Exploring the Benefits and Drawbacks of Investing in ULIPs

In the vast landscape of financial options, various avenues exist for individuals seeking to grow their wealth while simultaneously ensuring protection for their loved ones. Among these choices stands a particular product that combines elements of both insurance and market-linked features, catching the attention of many savvy consumers. Its structure allows policyholders to potentially accumulate wealth over time while enjoying the security that insurance provides.

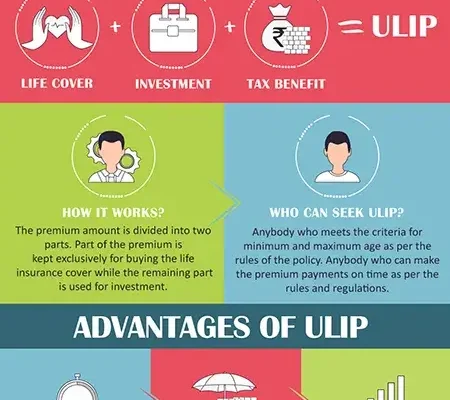

As you delve deeper, you’ll find that this offering is not just a mere financial tool; it’s a complex blend of savings and risk management. The appeal lies in its dual nature, where a portion of your contributions is directed towards life coverage, while the remainder is invested in market-driven instruments. This creates the potential for greater returns in comparison to traditional savings methods, though it’s essential to tread carefully and fully understand what’s at stake.

So, is engaging with this type of financial solution the right choice for you? It ultimately depends on your individual circumstances and financial aspirations. An informed analysis of both the benefits and drawbacks will guide you in making the best decision tailored to your unique situation. Let’s unravel the finer details together and see how it aligns with your goals.

Understanding ULIPs: Key Features Explained

When it comes to financial tools that blend protection and growth, there’s much to explore. One of the popular options combines life coverage with the opportunity to enhance your wealth over time. This hybrid approach makes it essential to understand its core attributes before diving in.

- Life Insurance Component: At its foundation, this product offers a safety net for your loved ones. In case of unforeseen circumstances, a specified sum is paid out, ensuring financial security.

- Investment Component: Alongside the protective element, a portion of contributions is allocated to various markets. This allows for potential capital appreciation, depending on market performance.

- Flexibility: Many of these products provide options to adjust premium payments and switch between different fund types, catering to changing financial goals and risk tolerance.

- Tax Benefits: Contributions often come with the advantage of tax deductions, making this a favorable choice for those looking to minimize their tax liability.

- Lock-in Period: Usually, there’s a predetermined duration where funds cannot be accessed. This encourages individuals to stay committed to their financial goals.

Understanding these features can help you assess whether this blend of insurance and financial growth aligns with your long-term objectives. Taking the time to analyze the nuances ensures you make an informed decision in the landscape of financial planning.

Investment Potential of ULIPs Versus Alternatives

When considering various financial products, it’s essential to explore their potential returns and how they stack up against each other. Some offerings blend protection with a chance to grow funds over time, whereas others focus solely on either wealth accumulation or safeguarding assets. Understanding the nuances can help you make an informed decision based on your financial goals.

One appealing aspect of certain hybrid products is their dual nature. They provide a life cover component, ensuring that loved ones are protected, while also allowing for the possibility of capital growth through market-linked returns. This blend can be particularly attractive for those looking to build wealth while ensuring security for their families.

On the flip side, traditional avenues such as fixed deposits or government bonds offer stability and guaranteed returns. However, their potential for growth might be limited, especially in a fluctuating economic environment. Investors often seek alternatives that can keep pace with or outstrip inflation, making more dynamic solutions tempting for those willing to accept some degree of risk.

When weighing these choices, it’s crucial to consider individual risk appetites and time horizons. Some prefer the safety and predictability offered by conservative vehicles, while others might argue for the necessity of more aggressive strategies that could yield higher returns. Analyzing both options thoroughly could lead to a more balanced portfolio.

Ultimately, the decision will hinge on personal circumstances, including financial aspirations and comfort with market volatility. Engaging with a financial advisor can also provide clarity, enabling you to carve a path that aligns with your objectives. Remember, crafting a diverse strategy is often the key to navigating the complex world of finance.

Factors to Consider Before Investing in ULIPs

When thinking about putting your hard-earned money into a financial product that combines protection and growth, it’s essential to weigh multiple aspects. These elements will help you make a well-informed decision that aligns with your long-term goals.

Understand Your Financial Goals: Before diving into any financial tool, clarify what you aim to achieve. Are you saving for retirement, a child’s education, or maybe a dream vacation? Having clear objectives will guide your choices.

Assess Your Risk Appetite: Each person has a different level of comfort when it comes to risk. Some are willing to take chances for potentially higher returns, while others prefer a safer approach. Knowing where you stand can help you choose the right fit.

Expense Structure: It’s important to scrutinize the associated costs, including management fees and surrender charges. High fees can eat into your returns, so ensure you’re aware of what you’ll be paying throughout the term.

Performance of Fund Options: Research the historical performance of the underlying funds available within the framework. Past performance is not a guarantee of future results, but it can offer insights into how different strategies have fared.

Lock-in Period: Most options come with a lock-in period, during which you cannot withdraw your funds. Consider whether you’re comfortable with having your money tied up for a certain duration, and think about your liquidity needs.

Tax Implications: Look into the tax advantages and implications associated with your choices. Understanding how tax laws apply can influence your overall returns and make the decision more appealing.

By considering these factors, you can navigate the complexities more effectively and determine whether this type of financial solution aligns with your overall strategy.