Evaluating the Investment Potential of VOO for Savvy Investors

When it comes to navigating the world of finance, many individuals find themselves pondering the prospects of specific exchange-traded funds. These financial instruments have garnered attention for their unique composition and the advantages they may offer to those seeking to enhance their portfolios. Understanding the nuances of these products is essential for making informed decisions.

There are numerous factors to consider when assessing whether a particular fund aligns with your financial goals. The growth potential, the composition of its underlying assets, and historical performance often play significant roles in this evaluation process. Additionally, your personal risk tolerance and investment horizon can greatly influence whether such an option fits into your overall strategy.

Before diving into any conclusions, it’s wise to conduct thorough research and analysis. Engaging with market trends, expert opinions, and financial metrics can provide valuable insights. In this exploration, we will unravel the intricacies surrounding this specific fund and help you determine if it’s a fitting choice for your financial journey.

Understanding VOO’s Investment Performance

When diving into the world of finance, it’s essential to grasp how various options have fared over time. Various factors contribute to the overall performance and can help individuals assess the potential of a particular choice. Analyzing historical data, market trends, and external influences can provide a clearer picture.

One of the key aspects to examine is the return generated over the years. By looking at past performance metrics, investors can glean insights into whether a specific option aligns with their financial goals. Additionally, understanding volatility and market fluctuations can help individuals gauge risk levels associated with their choices.

Furthermore, comparing the results with similar products can shed light on relative strengths and weaknesses. Evaluating metrics like expense ratios, dividends, and growth rates allows for a comprehensive view of how well the asset has performed in varying market conditions.

It’s also important to consider broader market trends and how they impact the asset class. Economic indicators, geopolitical events, and changes in consumer behavior can all play a significant role in shaping performance. By staying informed, potential stakeholders can better anticipate future movements and make educated decisions.

In summary, understanding the intricacies of how this particular option has performed historically can greatly aid anyone looking to navigate their financial journey. With the right analysis and insights, individuals can make more tailored financial decisions that suit their unique situations.

Evaluating Risks and Rewards of VOO

When considering a certain type of financial product, it’s essential to weigh both the potential upsides and the inherent challenges. Understanding these factors can help in making a well-rounded decision. Let’s dive into what you might gain and what you might have to navigate in this context.

Potential Benefits: One of the most appealing aspects is the broad exposure to numerous companies, which can lead to diversified gains over time. Holding a stake in a wide array of industries can cushion against the volatility that often characterizes individual stocks. Historically, similar options have shown a tendency for long-term growth, making them attractive for those with a patient outlook.

However, it’s not all sunshine and rainbows. Risks are an inevitable part of any financial journey. Market fluctuations can lead to unpredictable results; what seems promising today may change overnight. Economic downturns or shifts in investor sentiment can significantly impact value. Therefore, being aware of the market environment and external influences is crucial.

In summary, the balance between potential growth and accompanying risks is delicate. It’s vital to do thorough research and consider your personal financial goals before proceeding. Each individual’s situation is unique, and what works for one might not suit another.

Comparative Analysis with Other ETFs

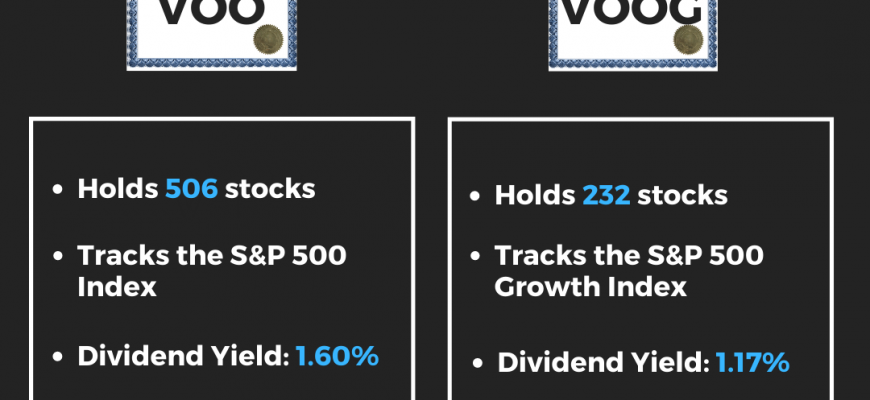

When navigating the world of exchange-traded funds, it’s essential to compare different options to determine which ones align with your financial aspirations. Each fund comes with its own unique features, risks, and returns, making it crucial to evaluate them in relation to one another. This section aims to shed light on how one particular fund measures up against its peers in the ever-competitive ETF landscape.

Let’s take a closer look at a few popular alternatives that often enter the conversation. For example, funds that track the S&P 500 might be contrasted with those focusing on international markets or specific sectors, such as technology or healthcare. By examining their performance metrics, expense ratios, and historical returns, you can gain valuable insights into which options may suit your strategy better.

In addition, consider factors such as liquidity and trading volume. A fund with higher daily trading activity might offer smoother access to your assets, while those with lower volumes could pose challenges when trying to exit positions. This aspect becomes increasingly important if you’re looking to implement a more active trading approach.

Another crucial element to weigh includes diversification. While broad-market funds typically boast a wide range of holdings, specialized ETFs may offer concentrated exposure to growth sectors or emerging markets. Understanding how these distinctions impact your overall portfolio risk can help you make more informed choices.

Ultimately, the key to drawing meaningful comparisons lies in your individual circumstances and objectives. Whether you’re aiming for steady growth, capital preservation, or aggressive expansion, analyzing various funds against each other empowers you to craft a strategy that aligns perfectly with your financial goals.