Evaluating the Investment Potential of the Vanguard S&P 500 ETF

When it comes to enhancing your financial portfolio, numerous options at your disposal often spark heated debates among seasoned enthusiasts and novice investors alike. The buzz surrounding a specific index fund has gained considerable traction, with many advocating for its potential to deliver robust returns over time. But what really lies beneath the surface? Is it the goldmine some suggest, or just another trend that may fizzle out?

In this section, we will dive into the nitty-gritty of this widely discussed financial vehicle. By examining its historical performance, underlying structure, and advantages, we aim to provide a comprehensive overview for those considering whether to venture into this particular asset class. With insights from various perspectives, you’ll be better equipped to make an educated decision on if it’s the right path for your monetary goals.

Join us as we sift through the pros and cons, breaking them down in a straightforward manner. Whether you’re looking to diversify your holdings or make a strategic move, understanding this financial product is essential before you dive headfirst into the world of investing.

Understanding Vanguard S&P 500 ETF Performance

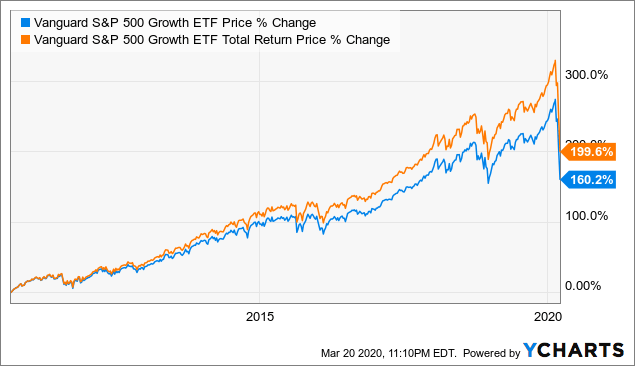

When it comes to assessing the performance of a specific index fund, there are several key factors to consider. These include market trends, historical returns, and the overall economic landscape. Analyzing these elements can provide insights into how well the chosen financial vehicle behaves over time and under various conditions.

Historical analysis is crucial. Review how the fund has performed during different market cycles, including both bull and bear markets. This understanding helps gauge resilience and potential for future growth. Additionally, take note of the volatility levels. A stable asset with minor fluctuations might offer peace of mind, while one with high volatility could present opportunities for higher returns–but also risks.

Furthermore, the underlying index’s composition plays a significant role. The performance of this particular fund is closely tied to the stocks it holds. Observing the sectors represented can indicate whether the fund is well-positioned to capitalize on emerging trends or recover from downturns.

Investors should also factor in expenses, as management fees can eat into returns over time. Low-cost options often provide an edge, allowing more of the earnings to stay in the investor’s pocket.

Lastly, it’s essential to align the choice with personal financial goals and risk tolerance. A well-informed decision considers not just historical performance, but future potential as well. In summary, comprehending how a specific fund operates within the broader market context is key to making savvy financial choices.

Benefits of Investing in Index Funds

When considering a path to grow your wealth, putting your money into funds that track the performance of a broad market can be an appealing strategy. These financial products offer a range of advantages that can enhance your overall portfolio and help you reach your financial goals.

Low Costs: One of the standout features of these funds is their cost-effectiveness. With lower management fees compared to actively managed alternatives, more of your money remains invested and working for you.

Diversification: By investing in a single fund, you gain exposure to a variety of stocks across different sectors. This diversification helps reduce risk, as the performance of your investment is not tied to a single company or industry.

Transparency: These funds typically have clear objectives and strategies, making it easier for investors to understand their holdings. Knowing where your money is allocated brings peace of mind and simplifies tracking your performance.

Consistency: Historically, these funds have shown consistent returns that outperform many actively managed funds over the long term. This reliability can be particularly attractive for those looking to build wealth gradually.

Accessibility: With various options available, these financial products are easy for everyday investors to access. You can start with a relatively small amount and gradually increase your contributions over time.

Simplicity: Investing in such funds requires minimal effort and time. There’s no need to constantly monitor individual stocks or make complex decisions, allowing you to focus on other aspects of your life.

In summary, immersing yourself in this type of financial instrument can provide a robust framework for achieving your financial aspirations. From cost savings to diversification and peace of mind, the benefits are numerous and compelling.

Risks to Consider with Exchange-Traded Funds

When diving into the world of financial products that pool various assets, it’s essential to stay aware of the potential pitfalls that can accompany them. Like any other type of financial tool, these collective investment vehicles come with their own set of risks that savvy individuals need to consider before jumping in.

Market Volatility: One of the primary concerns is the fluctuation in market prices. The value of these products can rise and fall dramatically, influenced by numerous external factors such as economic shifts, political events, or changes in interest rates. If you are not prepared for price swings, you could find yourself in a precarious situation.

Liquidity Risks: While many assets in the marketplace are easily traded, some products might not be as liquid as one would hope. This can result in challenges when trying to sell your shares without affecting the market price negatively. It’s crucial to know how easily you can convert your holdings into cash when the need arises.

Management Fees: Pay attention to the costs associated with these financial vehicles. Although they can offer diversification, the management fees might eat into your returns over time. Evaluating the total costs will ensure that your financial strategy remains aligned with your goals.

Tracking Error: Keep an eye on how well the product performs in relation to its underlying index. A significant discrepancy could indicate inefficiencies in management or other issues, leading to returns that do not match your expectations. Understanding this discrepancy is vital for a clear assessment of performance.

Being informed about these potential challenges will help you navigate the waters of collective investment tools more confidently. By considering these factors, you can make more educated choices that align with your financial objectives.

This is absolutely stunning! Your confidence and grace just take this video to another level!