Is Investing in ZS Stock a Smart Move for Your Portfolio

When it comes to exploring potential additions to your portfolio, it’s essential to consider all angles. Investors often find themselves pondering the merits of various options, and ZS has recently caught the attention of many. The question on many minds is whether this particular entity presents a favorable opportunity in the current market climate.

Understanding the nuances behind the performance of ZS can be quite enlightening. It’s not just about numbers; it’s about the underlying factors that could influence its future trajectory. Analyzing recent trends, company developments, and overall industry dynamics can provide valuable insights into whether this opportunity aligns with your investment goals.

As we delve deeper into the characteristics of ZS, we’ll explore its positioning and the factors that might influence its appeal. By assessing market conditions and evaluating potential risks and rewards, we can better determine if this prospect is worthy of further consideration.

Understanding ZS Stock Performance Trends

Analyzing the performance patterns of ZS shares can provide valuable insights for investors seeking new opportunities. By examining historical data and recent developments related to this particular entity, we can gain a clearer view of its potential trajectory in the market. Trends often reveal how external factors, economic conditions, and company announcements can influence the value of these assets.

Recent Fluctuations: The price movements of ZS have exhibited both volatility and resilience. Recent reports suggest that despite some dips, the overall outlook has remained optimistic, driven by strong demand in its sector. Monitoring periods of rapid changes can highlight the underlying strength of the fundamentals.

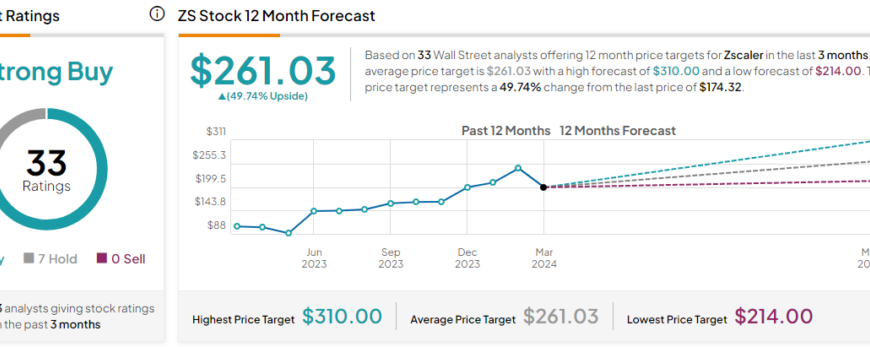

Market Sentiment: Investors’ perceptions can heavily impact the performance of ZS. Social media buzz, analyst ratings, and market buzz often shape the psychological factors that affect trading volumes. Keeping an ear to the ground for chatter among financial experts can help contextualize any observed shifts in price activity.

Competitor Analysis: Comparing ZS with similar entities can also shed light on its positioning within the industry. Identifying how competitors are performing and adjusting to market dynamics allows for a more informed view of ZS’s strengths and weaknesses.

Future Projections: Looking ahead, evaluating forecasts and analysts’ predictions can provide potential scenarios for ZS. While past performance doesn’t guarantee future results, if the trends continue upward with positive indicators, it may suggest an encouraging path for enthusiasts and investors alike.

Factors Influencing Investment Decisions for ZS

When considering an opportunity like ZS, several elements come into play that can shape your choice. Investors often dive into a mix of quantitative and qualitative factors to gauge potential outcomes. These aspects are crucial for making informed decisions in today’s dynamic market landscape.

One key area to explore is the company’s financial health. Profit margins, revenue growth, and cash flow are metrics that typically attract attention. If ZS has been consistent in delivering strong results, this can inspire confidence among prospective investors.

Market trends also play a significant role. Analyzing industry performance and potential shifts in demand can provide insights into ZS’s future. Awareness of competitors and understanding where ZS fits within the larger ecosystem can influence the investment narrative.

Another important consideration is the leadership team. Strong governance and a clear strategic vision often give investors a sense of security. Knowing who is at the helm can be a decisive factor when weighing options in the investment avenue.

Additionally, external factors such as economic conditions, regulatory changes, and technological advancements should not be overlooked. These elements can affect the overall performance of ZS and alter the investment landscape dramatically.

In summary, making a well-rounded decision regarding ZS involves looking at various dimensions, from financial metrics to market dynamics. By taking a holistic view, investors can better navigate the complexities of this opportunity.

Comparative Analysis with Industry Peers

When evaluating the potential of a particular entity within its sector, it’s essential to take a closer look at how it stacks up against its competitors. By examining various performance metrics, market trends, and strategic positioning, one can gain valuable insights into whether it stands out or lags behind others in the same field.

In this context, we should analyze key financial ratios such as price-to-earnings and debt-to-equity, comparing them with those of relevant rivals. This will help us understand the company’s relative valuation and financial health. Additionally, looking into growth rates and revenue trends can provide clarity on which firms are expanding their market share effectively, offering a glimpse into their long-term sustainability.

Moreover, assessing competitive advantages like brand strength, innovation, and customer loyalty can highlight unique aspects that may influence future performance. It’s also worthwhile to consider macroeconomic factors and regulatory environments that may impact not just one entity, but the entire industry. All these factors combined can paint a comprehensive picture, aiding in informed decision-making moving forward.

You just keep getting better and better! This video was a joy to watch;and I can’t wait to see what you do next!