Understanding the 2025 Finance Law and Its Impact on Tax Credits

The upcoming changes in the tax landscape are generating considerable interest among citizens and entrepreneurs alike. With various adjustments expected to take effect soon, there’s a lot to discuss regarding how these modifications will impact financial planning and overall economic health. This section aims to shed light on the newly introduced measures aimed at easing the fiscal burden on individuals and companies in the coming years.

As the economy evolves, governments are continuously seeking ways to enhance growth and stimulate investments. The initiatives on the horizon promise to provide various forms of support that are designed to encourage expenditure, promote sustainability, and ultimately bolster the financial standing of the populace. It’s an exciting time, and understanding these upcoming provisions is crucial for both personal and business finance strategies.

From tax deductions to innovative funding options, the provisions aim to create a more favorable environment for economic activity. Whether you’re a hardworking individual wanting to optimize your situation or a business owner seeking to invest in growth, staying informed about these changes can make a significant difference. Let’s delve deeper into what these new regulations entail and how they might affect you!

Understanding the 2025 Budgetary Framework

The upcoming financial framework introduces several measures that aim to stimulate economic growth and support individuals and businesses alike. By analyzing the changes, we can gain insight into how these adjustments will affect our everyday lives and the broader economy. With an eye on innovation and sustainability, the new policies are designed to foster an environment conducive to prosperity.

One of the key aspects of this new framework is its approach to tax incentives. These attractive arrangements are aimed at various segments, encouraging investment and paving the way for enhanced economic activity. As a result, individuals may find themselves benefiting from reduced expenses, enabling them to allocate funds elsewhere.

Moreover, the initiative places a strong emphasis on supporting green initiatives. By doing so, it seeks to align financial benefits with environmental responsibilities, promoting a shift towards more sustainable practices. In this way, not only does it provide immediate relief, but it also lays the groundwork for a healthier planet.

Understanding this financial structure is essential for navigating the changes ahead. By familiarizing ourselves with these new opportunities, we can make informed decisions that will ultimately enhance our financial welfare and contribute to a thriving economy.

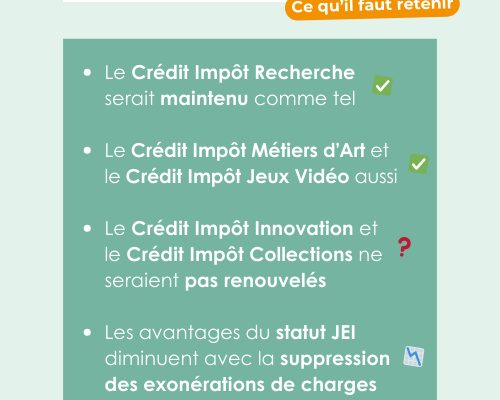

Tax Credit Changes and Implications

Upcoming modifications in the tax landscape have the potential to impact individuals and businesses significantly. These adjustments aim to redefine how people benefit from relief programs, potentially offering new opportunities while also presenting challenges in navigating the revised system. Understanding these changes is crucial for anyone who wishes to optimize their financial strategies.

With the anticipated alterations, taxpayers may need to reassess their financial planning approaches. For some, the new relief initiatives could mean increased returns, while others might find themselves facing a more complex set of regulations. Staying informed on these developments will be essential in making the most of available advantages and minimizing any adverse effects.

Additionally, the modifications may lead to a shift in government priorities, reflecting an evolving economic landscape. As policymakers seek to balance growth and equity, individuals should remain proactive in understanding their options to ensure they can take full advantage of the benefits that lie ahead.

Key Benefits for Taxpayers

In the upcoming fiscal year, individuals will discover a range of advantages aimed at easing their financial burdens. These enhancements are crafted with the intent to support taxpayers in managing their expenses more effectively and to encourage greater financial stability. From reduced obligations to added incentives, the changes are designed to foster a more favorable economic environment.

One of the standout features is a significant reduction in the overall tax liability, which allows individuals to retain more of their hard-earned money. This aspect is crucial, particularly for families and those on fixed incomes, as it provides them with greater flexibility to allocate resources as they see fit.

Moreover, various deductions and allowances will be broadened, empowering individuals to claim more for essential expenses like home improvements or educational pursuits. This initiative not only promotes personal investment but also stimulates economic growth through increased consumer spending.

Lastly, simplified processes for compliance mean less paperwork and easier navigation of regulations. This change aims to alleviate the administrative strain on taxpayers, enabling them to focus on what truly matters: their financial well-being and future planning.