Comparing Loans and Financial Aid Exploring the Key Differences and Benefits

Navigating the world of funding can feel a bit overwhelming, especially with so many choices available. Many individuals face similar challenges when it comes to paying for education, housing, or other significant expenses. With limited resources, it’s crucial to grasp the different routes you can take to secure the necessary funds.

When considering how to cover these costs, two main approaches often come to the forefront. One involves acquiring resources that you’ll need to repay over time, while the other provides support without the burden of repayment. Understanding the key differences between these options can empower you to make informed decisions that align with your financial goals.

It’s important to carefully weigh your options before committing to any financial strategy. Each alternative has its own set of advantages and disadvantages, which can play a pivotal role in your long-term well-being. By diving deeper into these concepts, you’ll be better equipped to choose the path that best matches your situation.

Understanding the Differences Between Borrowing Options

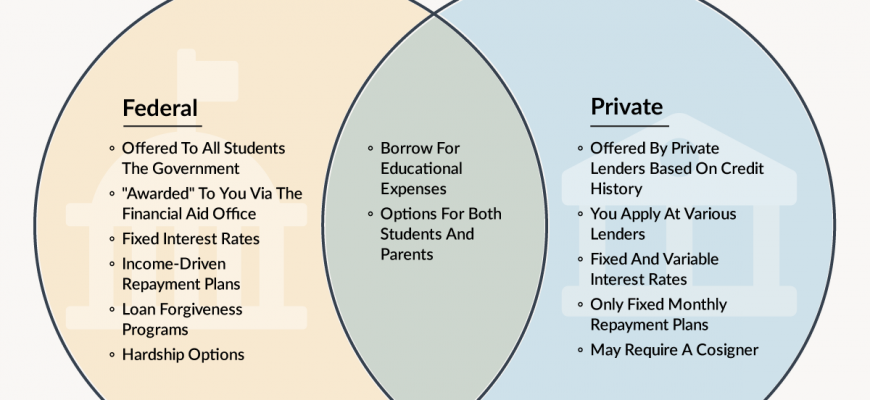

When exploring ways to fund your education or other important expenses, it’s vital to grasp the distinctions between various borrowing solutions. Each choice comes with its own set of rules, benefits, and responsibilities, which can significantly affect your financial future.

Types of Borrowing Solutions: There are generally two main categories of these options: those that require repayment and those that don’t. The first category typically involves receiving money with the promise to pay it back over time, often with interest, while the second may not necessitate returning the funds at all, depending on specific qualifications.

Repayment Terms: One of the key aspects to consider is how and when you’ll be expected to pay back what you’ve received. Some providers offer more flexible terms, allowing for lower payments over a longer duration, while others may require quicker repayment schedules, leading to higher monthly costs.

Interest Rates: Another crucial factor is the cost associated with borrowing. Rates can vary widely, influencing the total amount you’ll end up repaying. Typically, options with lower interest rates are more favorable, reducing the financial burden down the line.

Consequences of Default: Failing to meet your repayment obligations can lead to serious repercussions. It’s important to understand how default might affect your credit score and future borrowing opportunities. Some arrangements might offer more leniency in this regard, while others may impose strict penalties.

Conclusion: By familiarizing yourself with these differences, you can make more informed decisions about which option aligns best with your financial situation and long-term goals. Understanding the nuances will empower you to navigate your funding choices wisely.

Exploring Support Options Available

When it comes to funding your education, there are various pathways to consider that can significantly lighten the financial burden. These alternatives offer diverse solutions that can help you meet your goals without the stress of immediate repayment. Let’s delve into some of the most common resources that can ease your journey.

- Scholarships: These are grants that do not require repayment, awarded based on various criteria such as academic performance, talent, or community involvement. Researching available scholarships can open doors to substantial financial support.

- Grants: Similar to scholarships, these funds usually come from the government or institutions, aimed at helping students in need. They are generally awarded based on financial circumstances and do not have to be repaid.

- Work-study Programs: Many educational institutions offer part-time job opportunities as a way to fund your studies. These positions allow you to earn money while gaining valuable work experience, making education more accessible.

- Employer Assistance: Some companies provide educational benefits for their employees, which may cover tuition costs or reimburse you after completing a course. It’s worth checking with your employer about what support they might offer.

- State and Local Programs: Governments often have initiatives designed to help residents cover their tuition fees. These programs can vary, so it’s essential to explore what your specific area provides.

By exploring these options, you can create a comprehensive plan to cover your educational expenses. Each avenue brings its own benefits, so take the time to evaluate which ones fit your needs best!

Impact on Future Finances and Careers

When considering educational opportunities, the choices made can significantly shape one’s financial landscape and professional journey down the line. The avenues pursued, whether involving recurring obligations or gifts without strings attached, come with unique ramifications that influence both immediate budgets and long-term prospects.

On one hand, entering into agreements that require repayment can lead to rising debt levels, impacting monthly expenses and credit scores. This burden might restrict individuals from pursuing certain career paths due to financial constraints or the need to prioritize higher-paying jobs to meet obligations. The stress of managing repayments can also affect job performance and career satisfaction.

Conversely, receiving resources that don’t necessitate repayment often opens doors for exploration and creative pursuits. With fewer financial pressures, individuals may feel empowered to seek roles aligned with their passions, potentially leading to greater job satisfaction and innovative contributions to their fields. Moreover, without the weight of repayment, there’s a greater opportunity to invest in personal development, networking, and skill acquisition, all of which can enhance career trajectories.

Ultimately, the choice between these two types of support extends beyond the immediate monetary aspects. It’s about envisioning the future and understanding how the decision can play a pivotal role in shaping both financial stability and professional fulfillment.