Exploring the Investment Potential of UPS Stock for Savvy Investors

When considering where to allocate your resources, it’s essential to assess various options carefully. One intriguing prospect on the market has garnered significant attention due to its potential for growth and stability. Investors often find themselves pondering whether this entity is a wise choice for their portfolios.

This discussion delves into the fundamentals that could influence your decision-making process. Factors such as financial performance, market position, and industry trends play a crucial role in determining the overall viability of an investment.

As we explore this subject further, it’s important to weigh the benefits and challenges associated with engaging in this particular market segment. By evaluating critical metrics and insights, you can gain a clearer understanding of what such an investment could mean for your financial future.

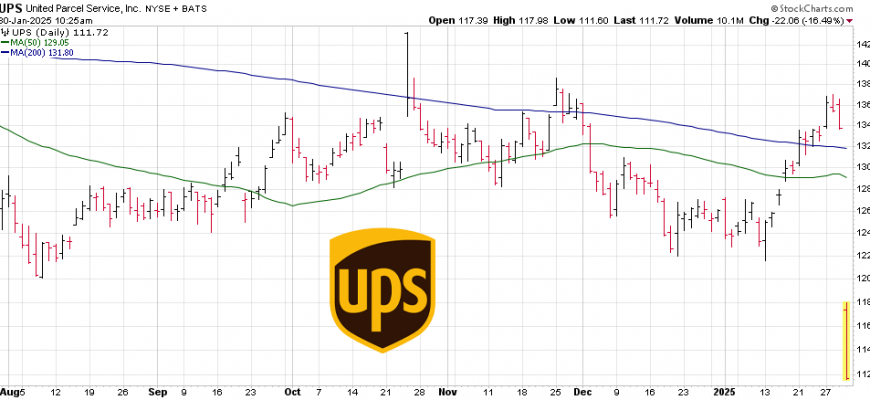

Analyzing UPS Stock Performance Trends

When diving into the dynamics of a certain delivery and logistics giant, it’s essential to grasp how its market position has evolved over time. Observing the movement of its market value and key indicators can unveil a narrative about the company’s resilience and growth prospects. Various factors, such as economic conditions, competition, and operational efficiency, significantly influence its performance trends.

Over the past few years, fluctuations in revenue and profit margins have sparked discussions among investors and analysts alike. The organization has shown adaptability in response to changing consumer behaviors and demand patterns, particularly with the rise of e-commerce. This ability to pivot can be a strong indicator of future stability and growth potential.

Additionally, evaluating the company’s investments in technology and infrastructure is vital. These strategic moves often reflect a commitment to improving service efficiency, which can enhance profitability in the long run. It’s worth noting how these advancements impact both short-term performance and long-term sustainability within the competitive landscape.

Furthermore, examining overall market trends and economic indicators is crucial. The interplay between global logistics challenges, regulatory changes, and consumer sentiment can create both opportunities and hurdles. Awareness of these external elements provides valuable context for interpreting the company’s historical and projected performance.

In conclusion, a thorough evaluation of this industry player requires a blend of internal metrics and external factors. By analyzing various performance trends, one can gain insights into the potential trajectory of this established entity in the logistics sector.

Market Factors Influencing UPS Valuation

When it comes to assessing the worth of a company in the logistics sector, several market elements come into play. Understanding these factors can provide valuable insights into how external conditions shape the financial performance and future prospects of the organization in question. Investors should pay attention to various influences that can sway market sentiments and, consequently, the valuation of the company.

Economic Conditions: The overall health of the economy plays a pivotal role in determining the financial viability of firms involved in shipping and delivery. For instance, during times of economic expansion, there tends to be an uptick in consumer spending, leading to increased demand for delivery services. Conversely, economic downturns can result in reduced shipping volumes, negatively impacting revenue.

Technological Advancements: Innovations in technology significantly affect operational efficiency and customer experience. Companies that embrace cutting-edge solutions can enhance their delivery processes and reduce costs, boosting their competitive edge. Consequently, the ability to adapt to technological trends often reflects in the company’s market position.

Regulatory Changes: The logistics industry is subject to various regulations that can influence operational practices and cost structures. Changes in labor laws, environmental regulations, and trade policies can all lead to shifts in operational costs. Awareness of such potential regulatory impacts is crucial for comprehending the market landscape.

Competition Dynamics: The presence of competitors in the delivery space can create pressure on pricing strategies and service quality. Increased competition may drive companies to innovate and improve their service offerings to attract and retain clients. Tracking competitor moves and their market strategies can provide insights into potential challenges and opportunities.

Consumer Trends: Shifts in consumer preferences, such as the growing demand for e-commerce and same-day delivery options, can significantly affect the business model of logistics providers. Companies that align their services with evolving consumer needs are more likely to thrive, making it essential for investors to monitor these trends closely.

Considering these market factors allows for a more nuanced view of the organization’s potential for growth and profitability. A keen understanding of how these elements interact can guide decision-making for those looking to navigate the complexities of the logistics sector.

Long-term Growth Potential for UPS

When considering the long-term trajectory of a company in the logistics sector, one must evaluate various aspects that contribute to its future performance. This involves looking closely at market trends, technological advancements, and the ability to adapt to changing consumer demands. In doing so, one can gain valuable insights into the potential for sustained progress over the years.

The global shift towards e-commerce has dramatically transformed delivery services, presenting both challenges and opportunities. Companies that are agile and innovative will likely thrive. Investment in technology, such as automation and data analytics, is crucial for optimizing operations and enhancing customer experience. This modernization can significantly improve efficiency and lead to a stronger competitive edge.

Additionally, as international trade expands, the necessity for reliable transportation options will only grow. A firm’s ability to maintain an extensive network and robust infrastructure enables it to capture a larger market share. By focusing on strategic partnerships and expanding service offerings, a business can position itself favorably for future growth.

Moreover, sustainability has become a pivotal concern for consumers and businesses alike. Firms that prioritize eco-friendly practices not only meet regulatory requirements but also resonate with a conscious customer base. Transitioning to greener logistics solutions could set a company apart, enhancing its brand value and long-term viability.

Ultimately, evaluating the prospects for a leading player in the logistics field involves examining its adaptability, technological investments, and commitment to sustainability. These factors will greatly influence how well positioned it is to harness growth opportunities and navigate the complexities of the future market landscape.