Understanding the Credit Card Limit and Its Implications for Your Finances

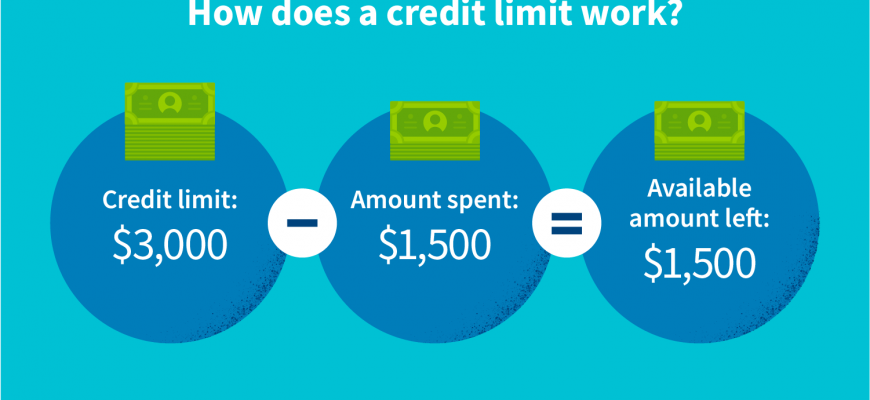

When it comes to managing personal finances, one key aspect to consider is how much you can borrow before encountering limitations. This figure plays a crucial role in determining your purchasing power and overall financial flexibility. Knowing the ins and outs of this concept can help you make informed decisions about your expenditures and savings.

Essentially, this value sets the stage for how much you can utilize without risking overspending or incurring unwanted penalties. It’s not just a number; it encompasses various factors, including your income, credit history, and even your relationship with financial institutions. Understanding this aspect can empower you to navigate your financial journey more confidently.

So, whether you’re planning a big purchase or just trying to keep your expenses in check, being aware of this financial principle will serve you well. Let’s delve deeper into what influences this important benchmark and how you can optimize your financial strategy moving forward.

Understanding Credit Card Limits

When it comes to using plastic money, many individuals often wonder about the boundaries set on their spending. These boundaries play a crucial role in managing finances and ensuring responsible usage. Knowing how these thresholds work can help you make informed decisions and avoid potential pitfalls.

What Determines Your Spending Cap? Several factors influence the maximum amount you can charge. Lenders typically evaluate your income, credit history, and outstanding debts to assess your financial behavior. A higher income and a solid repayment record usually mean a higher allowance, while previous defaults can lead to restrictions.

Why Are These Constraints Important? Having a set amount helps prevent overspending. It encourages users to be mindful of their expenses and promotes better budgeting practices. By understanding the confines of your financial tools, you can effectively manage your cash flow and avoid falling into debt.

It’s also worth noting that these restrictions can change over time. If your financial situation improves or declines, your lender may adjust your allowance accordingly. Staying informed about these changes can help you maximize your resources.

In conclusion, familiarizing yourself with the parameters of your spending capabilities is essential. It not only enables you to utilize financial products effectively but also fosters responsible handling of personal finances.

Factors Influencing Your Credit Limit

When it comes to how much you can borrow or spend, several elements come into play. Understanding these factors can empower you to make smarter financial choices and manage your resources effectively. Let’s dive into what really shapes your borrowing capacity.

First and foremost, your credit history holds significant weight. Lenders closely examine your track record of repaying debts. A solid, consistent history of timely payments often leads to greater flexibility. Conversely, missed payments or defaults can signal risk, potentially leading to a more conservative approach from lenders.

Your income plays a crucial role as well. A stable and substantial paycheck gives lenders confidence in your ability to repay borrowed amounts. Those with higher earnings are generally viewed more favorably, as they can better handle financial obligations.

Another key aspect is your existing debt levels. If you already have multiple outstanding loans, lenders may become wary, fearing you could overextend yourself. Balancing your overall obligations is essential to keep your financial options open.

Additionally, economic conditions can impact how much you can securely borrow. Lenders often adjust their policies based on market trends and economic stability. During prosperous times, you may enjoy more favorable terms, while uncertain economic climates can lead to tighter guidelines.

Lastly, the lender’s specific policies and risk appetite matter. Each institution has its own criteria and approach to assessing potential borrowers, which can lead to varying offers, even for individuals in similar financial situations. Being aware of these nuances can help you navigate the borrowing landscape with greater ease.

How to Enhance Your Credit Line

Boosting your available spending capacity can provide greater financial flexibility and empower you to handle unexpected expenses with ease. There are several strategies you can use to successfully increase the amount you can access, offering you a sense of security and better purchasing power.

First, consider reaching out directly to your provider to request a review of your account. Ensure that your payment history is stellar, as consistent, on-time payments will bolster your case. Be clear and concise about your reasons for wanting an increase, whether it’s for upcoming purchases or to improve your utilization ratio.

Another effective method is to enhance your overall financial profile. Assess your income and make sure it’s updated and accurately reflected in your account. Lenders often factor in your earnings when determining how much they’re willing to extend. Additionally, keeping your debts low and showing a responsible usage pattern can help sway decisions in your favor.

Lastly, consider waiting for a special occasion, like your account anniversary, to make your request. Sometimes, companies are more eager to offer increases to loyal customers at these times. Patience, preparation, and a proactive approach will bring you closer to achieving your desired outcome.