustainable infrastructure can reduce their dependency on imported fuels, allowing them to better navigate global shifts in energy supply and demand. This independence can create a ripple effect, influencing not just the pricing structures of different fuels but also the geopolitical landscape.

As renewable initiatives gain traction, they may also encourage innovation within the fossil fuel sector. Companies might focus on improving efficiency and lowering extraction costs to remain competitive, leading to advancements that could ultimately reframe cost structures. The need to adapt to changing energy preferences may push traditional energy producers to rethink their strategies and investment approaches.

In summary, the rise of green energy is set to reshape the economic fabric of traditional energy resources. With changing consumption patterns, increased competition, and the drive for innovation, the financial implications are both complex and far-reaching. The future will likely see a more balanced energy landscape, influencing how resources are valued in a world increasingly focused on sustainability.