Comprehensive Guide to Comparing Financial Aid Options with the ISAC Worksheet

When it comes to pursuing higher education, navigating through various support mechanisms can feel overwhelming. With numerous options available, it’s essential to make informed choices that align with your needs and goals. This section focuses on simplifying that journey by providing a resourceful guide to assess your opportunities effectively.

Having the right information at your fingertips can significantly ease the decision-making process. By examining different assistance possibilities side by side, you can gain insights into what works best for your situation. A clear overview allows you to weigh your options, ensuring that you are making savvy decisions about your financial commitments.

Moreover, understanding the distinctions and benefits of various programs promotes a sense of confidence, empowering you to take control of your educational journey. It’s all about finding the right fit and making the most of the resources at hand. Let’s dive in and explore how to optimize your options effectively.

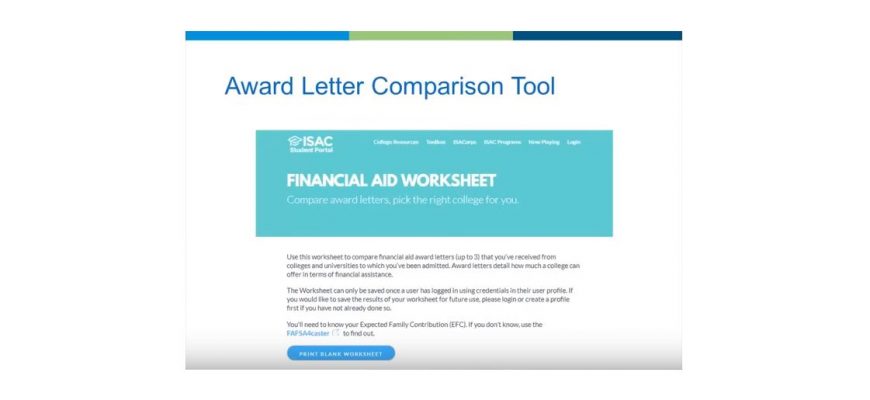

Understanding the ISAC Financial Aid Worksheet

When it comes to planning for your education expenses, navigating the world of assistance can feel overwhelming. This tool is designed to help you make sense of the various options available, breaking down essential factors that influence your funding opportunities. Whether you are a high school student preparing for college or an adult looking to return to school, grasping the components involved can make a significant difference in your financial planning.

At its core, this guide serves as a roadmap for evaluating your monetary support choices. It walks you through different categories of support, income assessments, and eligibility criteria for various programs. By highlighting the key elements, it encourages learners to examine their financial resources critically and understand the true cost of their educational journey.

With a focus on clarity, this resource also aims to alleviate some of the uncertainties surrounding the funding process. It empowers you to take informed steps by presenting comparisons of the types of support you may qualify for, along with timelines and application procedures. This way, you know exactly what to expect and can plan accordingly.

Ultimately, having a clear understanding of these essentials will equip you to make well-informed decisions regarding your educational financing. It’s all about setting yourself up for success and ensuring that you are prepared for the financial responsibilities that come with pursuing your academic goals.

How to Effectively Use the Comparison Tool

When it comes to evaluating different opportunities for funding your education, utilizing a comparison tool can really make a difference. This handy resource enables you to assess various options side by side, helping you to make more informed choices. With the right approach, you can navigate through complex information with ease and clarity.

To start, gather all necessary details about each funding source. This might include aspects such as the amount, eligibility criteria, and repayment terms. By having all your information in one place, you’ll be able to identify which ones align best with your financial situation and academic goals.

As you delve into the comparisons, pay close attention to key factors that matter to you. Some may prioritize low repayment amounts, while others might be more focused on flexible terms or the potential for forgiveness. Highlight these elements as you analyze each option. This step is crucial, as it brings clarity to your personal needs and preferences.

Also, don’t hesitate to reach out for support if you find yourself confused by the numbers or terms. Talking to a mentor, advisor, or even a knowledgeable peer can provide you with insights that are hard to gather alone. Two heads are often better than one, especially when navigating such important decisions.

Finally, take your time. Rushing through the process can lead to overlooking vital details that may impact your future. By approaching the evaluation thoughtfully, you’ll set yourself up for a successful and well-informed selection.

Benefits of Utilizing Financial Assistance Resources

Exploring various forms of funding for education can be a game changer for many students. Tapping into these resources opens doors to opportunities that might otherwise seem out of reach. Understanding the advantages of leveraging these options can significantly ease the financial burden of pursuing higher learning.

One major benefit is access to a wider range of options to cover tuition and living expenses. This support can include grants, scholarships, and low-interest loans, all tailored to meet individual needs. As a result, students can focus more on their studies rather than worrying about mounting debts.

Another important aspect is the ability to enhance educational choices. With various funding avenues, students can consider institutions or programs they may have initially thought impossible due to costs. This flexibility often leads to a more fulfilling and impactful college experience.

Additionally, many of these programs provide resources such as financial literacy workshops. Gaining knowledge about budgeting, saving, and managing credit can empower students to make informed decisions, not just during their time in school but throughout their lives.

Finally, receiving support fosters a sense of community and connection. Students who engage with these opportunities often find themselves surrounded by peers facing similar challenges, promoting camaraderie and encouragement. This solidarity can make the academic journey feel less isolating and more collaborative.