Is Investing in Xcel Energy a Smart Choice for Your Portfolio

When it comes to making financial decisions in the realm of utility providers, many individuals find themselves asking a crucial question: is this particular company a wise choice for their portfolio? With fluctuating markets and varying economic conditions, understanding the fundamentals of such enterprises is essential for informed decision-making. The landscape is filled with options, but how do you discern which ones truly stand out?

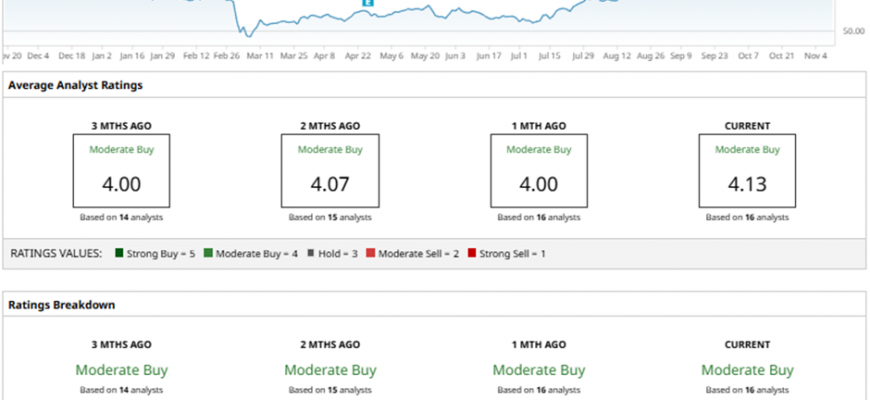

Investors often delve into several factors that can influence their selections. Analyzing historical performance, examining financial health, and considering future growth prospects are all vital. Additionally, the role of regulations and industry trends cannot be overlooked, as these elements can significantly impact the trajectory of a utility provider. So, what should one contemplate before taking the plunge into a commitment involving this specific firm?

Ultimately, diving deeper into the intricacies of this provider’s operations and positioning within the market can shed light on its viability as an investment. Whether you are a seasoned market participant or a newcomer to the investment world, understanding these nuances can empower you to make choices that align with your financial goals. Let’s explore the factors that play a role in determining the appeal of this particular entity.

Analyzing Market Performance

When looking at the financial landscape of a utility provider, it’s essential to scrutinize their recent performance in the market. This includes examining various metrics and trends that could indicate future potential. Investors often evaluate a company’s stability, growth prospects, and how well it manages challenges in an evolving industry.

In assessing the current valuation, factors such as revenue growth, earnings reports, and dividend history come into play. Stakeholders should also consider how external elements, like regulatory changes and technological advancements, influence the organization’s strategies and market position. Comparisons with competitors add another layer of understanding regarding its relative strength and market share.

Overall, due diligence is vital. By looking closely at these elements, one can form an educated perspective on whether this utility provider represents a promising opportunity within the sector.

Factors Influencing Energy Stock Investment

When it comes to putting your money into the market segment related to power providers, several elements come into play. Understanding these factors can significantly impact your decision-making process and help you navigate the often complex landscape of this particular investment area.

One crucial aspect to consider is regulatory policies. Governments around the world implement various regulations that can affect the financial health of these companies. Changes in legislation regarding emissions, renewable resources, and tariffs can create ripples in performance, making it vital for investors to stay informed.

Market trends also play a significant role. Investors should keep a close eye on the shift towards renewable sources and how traditional firms adapt to these changes. A company’s ability to innovate and pivot toward sustainability can greatly influence its long-term viability and, consequently, the sentiment around it in the financial arena.

Another important factor is the overall economic environment. Economic stability or volatility can directly affect consumption rates and, in turn, revenues. During economic downturns, demand for power may dip, whereas growth periods could see increased usage, impacting profits in either direction.

Lastly, examining a company’s financial health is essential. Key indicators such as debt levels, cash flows, and earnings can help paint a clearer picture of its viability as an investment. A strong balance sheet might provide reassurance, while high levels of debt could pose risks for potential backers.

Future Prospects for Excel Energy

When we consider the trajectory of a particular utility provider, it’s essential to evaluate various dimensions that could impact its development and market relevance in the coming years. Factors like advancements in renewable sources, regulatory changes, and the commitment to sustainability play a pivotal role in shaping the landscape. In this section, we will dive into potential opportunities and challenges ahead for this notable player in the energy sector.

Renewable Initiatives: One exciting aspect is the growing emphasis on clean and sustainable solutions. The transition towards greener alternatives not only attracts conscientious consumers but also aligns with global initiatives to combat climate change. Investments in solar and wind projects stand to enhance the company’s portfolio and bolster its reputation.

Regulatory Environment: Keeping an eye on policy shifts is crucial. New government regulations aimed at reducing carbon emissions can create both hurdles and avenues for growth. How well the firm adapts to these changes can significantly influence its operational efficiency and profitability.

Technological Advancements: Innovation in energy management systems can provide a competitive edge. The incorporation of smart grids and energy storage solutions may lead to enhanced service reliability and customer satisfaction, which are vital for long-term success.

Market Demand: As society becomes more energy-conscious, the demand for efficient and sustainable solutions is only expected to rise. By positioning itself strategically to meet these evolving needs, the entity could play a crucial role in shaping the future of energy consumption.

In summary, by leveraging its strengths and adapting to emerging trends, this utility provider is well-placed to navigate the complexities of the market effectively. The future certainly holds a wealth of possibilities for continued success and impact within the industry.