Evaluating the Potential of UNH as a Worthwhile Investment Opportunity

When considering potential opportunities in the market, it’s essential to evaluate various aspects of a particular entity. This involves looking beyond mere numbers and delving into the overall performance, market position, and future outlook. Investors often find themselves at a crossroads, weighing the advantages against the risks involved. In this space, making informed decisions can significantly impact one’s financial journey.

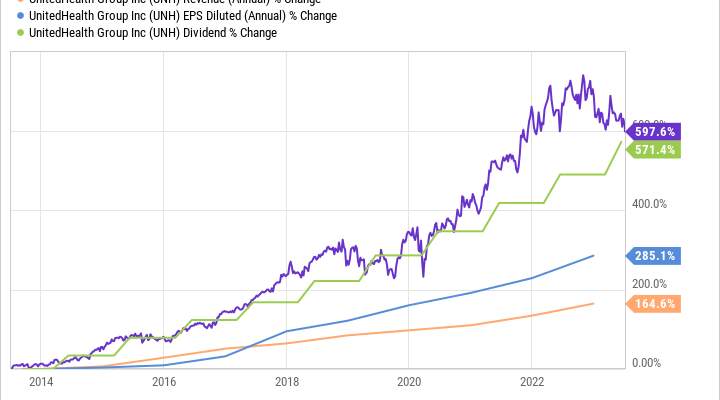

One of the primary focal points for potential investors is the company’s past performance. Analyzing historical trends provides insight into its resilience and adaptability in changing economic landscapes. By examining key metrics and growth indicators, individuals can form an educated perspective on whether to take a leap or hold back.

Moreover, understanding the industry dynamics and competitive landscape is equally crucial. How does this player fare against its peers? What unique attributes does it possess that position it for success? Evaluating these factors can serve as a compass, guiding prospective investors toward a conclusion that aligns with their financial goals and risk tolerance.

Analyzing Financial Performance

When it comes to evaluating the financial health of a company, several key indicators can illuminate its trajectory. An in-depth look reveals how well the entity manages its resources, generates revenue, and adapts to market conditions. Understanding these components can provide valuable insights into the overall stability and potential for growth.

One of the critical metrics to examine is revenue growth, which reflects the company’s ability to attract customers and expand its market share. Consistent upward trends in sales figures often signal a strong demand for products and services offered. Additionally, profit margins offer another layer of insight, showcasing how efficiently a company transforms revenue into profit. High margins indicate effective cost management alongside robust pricing strategies.

Furthermore, cash flow analysis is essential, as it illustrates the liquidity available for day-to-day operations and investments. A healthy cash flow ensures that the organization can cover its obligations while pursuing future opportunities. Debt levels are also crucial; examining how well a firm balances leverage against its earnings potential helps to understand its financial risk.

Finally, comparing these metrics with industry peers can provide context on performance. Benchmarking against competitors highlights strengths and weaknesses, enabling stakeholders to gauge relative positioning in the market. In summary, a comprehensive financial analysis unveils the nuances that determine a firm’s viability and potential for future success.

Market Trends Affecting UNH Shares

When it comes to assessing the value of a particular company, one cannot overlook the various market dynamics at play. Understanding these trends can offer insights into how certain factors may influence the performance of any given investment. In this case, let’s delve into the elements impacting the financial health and outlook for this major player in the healthcare sector.

- Regulatory Changes: Frequent adjustments in healthcare regulations can significantly shape the landscape. Investors must keep an eye on new policies that might either enhance or restrict business operations.

- Technological Advancements: Innovations in medical technology and telehealth solutions have a direct impact on how companies operate. The rise of digital health trends is reshaping patient care and operational efficiency.

- Economic Indicators: Economic conditions greatly influence consumer spending on health services. Fluctuations in the economy can lead to changes in healthcare demand and subsequently affect company performance.

- Competitor Movements: It’s crucial to monitor the actions of rival firms. New strategies, product launches, or partnerships by competitors can change market share dynamics, impacting investor sentiment.

Being aware of these trends can provide a more comprehensive picture of what lies ahead for this major entity. For anyone involved in the market, staying informed is essential to making savvy decisions amidst the ever-evolving landscape.

Expert Opinions on UNH Investment

When it comes to assessing the potential of a particular entity in the financial market, insights from seasoned professionals can be invaluable. These specialists analyze various aspects, including market trends, financial health, and future growth prospects. Let’s delve into what experts are saying about this prominent player in the healthcare sector.

Analysts have expressed a range of views, with some highlighting the company’s robust fundamentals as key indicators of its long-term viability. They often point to its impressive revenue streams and strategic positioning, asserting that these factors could lead to sustainable growth in the years ahead. Moreover, many experts emphasize the importance of its diversified product offerings, which may cushion the impact of market fluctuations.

However, not everyone shares the same enthusiasm. Some analysts caution against potential risks associated with regulatory changes and market competition. They argue that while the organization has a strong track record, shifts in policy or an increasingly crowded market could influence performance negatively.

Ultimately, it’s vital for investors to weigh these perspectives carefully. While there are compelling arguments for optimism, understanding the landscape and potential pitfalls is just as crucial. Engaging with these expert insights can provide a more nuanced perspective on whether entering into a position aligns with one’s financial goals.