Exploring the Investment Potential of VICI Properties as a Stock Option

When considering options in the bustling world of finance, it’s crucial to sift through various choices to find those that align with your investment strategy. With so many entities vying for attention, discerning whether a particular player merits your consideration can often feel like navigating a maze.

The landscape of this market is filled with opportunities and risks. Numerous factors, such as performance metrics, market trends, and overall stability, can significantly influence your decision-making process. It’s essential to delve into the finer details and weigh both sides carefully, ensuring that your investment aligns with your financial goals.

As we explore this particular opportunity, let’s examine the underlying fundamentals, industry positioning, and future growth prospects. By doing so, we can gain a clearer understanding of whether this investment could potentially enhance your portfolio or if it might be wise to look elsewhere.

Understanding Vici’s Financial Health

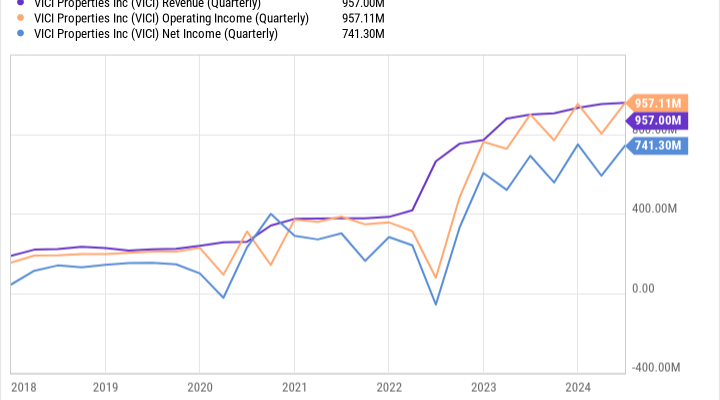

Diving into the financial well-being of a company reveals important insights that can influence investment decisions. Analyzing various metrics allows potential investors to gauge stability, growth potential, and overall performance in the market. By dissecting factors such as revenue, expenses, and profit margins, one can form a clearer picture of where the organization stands and where it might be headed.

Revenue trends play a crucial role in assessing the potential for future profitability. Consistent growth in sales often indicates a strong demand for services or products, positioning the entity favorably in its sector. Comparing this growth to industry averages can further highlight competitive advantages or weaknesses.

Debt levels are another vital aspect to consider. A balance between leverage and liquidity can indicate sound management practices. Low Debt-to-Equity ratios suggest that the business is not overly reliant on borrowed funds, which can be a positive sign of financial prudence.

Moreover, cash flow analysis provides deep insights into the company’s operational efficiency. Positive cash flow ensures that the entity can meet its short-term obligations while also funding expansion activities and returning value to shareholders.

Lastly, examining the dividend history can give clues about the company’s commitment to returning profits to its investors. Regular and increasing dividends often signify confidence in sustained earnings and future growth, which many view as a reassuring factor.

Recent Market Trends Impacting Vici

In today’s ever-evolving financial landscape, several recent trends have emerged, significantly shaping investment opportunities and strategies. Many investors are keeping a close eye on various sectors that have shown resilience or growth potential, particularly in the gaming and leisure industries. Understanding these shifts is crucial for making informed decisions and recognizing the underlying factors that could influence future performance.

One noteworthy trend is the increasing consumer demand for entertainment and hospitality experiences, particularly as the world continues to recover from recent global events. This surge in interest has led to revitalized foot traffic and higher spending in resorts and casinos, indicating a positive outlook for businesses operating in this space. As more people feel comfortable traveling and enjoying recreational activities, the overall industry sentiment appears to be on the upswing.

Additionally, the current interest rate environment plays a significant role in shaping investment sentiments. With potential shifts in monetary policy, financial institutions are adapting to changing conditions, which could impact the cost of capital for various enterprises. Consequently, investors are closely monitoring these developments, as they could affect valuations and future cash flows across the board.

Furthermore, technological advancements are transforming the way businesses within this sector operate. The integration of innovative solutions, from online gaming platforms to enhanced customer experiences, is attracting a new demographic of consumers. Such transformations are not only boosting revenue streams but also reshaping competitive dynamics, creating a landscape where adaptability and innovation are paramount to success.

In summary, understanding these recent market dynamics is essential for evaluating potential opportunities in this vibrant industry. By staying informed about consumer preferences, macroeconomic factors, and technological progress, investors can better position themselves to capitalize on favorable trends as they unfold.

Analyst Opinions on Vici Stock Performance

When it comes to evaluating the potential of a particular investment option, expert insights play an indispensable role. Analysts, with their in-depth research and understanding of market dynamics, weigh in on various aspects of a company’s prospects. Their assessments often reflect economic conditions, competitive positioning, and future growth possibilities, creating a comprehensive picture for investors to consider.

Many financial experts have expressed a favorable outlook regarding the future trajectory of this asset. Positive earnings reports and strategic acquisitions are frequently highlighted as key factors that underpin their optimistic assessments. Furthermore, analysts are keen on discussing the solid revenue streams generated by this entity, which positions it well within the industry.

Conversely, some analysts maintain a cautious stance, urging potential investors to consider market volatility and economic uncertainties. These voices emphasize the importance of due diligence, suggesting stakeholders remain vigilant about external factors that could influence performance. Observations around interest rate changes or shifts in consumer behavior are often cited as critical elements in their evaluations.

In summary, the analysis surrounding this particular option is rich and varied, showcasing a spectrum of opinions. Whether leaning towards enthusiasm or caution, the insights provided by market specialists serve as a valuable resource for anyone contemplating their financial decisions.