Understanding Whether a Visa Card Functions as a Credit Card or a Debit Card

When it comes to managing our finances, the choices we make about how to spend and control our money can be a bit puzzling. There are various methods to facilitate transactions, each with its own set of features and benefits. Whether you’re shopping online, dining out, or traveling, knowing the ins and outs of these payment tools can greatly enhance your experience.

One particular payment option stands out due to its widespread acceptance and convenience. Many people use this tool daily, but few truly understand how it works behind the scenes. Are you using it like a loan or treating it as a direct withdrawal from your bank account? The difference ignites a vibrant discussion among users.

In this article, we’ll delve into the nuances of this widely recognized payment solution. We’ll explore its characteristics, clarify common misconceptions, and help you determine how best to utilize this financial instrument according to your needs. Buckle up, as we navigate the fascinating world of modern monetary transactions together!

Understanding Visa: Credit vs. Debit

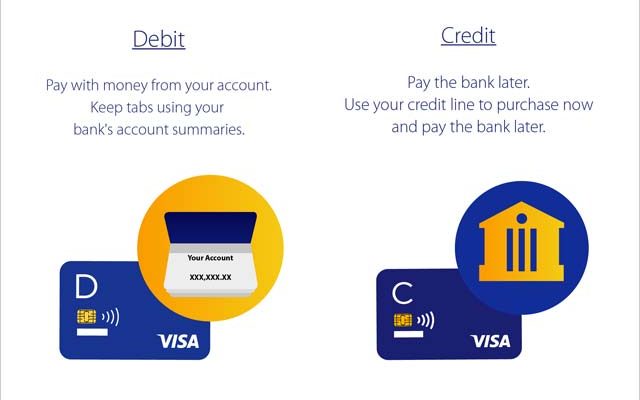

When we think about the payment methods in our wallets, two popular types often come to mind. Both offer convenient ways to make purchases, but they function differently. Let’s dive into the main features and differences between these two options.

Here are some key points to consider:

- Source of Funds: One method draws from your existing bank balance, while the other allows for borrowing money up to a limit set by the financial institution.

- Spending Limits: With one option, you’re limited to what you already own, whereas the other gives you a bit more freedom, extending beyond your available cash.

- Rewards and Benefits: Many users enjoy perks with one type, like cash back or travel rewards, while the other may come with different incentives.

- Interest Rates: If not managed properly, one choice can lead to interest charges, while the other typically does not, provided you stay within your means.

- Transaction Process: Both forms are widely accepted globally, but the way they process payments may vary, impacting your purchase experience.

Understanding these distinctions is essential for making informed financial decisions. Depending on your lifestyle and spending habits, one may serve you better than the other. Choose wisely!

How Payment Instruments Function in Transactions

When you make a purchase, there’s a seamless process that happens behind the scenes, ensuring that the transaction is completed efficiently. These payment tools serve as intermediaries between your bank and the merchant, allowing you to access funds and finalize a deal without hassle. Understanding how they operate can give you better insight into your financial dealings.

Initially, when you present your payment method at the counter or online, the details are sent for verification. This involves checking for sufficient funds and confirming that the account is active. Once those factors are validated, authorization is granted, enabling the exchange to proceed smoothly. This quick yet complex interaction is often completed in mere seconds.

After the approval, the actual transfer of money occurs. The specified amount is debited from your account and credited to the merchant’s, allowing both parties to fulfill their obligations. Typically, these transactions are processed through a network that connects various financial institutions, ensuring that everything is secure and efficient.

One of the key components of this system is the availability of diverse security features that protect your data during transactions. Encryption, tokenization, and other technologies are employed to safeguard sensitive information, helping to prevent fraud and unauthorized access. This secure environment allows consumers to shop confidently, knowing their financial details are well-protected.

In essence, these financial instruments streamline the purchasing experience, making it more convenient for both buyers and sellers. Understanding this flow can enhance your appreciation for how modern payment solutions have evolved to meet today’s demands.

Benefits of Using Visa for Payments

Using a popular payment method comes with a variety of advantages that make transactions smoother and more convenient. From security features to convenience, many users appreciate this option for both online and in-store purchases.

Enhanced Security: One of the standout features of this payment method is its robust security measures. With advanced encryption technology and fraud detection systems, consumers can shop with confidence, knowing their financial information is well-protected.

Global Acceptance: This option is widely accepted across the globe, making it easy to make purchases while traveling or ordering from international retailers. This universal acceptance simplifies the process of managing expenses in different currencies.

Convenience: Whether you prefer shopping online or in physical stores, this payment alternative offers seamless transaction capabilities. The ease of use and quick checkout process means you can spend less time at the register and more time enjoying your purchases.

Rewards and Benefits: Many users enjoy additional perks, such as cashback offers, discounts, or loyalty rewards. These added incentives can enhance the overall shopping experience and provide extra value for each purchase.

Budgeting Tools: This payment method often provides tools that help users track spending and manage finances effectively. By offering insights into purchase behaviors, individuals can better plan their budgets and control their expenses.

In conclusion, opting for this widely recognized payment solution offers an array of benefits that cater to modern consumers’ needs, ensuring a pleasant and secure shopping experience.