Comprehensive Guide to Creating a Journal Entry for a Credit Memo

Every business occasionally finds itself in situations where it needs to revise past transactions. This can happen for a variety of reasons, such as returning goods, correcting overcharges, or offering discounts after an initial sale. Understanding how to properly document these adjustments is crucial for maintaining accurate financial records.

When it comes to reflecting these modifications in the accounting system, clarity is key. Properly recording these transactions ensures that financial statements remain reliable and trustworthy. Whether you’re a small business owner or a seasoned accountant, grasping the mechanics of this documentation will help you manage your finances more effectively.

In this guide, we’ll break down the essential steps involved in this process, providing insights into best practices and common pitfalls to avoid. By the end, you’ll have a solid grasp of how to navigate this vital aspect of your financial operations with confidence.

Understanding Credit Memos in Accounting

In the world of finance, adjustments and corrections are part of the daily routine. One key aspect of these adjustments involves recognizing transactions that need alterations, whether due to returns, pricing errors, or customer allowances. It’s essential to grasp how these adjustments affect accounts, ensuring accuracy in financial records and transparency in business dealings.

These forms of adjustments serve to lessen the amount billed to a customer or rectify previous entries in the company’s accounting books. By issuing such documents, businesses can maintain proper balance in their accounts, reflecting the true financial position. They play a vital role in keeping the books straight and ensuring both parties understand the changes in their financial obligations.

When a company issues such documents, it essentially communicates a reduction in the total amount owed by the client. This not only helps in maintaining trust and goodwill but also ensures that future transactions are free from confusion. It’s like having a gentle reminder of the adjustments made, providing clarity for both the seller and the buyer.

In conclusion, understanding these adjustments is crucial for anyone involved in financial management. By properly handling them, businesses can foster better relationships with clients while ensuring their accounts accurately reflect current conditions. This approach ultimately supports sound financial practices, guiding firms toward stability and success.

Recording Transactions Using Journal Entries

When it comes to managing finances, accurately documenting each transaction is essential. This process allows businesses to maintain a clear and organized record of their financial activities. It creates a framework where every purchase, sale, or adjustment can be traced back, ensuring transparency and accountability. By properly capturing these instances, companies can better analyze their performance and make informed decisions.

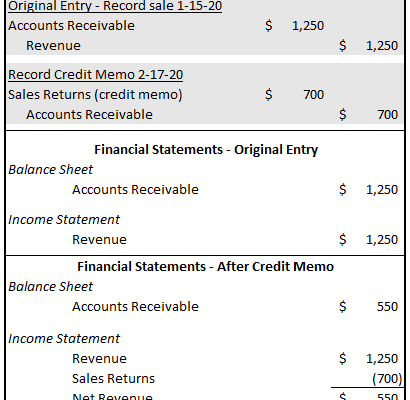

Every time a financial event occurs, it needs to be logged in a structured manner. This involves identifying the involved accounts and determining how the event impacts them. Whether it is an increase or decrease, understanding the correct allocation is vital. This systematic approach not only helps in maintaining order but also aids in preparing reports that reflect true financial health.

In practice, each recorded occurrence typically requires a pairing of accounts: one will see an increase, while the other is affected in the opposite direction. This duality balances the financial picture. It’s crucial to follow standardized practices while ensuring that everything aligns with applicable regulations and guidelines. This attention to detail fosters reliability in financial reporting.

To conclude, utilizing this meticulous approach to record events ensures that a company’s financial activities are well captured and organized. It provides a solid foundation for analysis and decision-making, which ultimately drives success in the business environment.

The Impact of Credit Memos on Financial Statements

Moreover, the balance sheet is also influenced by such adjustments. As sales figures change, corresponding changes occur in accounts receivable. A return or adjustment reduces the amount owed to the company, thereby directly impacting this asset. By keeping these records up to date, a business can better manage its cash flow and ensure that liquidity ratios remain healthy.

In addition to these impacts, the statement of cash flows can also be affected. While the changes might not directly alter cash movements in the short term, they provide better context for understanding future cash inflows from customer collections. Accurate documentation means that forecasting can become more reliable, allowing for more informed strategic planning.

Ultimately, accurately reflecting these changes ensures that the financial documents are not only dependable but also serve as essential tools for decision-making. By recognizing the complexities of these adjustments, companies can better navigate their financial landscape and foster trust among stakeholders.