Exploring the Potential of Yeti as a Smart Investment Choice

When it comes to exploring new avenues for financial growth, it’s essential to dive deep into the potential of various entities in the marketplace. Understanding the dynamics at play can make a significant difference in the decisions you ultimately make. Each opportunity presents a unique set of challenges and advantages that can influence your investment journey.

As enthusiasts of the market often say, knowledge is power. By analyzing factors such as company performance, market trends, and competitive positioning, you can gain valuable insights. This allows you to assess whether this particular endeavor aligns with your financial goals and risk tolerance.

In recent times, this specific brand has sparked considerable interest among investors, leaving many wondering about its long-term viability. Exploring its performance metrics and overall market reception can help clarify whether it deserves a place in your portfolio. So, let’s take a closer look at what this venture has to offer and determine if it’s worth your consideration.

Analyzing Financial Performance

When it comes to evaluating a company’s fiscal health, several key indicators come into play. By diving deep into revenue trends, profit margins, and overall growth trajectories, investors can gain valuable insights into the viability of an investment. This analysis helps to determine whether the business is on a solid path or facing challenges that could impact future returns.

One essential aspect to consider is revenue growth over recent years. Observing sales figures can reveal how well the enterprise is expanding its market presence. Coupled with this, examining net income provides clarity on profitability. High profit margins often signal effective cost management, while consistent earnings indicate a robust operational framework.

Furthermore, it’s crucial to analyze the company’s balance sheet. A healthy level of assets compared to liabilities enhances financial stability and reduces risks for shareholders. Additionally, cash flow statements offer insights into the liquidity position, helping to assess how effectively the organization manages its resources in the short term.

Lastly, comparing these metrics with industry benchmarks can lend context to the analysis. Understanding where the business stands among its peers can highlight competitive advantages or potential areas of concern. In essence, a thorough examination of financial performance lays the groundwork for informed decision-making.

Market Trends Impacting Yeti’s Growth

Understanding the dynamics at play in the marketplace is crucial for any entity aiming for expansion. Several key trends are shaping the landscape, influencing consumer behavior and overall business trajectory. These factors can create opportunities or pose challenges, making it essential to keep an eye on them.

- Outdoor Lifestyle Surge: The growing interest in outdoor activities is spurring demand for high-quality products that cater to adventurous individuals. The lifestyle shift towards nature exploration promotes brands that resonate with these values.

- Eco-conscious Consumerism: Today’s buyers are increasingly prioritizing sustainability. Companies that adopt environmentally friendly practices and materials often capture a larger share of the market.

- Technological Integration: Innovations in product design and e-commerce are transforming how consumers interact with brands. A seamless online experience and smart features in products can enhance attractiveness.

- Social Media Influence: Platforms are playing a significant role in shaping consumer preferences. Engaging content and influencer partnerships can drive awareness and spur sales among targeted demographics.

These trends illustrate the evolving market environment and highlight the importance of adaptability for any brand striving for prosperity. Staying attuned to these changes can pave the way for strategic decision-making and long-term growth.

Expert Opinions on Future Potential

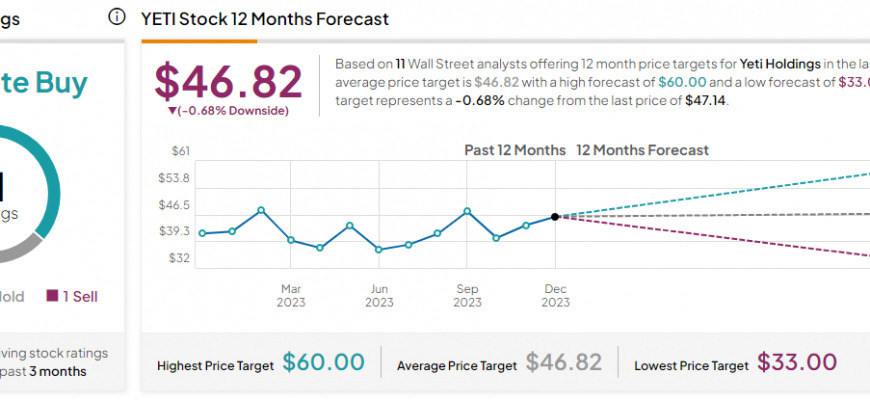

When diving into the outlook of this outdoor gear company, analysts have diverse views on where it’s headed. Many experts are closely observing market trends and the evolving consumer preferences that could impact the brand’s trajectory. The growth in outdoor activities and the demand for durable and stylish products play significant roles in shaping expectations.

Some industry specialists argue that the company has a strong foothold due to its robust brand loyalty and innovative designs. They highlight how an emphasis on sustainability and quality resonates well with environmentally-conscious consumers, which may enhance its appeal in the long run. The company’s marketing strategies also attract attention, as they effectively engage younger audiences through social media and influencer partnerships.

On the flip side, there are concerns regarding competition. Analysts point out the increasing number of players entering the market could pose challenges. Additionally, fluctuations in raw material costs and economic uncertainties might create headwinds for profitability. Nevertheless, many believe that effective management and strategic adaptations can counterbalance these risks.

Ultimately, opinions vary widely. While some are optimistic about its potential growth due to solid fundamentals, others urge caution given the competitive landscape. Keeping an eye on upcoming product launches and market developments will be crucial for anyone assessing the brand’s future viability.