Evaluating the Investment Potential of Yext Shares

When considering opportunities in the marketplace, one often finds themselves sifting through various options, looking for promising candidates. In this landscape, it becomes essential to evaluate various factors that can impact the potential for substantial returns. Today, we delve into one particular entity that has garnered attention from analysts and enthusiasts alike.

Understanding the intricacies of this firm is crucial. From its financial health to market positioning, every detail plays a vital role in determining its future trajectory. With fluctuating trends and evolving technologies, assessing how this company aligns with broader industry dynamics can reveal valuable insights for those looking to enhance their investment strategies.

As you join us on this exploration, we will dissect pertinent aspects such as recent performance metrics, competitive advantages, and potential risks. Equipped with this knowledge, informed decisions can be made, guiding you toward a more strategic approach in your financial ventures.

Market Performance of Yext Stock

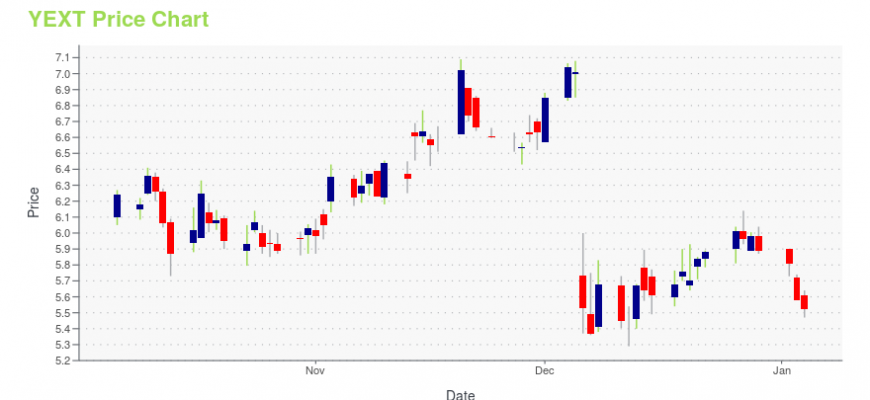

When examining the performance of this particular entity in the financial arena, one can observe various trends and patterns that may influence investor sentiment. The valuation has demonstrated fluctuations over time, reflecting broader economic conditions as well as company-specific developments. Understanding these dynamics can provide insight into potential future movements.

Recent trends indicate a certain level of volatility, with significant price movements corresponding to quarterly earnings reports and industry-related news. Investors have been attentive to these shifts, gauging the company’s ability to adapt and grow amid competitive pressures.

Additionally, analysts have offered differing perspectives on what the future holds, examining both short-term predictions and long-term outlooks. Engaging with these analyses may help inform decision-making for those considering an interest in the company’s performance. Observing the response from the market can be equally telling, as it often reveals how traders interpret the underlying fundamentals.

Ultimately, a thorough exploration of relevant metrics and broader market sentiment can equip potential investors with a well-rounded understanding of this entity’s position within its sector. An informed approach may lead to more confident choices, regardless of the investment strategy in play.

Key Factors Influencing Investment Decisions

When considering where to allocate your funds, several critical elements come into play. These factors can significantly affect potential returns and risks, shaping your overall investment strategy. Understanding what to prioritize can help streamline your decision-making process.

- Financial Performance: Analyzing earnings reports, revenue growth, and profit margins is essential. Consistent financial health often signals stability.

- Market Trends: Keeping an eye on industry developments, consumer trends, and market sentiment provides valuable insights into future potential.

- Leadership Team: The experience and track record of the management team can influence company performance. Strong leaders often navigate challenges effectively.

- Competitive Landscape: Understanding a company’s position relative to its competitors is crucial. A strong market presence can provide a competitive edge.

- Valuation Metrics: Assessing ratios like price-to-earnings or price-to-book can help determine if an investment is reasonably priced compared to its potential.

Each of these components plays a vital role in crafting a comprehensive investment approach. Whether one is focusing on long-term growth or short-term gains, staying informed about these factors can lead to more strategic choices.

Expert Opinions on Yext’s Future

When it comes to evaluating the trajectory of a particular technology company, insights from seasoned analysts can be invaluable. These professionals dive deep into financial metrics, market trends, and competitive landscapes to provide a well-rounded perspective. In this section, we’ll explore what experts are saying about the potential direction of the company and its role in the ever-evolving digital landscape.

Several industry analysts have expressed optimism regarding the company’s innovative solutions aimed at enhancing online presence. They highlight how the ongoing shift towards digital engagement can serve as a catalyst for growth. Moreover, the firm’s ability to adapt to market demands has garnered attention, suggesting a promising outlook for future performance.

On the other hand, some skeptics caution about potential hurdles, such as increased competition and market saturation. Experts underline the importance of continued innovation and effective marketing strategies to maintain relevance. This mixed sentiment emphasizes the importance of closely monitoring industry trends and the company’s responses to challenges ahead.

Overall, while opinions vary, the consensus remains that the company’s strategic initiatives and market adaptability will play critical roles in shaping its future prospects. By keeping an eye on performance indicators and expert analyses, investors can make more informed decisions moving forward.