Evaluating the Investment Potential of Walmart Stock

When it comes to considering where to put your hard-earned cash, the landscape can be quite intricate. There are numerous factors to weigh, especially if you’re looking at a familiar retail giant that has been a staple in many communities. Understanding the nuances of its performance and the broader market will help clarify whether this option aligns with your financial aspirations.

Investors often grapple with questions about value, growth potential, and market stability. With so much information available, it can become overwhelming to discern what holds significance and what is merely noise. By examining trends, financial health, and even consumer sentiment, you can gain insights that may lead you to a more informed conclusion about this retail behemoth.

In a world where market dynamics shift rapidly, some would argue that keeping a close eye on the fundamentals is essential. Evaluating past performance, future forecasts, and industry positions can provide the clarity needed to make educated choices. As you delve deeper into this matter, consider what aspects resonate with your personal goals and risk tolerance.

Understanding Financial Performance

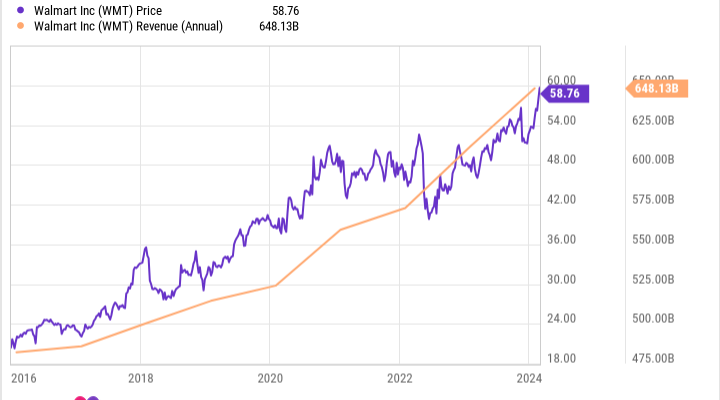

When assessing a company’s potential in the market, it’s essential to look at its financial health. This includes evaluating revenue trends, profit margins, and overall fiscal responsibility. A strong performance in these areas often indicates stability and growth prospects for the future.

One of the key metrics to consider is total revenue, which gives insight into how much business a company is generating. Increasing sales figures generally signal that a firm is appealing to consumers and effectively managing its operations. Additionally, profit margins reveal how efficiently a company is converting sales into actual earnings, reflecting its cost management strategies.

Another important aspect to discuss is the company’s debt levels. High debt may pose risks, particularly in economic downturns, whereas manageable debt can suggest a well-structured balance sheet. Moreover, return on equity (ROE) is a critical ratio that helps in understanding how effectively management is utilizing shareholders’ funds to generate income.

Investors often pay close attention to historical performance and forecasts, as they provide context for future expectations. A company that showcases consistent growth and adaptability to market changes can entice potential backers, indicating that it possesses the resilience needed to navigate challenges. Overall, a thorough examination of these financial indicators can shed light on the broader picture and assist in making informed decisions.

Factors Influencing Retail Stock Value

When considering the performance of a retail company, several elements come into play that can affect its worth in the market. Understanding these factors can help one gauge how a company is faring in the competitive landscape and what might influence its future trajectory.

Customer behavior is a significant driver. How shoppers react to pricing, promotions, and products directly impacts sales figures. Trends, preferences, and overall consumer sentiment can shift quickly, making it crucial for retailers to stay attuned to their target audience.

Another aspect to examine is the overall economic climate. When the economy is thriving, consumers typically have more disposable income, which can lead to increased spending in retail. Conversely, during recessions, spending often tightens, which can negatively affect a retailer’s performance.

Operational efficiency is also key. A company that manages its inventory, supply chain, and logistics effectively can maintain better margins and capitalize on opportunities quickly. On the other hand, inefficiencies can lead to higher costs and lower profitability.

Lastly, competitive dynamics play an integral role. The retail landscape is always changing, with new players entering and established ones adapting. A company that innovates and differentiates itself amid fierce competition is more likely to thrive and enhance its market performance.

Comparing Walmart to Competitors

When evaluating the performance of retail giants, it’s essential to look at how they stack up against each other. The retail sector is highly competitive, with various players offering similar products and services. Each company has its strengths and weaknesses, and understanding these nuances can help assess their overall market positions.

One critical factor to consider is pricing strategy. While some competitors focus on premium offerings, others aim for a more budget-conscious consumer base. This distinction can greatly influence their customer loyalty and market share. Additionally, the supply chain efficiency and logistics can vary significantly among these businesses, impacting their ability to manage costs and deliver products promptly.

Moreover, customer experience plays a pivotal role in shaping a company’s reputation. In today’s world, shoppers often look for more than just low prices; they seek convenience, service quality, and an enjoyable shopping atmosphere. Thus, comparing how different retailers approach these aspects can provide valuable insights into their potential for growth.

Lastly, it’s crucial to analyze technological advancements embraced by each firm. In an era where online shopping is booming, a strong digital presence and effective logistics can set a company apart. Observing how competitors adapt to changing consumer behaviors can reveal much about their future prospects and sustainability in the evolving marketplace.