Exploring the Investment Potential of Xeqt and Its Market Viability

When it comes to making decisions about where to place your financial resources, it’s essential to navigate through various options with a keen eye. Every potential opportunity can present a unique mix of advantages and drawbacks, making it crucial to analyze the factors at play. In this ever-evolving market landscape, understanding the intricacies of different opportunities can significantly influence your financial well-being.

In this article, we will delve into the characteristics and performance of a certain portfolio that has caught the attention of many. Exploring its historical data, market behavior, and overall strategy will provide you with the insights needed to determine if it aligns with your financial goals. It’s not just about the present; evaluating future potential is equally important in making informed decisions.

As we venture further into this discussion, we’ll highlight critical elements that can help clarify whether this option stands out among its peers. By examining various criteria and outcomes, you’ll be better equipped to understand if this choice is genuinely worthwhile for your portfolio. Let’s embark on this exploration together!

Understanding the XEQT Investment Landscape

Diving into the world of financial opportunities can be quite an adventure, especially when exploring options that cater to a diverse range of preferences and goals. For those seeking a simplified approach with a blend of various assets, it’s worth considering how such a strategy can align with one’s long-term aspirations. In this ever-changing marketplace, gaining insight into different products can help individuals make informed decisions.

When evaluating this option, it’s essential to grasp the underlying principles that govern its framework. Many individuals are drawn to the convenience of a singular solution that offers exposure to multiple sectors and geographies. This method not only mitigates risk by spreading assets across various categories but also provides a potential for growth by tapping into different market trends.

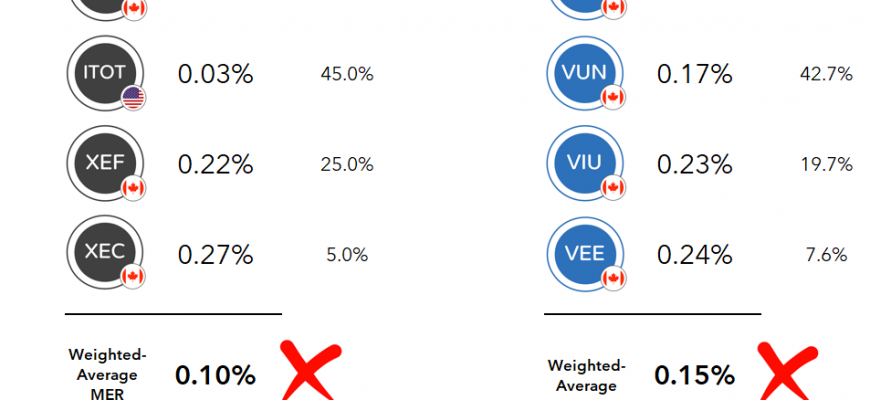

Additionally, understanding the cost structure associated with such financial choices is crucial. Lower fees can significantly enhance overall returns, making it a compelling aspect for anyone looking to optimize their portfolio. By prioritizing quality management and robust performance, one can navigate the complexities of the financial landscape with greater ease.

Lastly, keeping an eye on past performance while acknowledging the dynamic nature of markets can serve as a valuable guide. While previous results do not guarantee future achievements, they can provide context and help shape expectations as one explores potential pathways. Embracing this knowledge empowers individuals to chart a course that aligns well with their unique financial journey.

Potential Risks of Investing in XEQT

When considering a new opportunity in the financial market, it’s essential to weigh both the potential benefits and the pitfalls that might accompany it. While the allure of growth and diversification can be tantalizing, there are a few factors that could lead to unforeseen setbacks. Understanding these risks can help you make a more informed decision before diving into this particular venture.

First off, market volatility is a significant concern. Like many assets, the value can fluctuate based on broader economic conditions, leading to potential losses. This unpredictability means that prices can soar one day and plummet the next, leaving investors in a precarious position.

Additionally, the dependency on underlying assets means that if those assets underperform, the returns may not meet expectations. Factors such as economic shifts, changes in consumer behavior, or even global events can impact performance dramatically, which could leave you feeling exposed.

There’s also the risk of management strategy. The decisions made by those in control play a crucial role in navigating challenges. If the approach taken is flawed or fails to adapt to market changes, it could hinder growth significantly.

Finally, it’s crucial to consider fees and expenses that might eat into returns. Whether it’s management fees or other costs associated with financial products, these can accumulate and erode potential gains over time. Therefore, a thorough assessment of all factors is paramount to ensuring a successful experience.

Factors Driving XEQT’s Market Performance

When it comes to understanding the dynamics that influence a certain fund’s market standing, several key elements play a crucial role. These factors can shape investor sentiment, drive demand, and ultimately affect the overall value of the asset in question. Grasping these aspects provides valuable insights into how this particular option may fare in today’s ever-changing financial landscape.

Firstly, the economic climate significantly impacts market performance. Inflation rates, interest rate fluctuations, and general economic growth can either bolster or hinder returns. When the economy is thriving, investors are more inclined to allocate resources, driving up demand for assets. Conversely, in times of economic uncertainty, people often become more cautious, which can lead to increased volatility.

Moreover, corporate earnings reports and the success of major industries underpin overall market attractiveness. Positive earnings can spark investor interest, creating a positive feedback loop as more individuals seek to capitalize on anticipated growth. Conversely, disappointing results can dampen spirits and result in sell-offs that affect broader market trends.

Additionally, geopolitical events and regulatory changes can create ripples in market performance. Uncertainty arising from international relations, trade agreements, or new regulations can sway investor confidence, influencing decisions. Keeping an eye on these developments is crucial, as they often have direct implications on market trajectories.

Finally, investor behavior itself plays a vital role. Trends, sentiment, and the psychology of the market can lead to fluctuations that don’t always align with fundamental values. Observing social media, news cycles, and general public perception can provide context for why a particular asset may be experiencing rapid changes in its performance.